The digital gold rush ain’t what it used to be. Bitcoin sits at $111,605, like a tired prospector leaning on his shovel, with a market cap of $2.22 trillion and a 24-hour trading volume of $40.44 billion. The price wobbles between $109,873 and $111,790-narrower than a one-lane desert road. The market ain’t asleep, but it’s sure taking its sweet time.

Bitcoin Chart Outlook

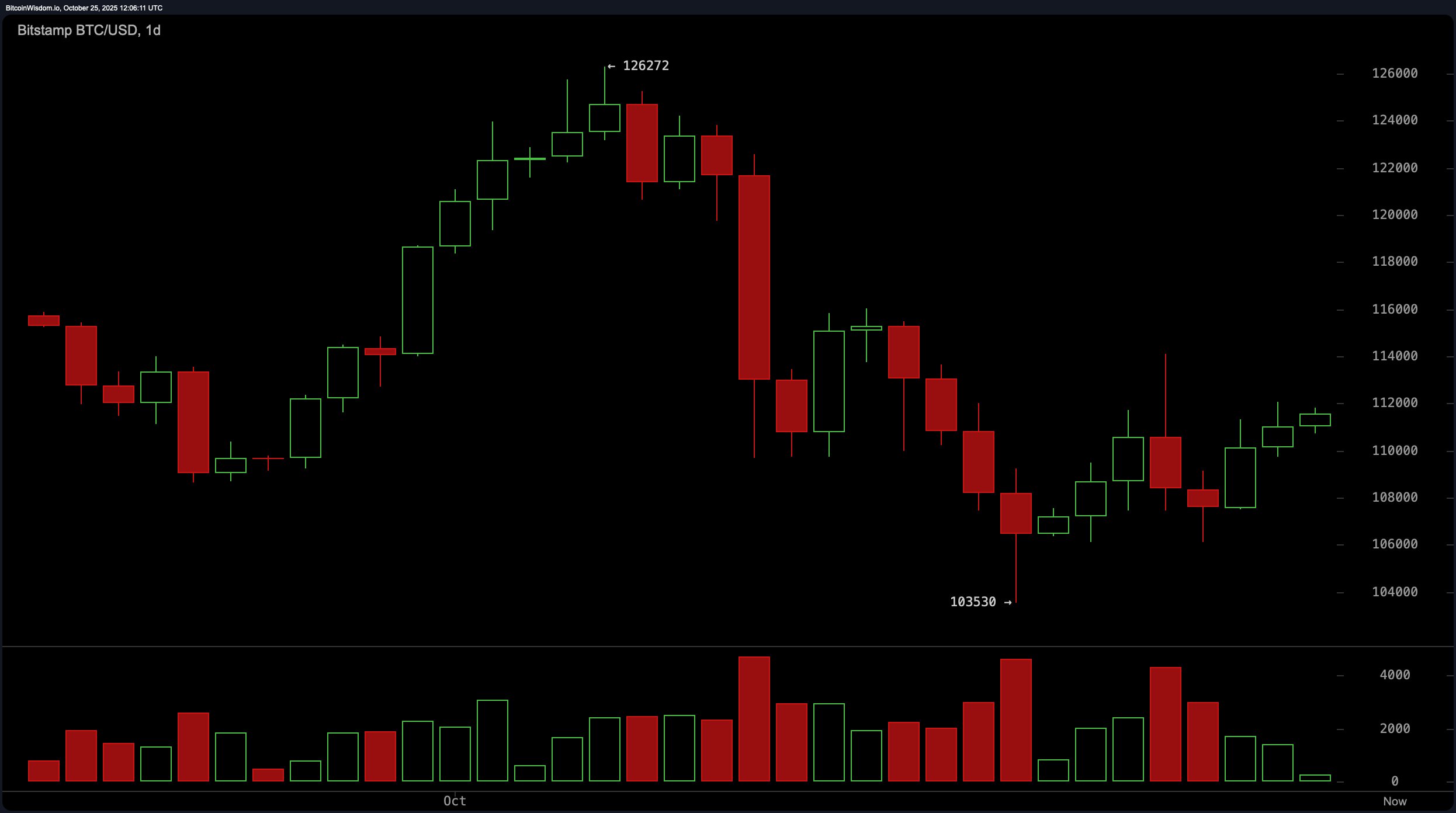

The daily chart tells a story of hope and heartbreak. Bitcoin, that fickle beast, tried to claw its way back after tumbling from $126,272 like a drunk stumbling out of a saloon. A bearish engulfing pattern sent traders scrambling faster than a rattlesnake in a boot shop. It bottomed at $103,530 before mustering a half-hearted rebound. Now, $112,000 stands like a bouncer at a speakeasy-no volume, no entry.

Resistance lurks between $114,000 and $116,000, flipping roles quicker than a card shark in a rigged game. Swing traders eye $108,000-$110,000 like vultures circling a wounded jackrabbit, waiting for hammers or doji candles to signal their feast.

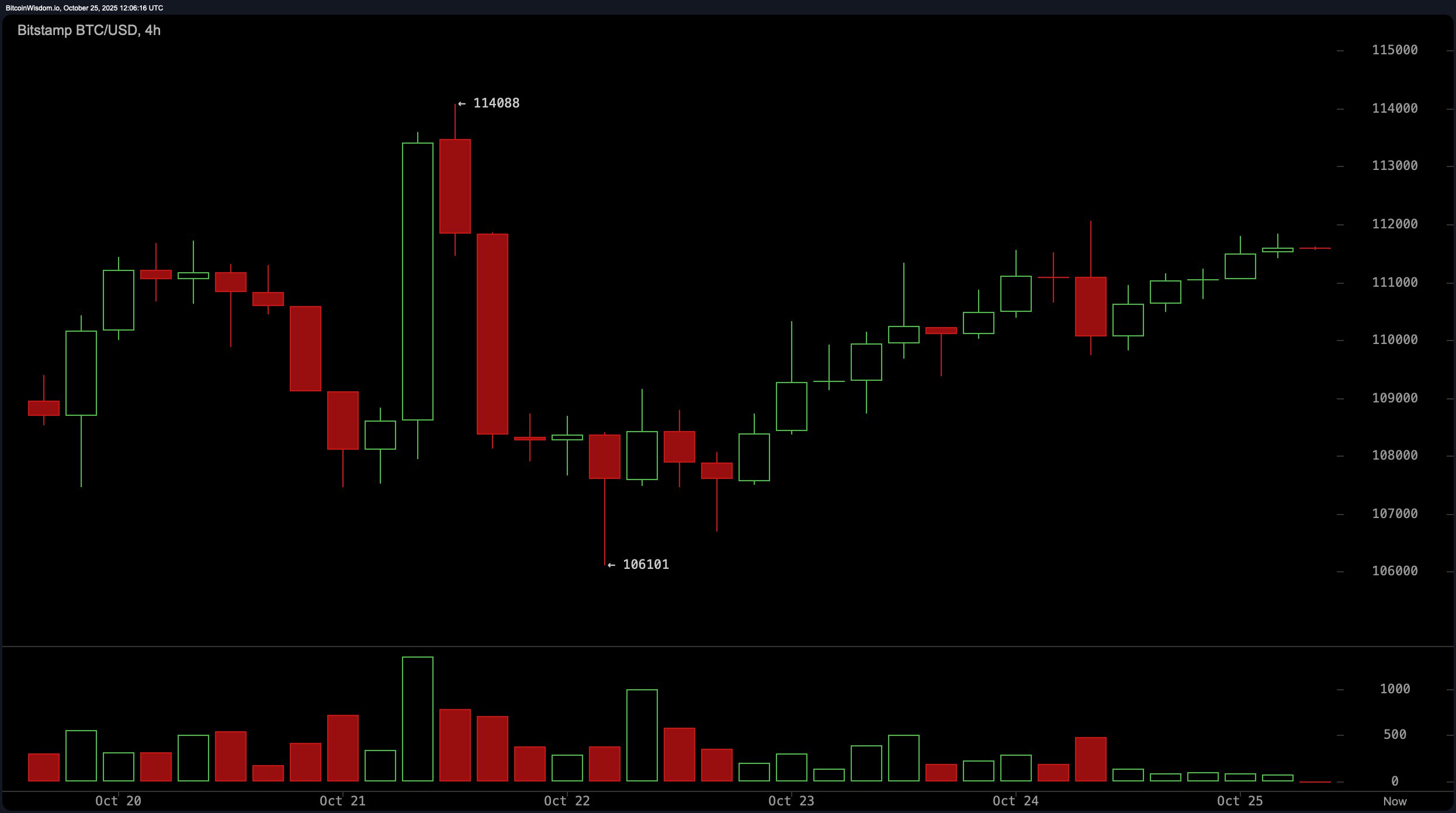

The 4-hour chart’s got more energy than a jacked-up coyote. After dipping to $106,101, Bitcoin’s been climbing like a stubborn mule, printing higher lows. Clean green candles? Sure. But volume’s drying up like a puddle in Death Valley. A pit stop at $110,000 with a bullish engulfing might lure momentum traders back in. But $114,000’s been slapping Bitcoin down like an overzealous schoolmarm-break through with volume, or forget sniffing $118,000.

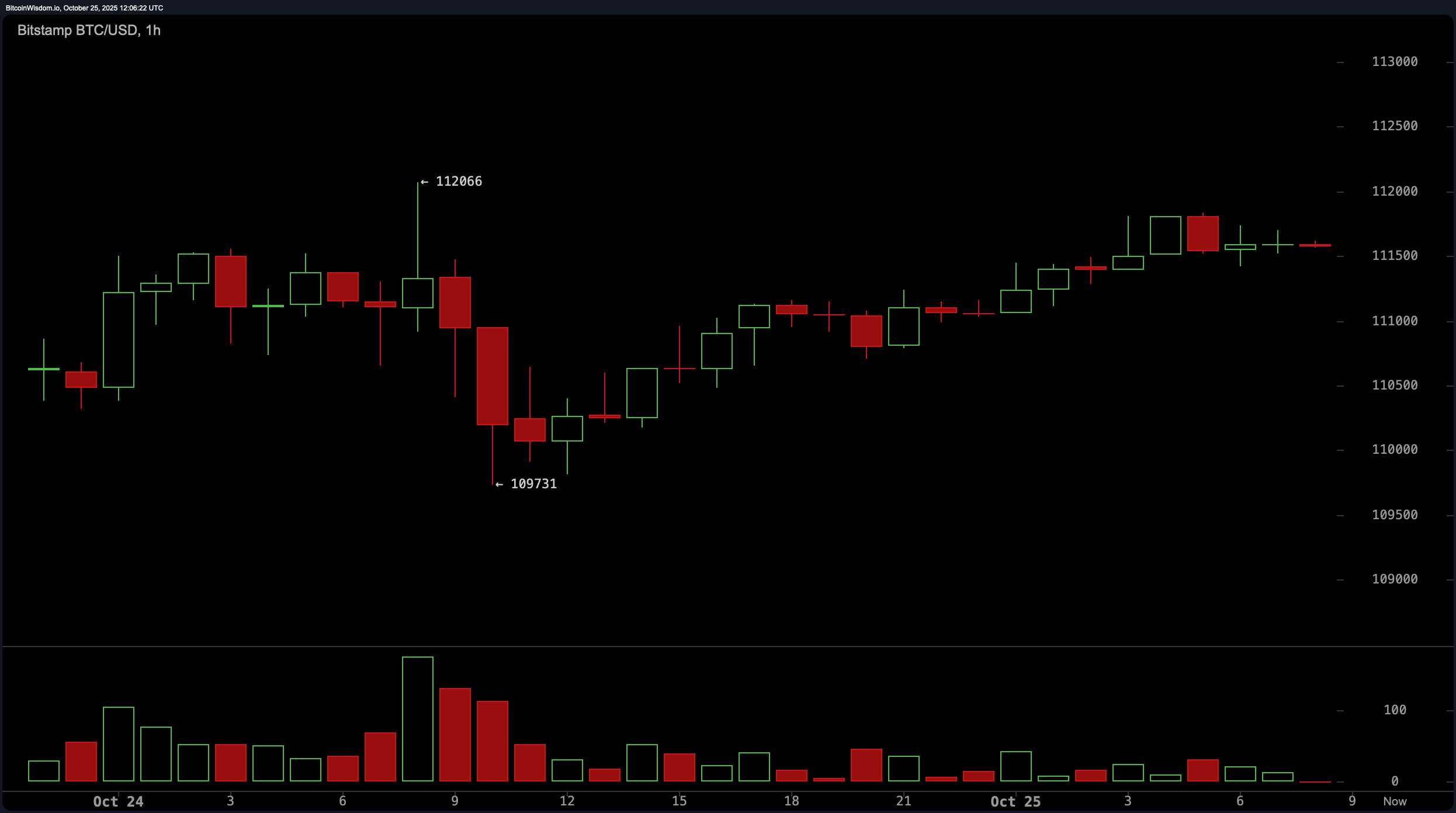

The hourly chart? A staring contest. Bitcoin hovers below $112,000, tighter than a miser’s purse strings. Volume’s gone missing like whiskey at a temperance meeting. Break $112,100 with gusto, and it’s a quick gallop to $113,500. Slip below $111,200, and it’s back to $110,000-scalp traders’ll be happier than pigs in mud.

Indicators? Neutral as a cow chewing cud. RSI at 48, stochastic at 53, CCI at -26-no trend, just vibes. ADX at 20 shrugs. Awesome Oscillator at -3,911? Yawn. Momentum at 798 winks hopefully, but MACD at -1,649 growls a sell signal. Plot twist! 🎭

Moving averages? A family feud. The 10-day EMA and SMA nod upward, but the 20-day and beyond side-eye like disapproving in-laws. The 200-day EMA and SMA at $108,000 are the only long-term cheerleaders. The rest? Bearish as a grizzly in a beehive.

Bull Verdict:

If Bitcoin plants its boots above $110,000 and storms $112,000 with volume, the bulls might just giddyup toward $114,000-$116,000. Momentum’s stirring like coffee in a tin cup-warm, but not scalding.

Bear Verdict:

Bitcoin’s stuck under resistance like a wagon in quicksand. Oscillators yawn, volume’s scarce, and moving averages loom like storm clouds. Without a clean break past $112,000, $108,000-or worse, $103,000-beckons like a debt collector.

FAQ 💡

- What’s Bitcoin’s price today?

As of October 25, 2025, Bitcoin’s trading at $111,605-same as a decent used tractor. - Bullish or bearish?

Mixed signals, like a drunk giving directions. - Where’s the resistance?

$114,000-$116,000-thicker than molasses in January. - Key support?

$108,000-$110,000-the last saloon before tumbleweed territory.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- EUR CNY PREDICTION

2025-10-25 15:58