What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin, once a beacon of hope, now languishes at $107,000, a shadow of its former self, as the market’s “reset” leaves traders in despair. 🤡💸

On-chain data, like a cold, unyielding judge, declares that the recent chaos has purged excess leverage, yet the long-term structure remains unscathed. A hollow victory, indeed. 🧊

Yet Samer Hasn, a senior market analyst at XS.com, claims Bitcoin is “trapped within a bearish structure.” Because nothing says “optimism” like a 20% drop. 🎭

“For any meaningful reversal to take hold, the asset needs to reclaim and hold solidly above $111K,” Hasn wrote. A level that might as well be on Mars. 🌍🚀

Still, some crypto market participants see this as a buying window. BitMine, under the guidance of Tom Lee, pours $800 million into its ether treasury-a testament to human folly and the eternal quest for more. 🤯

Ripple-backed Evernorth Holdings signs a SPAC deal to list on Nasdaq, aiming for a “largest public XRP treasury.” Because nothing says “financial innovation” like a $1 billion gamble. 🎲

Meanwhile, macro shifts? Equity prices rise as trade tensions ease. Gold falls 2% as capital “rotates back into risk.” Because nothing says “confidence” like a 2% drop. 📉

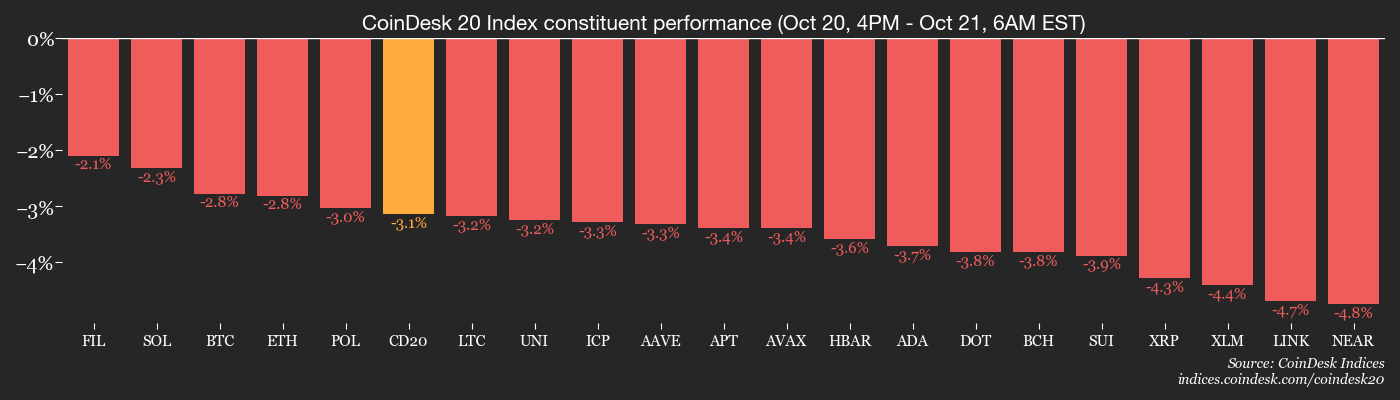

The technical setup? A nightmare. The CD20 index retreats 3.56%, and all members trade lower. A crypto apocalypse, perhaps? 🌪️

Hasn notes, “The broader crypto market continues to experience a deep phase of deleveraging.” Because who doesn’t love a good financial purging? 🧼

“Should this pattern persist, it may later serve as a foundation for a more resilient bull recovery.” If the moon turns green and pigs fly. 🐖🌕

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 🗓️

- Day 2 of 2: DigiAssets US 2025 (Miami) 🏝️

- Day 2 of 2: Fintech Fringe Festival 2025 (London) 🇬🇧

- Day 1 of 2: Zebu Live (London) 🇬🇧

Token Talk

By Oliver Knight

- South Korean exchanges Upbit and Bithumb listed lower-cap tokens, sparking explosive moves. Because nothing says “excitement” like a 50% surge. 📈

- Upbit added SynFutures, a decentralized derivatives exchange. Because we needed more competition. 🏗️

- F climbed 50% before giving back gains. A classic crypto rollercoaster. 🎢

- Bithumb listed ZORA and RECALL. ZORA rallied 10%, RECALL followed the market. A tale of two tokens. 📉📈

- The increases bucked the altcoin trend, while CAKE and ETHFI dropped 10%. The market’s mood swings are as unpredictable as a Russian novel. 📖

- Traders analyze if the weekend bounce formed a lower high. Because nothing says “analysis” like a 2% drop. 📉

Derivatives Positioning

- Bitcoin futures show a measured recovery. Traders re-engage, but only after a 20% crash. 🤷♂️

- Funding rates flipped to neutral. A sign of hope? Or just a temporary truce? 🤔

- The BTC options market is bullish. Because who doesn’t want to bet on a rally? 🎲

- The 25-delta skew exceeds 11.86%. A premium for upside exposure, but who’s paying? 🤑

- Coinglass data shows $320 million in liquidations. A bloodbath, perhaps? 🩸

- Binance’s liquidation heatmap highlights $112,300. A level to monitor, or a trap? 🕵️♂️

Market Movements

- BTC is down -2.98%. A drop so steep, it could be a cliff. 🏔️

- ETH is down 3.3%. The second-largest coin is playing catch-up. 🏃♂️

- CoinDesk 20 is down 3.6%. A collective sigh of despair. 😩

- DXY is up 0.27%. The dollar, ever the victor. 🏁

- Gold futures are down 1.91%. A 2% drop, but who’s counting? 📉

- Silver futures are down 5.43%. A silver lining? Not really. 🌧️

- Nikkei 225 closed up 0.27%. A rare smile in Tokyo. 😊

- Hang Seng closed up 0.65%. A breath of fresh air. 🌬️

- FTSE is up 0.21%. The UK’s stock market, ever the optimist. 🇬🇧

- DJIA closed up 1.12%. A rally, but only for the lucky. 🎉

- S&P 500 closed up 1.07%. A small victory in a sea of losses. 🌊

- Nasdaq Composite closed up 1.37%. Tech stocks, ever the gamblers. 🧠

Bitcoin Stats

- BTC Dominance: 59.6% (unchanged). Still the king, but with a crown of thorns. 🏰

- Ether to bitcoin ratio: 0.03587. A tiny fraction, but still a fraction. 📏

- Hashrate: 1,133 EH/s. A beast of computation. 🐉

- Total Fees: 2.93 BTC. A drop in the ocean. 🌊

- CME Futures Open Interest: 144,835 BTC. A sea of bets. 🌊

Technical Analysis

- BTC was rejected from the 20-week EMA. A rejection, but not a defeat. 🛑

- Bulls need a daily close above 200-day EMA. A challenge, but not impossible. 🤔

- 50-week EMA at $100,200. A support line, but who’s holding it? 🤝

Crypto Equities

- Coinbase Global (COIN): closed at $343.78. A small gain, but the market’s mood is fickle. 🎯

- Circle Internet (CRCL): closed at $130.81. A 3.42% rise. A flicker of hope. ✨

- Galaxy Digital (GLXY): closed at $39.65. A 4.95% gain. A rare bright spot. 🌟

- MARA Holdings (MARA): closed at $20.73. A 5.93% rise. A fleeting victory. 🏁

- Riot Platforms (RIOT): closed at $22.01. A 9.89% surge. A rocket ship? 🚀

Crypto Treasury Companies

- Strategy (MSTR): closed at $296.61. A 2.33% gain. A small step forward. 🚶♂️

- Semler Scientific (SMLR): closed at $23.65. A 2.03% rise. A rare positive. 🌈

- SharpLink Gaming (SBET): closed at $14.79. A 3.14% gain. A glimmer of hope. ✨

ETF Flows

Spot BTC ETFs

- Daily net flows: -$40.4 million. A loss, but not a catastrophe. 🚫

- Cumulative net flows: $61.47 billion. A mountain of money. 🏔️

Spot ETH ETFs

- Daily net flows: -$145.7 million. A deeper hole. 🕳️

- Cumulative net flows: $14.47 billion. A vast expanse of capital. 🌍

Read More

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- USD VND PREDICTION

- ETH’s Descent: Will $2.5K Become Its New Country Club? 🐻📉 #CryptoDrama

- XDC PREDICTION. XDC cryptocurrency

- GBP MYR PREDICTION

2025-10-21 15:38