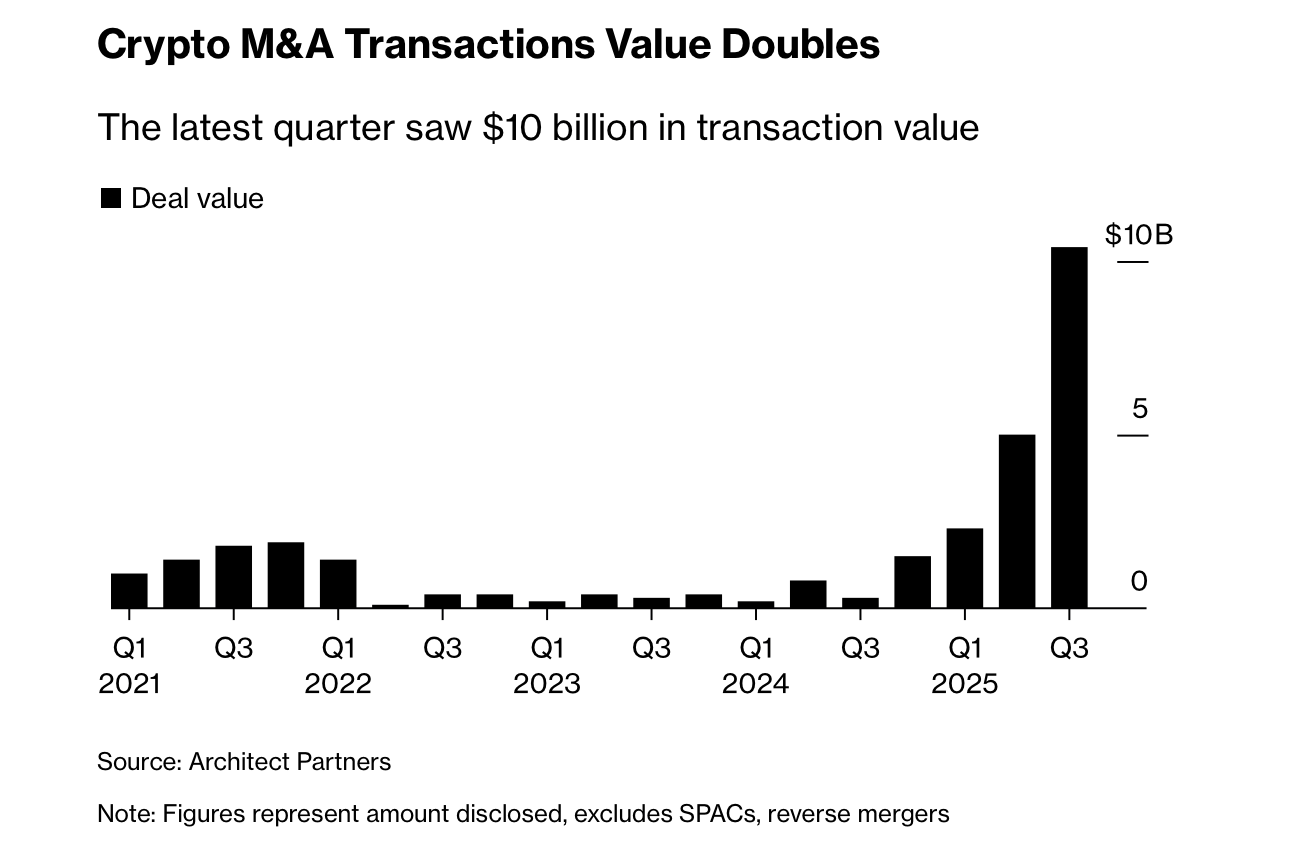

Crypto dealmaking has officially gone full Wall Street gala, blowing past $10 billion in Q3-a 30-fold leap from last year’s “meager” pile of monopoly money, per Bloomberg 🚀.

In what’s being called “the most dramatic financial plot twist since the invention of the piggy bank,” Bloomberg’s Isabelle Lee and Suvashree Ghosh report that crypto mergers and acquisitions (M&A) have breached the $10 billion threshold for the first time. This marks the moment crypto finally swaps its hoodie for a tailored suit and starts quoting Warren Buffett-sort of. Highlights include Falconx’s hostile takeover of 21shares (rumored to involve a literal chessboard), Ripple’s $2 billion purchase of GTreasury (because nothing says “trust us” like buying a company named after a board game), and Coinbase’s $2.9 billion hostile cuddle of Deribit. 🤝

Analysts blame the “Trump regulatory thaw” 🧊-because nothing says stability like a former president who once tweeted about Bitcoin from his golden toilet 🤷♂️-for letting crypto firms binge on acquisition snacks before Wall Street’s grown-ups storm the buffet. Goldman Sachs and Citigroup are allegedly circling like vultures, while crypto companies scramble to “get big or get eaten.” One executive reportedly whispered, “We’re basically playing musical chairs with a $10 billion monopoly set.”

FAQ: Because You’re Definitely Still Confused

- What did the report say about crypto M&A?

Bloomberg claims crypto M&A hit $10 billion in Q3 2025, a 30-fold jump year-over-year-which is fancy math talk for “hold my beer.” 🍻 - Which companies drove the surge?

Falconx, Ripple, and Coinbase led billion-dollar deals that made the sector look like a Black Friday sale at Walmart. 🛒 - Why the sudden M&A frenzy? Is this real life?

Regulatory easing and Wall Street’s “aww, crypto’s kinda cute” phase have crypto firms scrambling to merge before the big boys arrive. 🏦 - What’s next for the sector?

More mergers, more drama, and probably a crypto-themed IPO. One analyst said, “It’s like watching teenagers try to run a Fortune 500 company.” 🧐

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bewitching Meme Coins That Will Surely Charm August 2025

- Coinbase Spends $3Bn-A Whole Island Nation’s GDP-on One Dutch Derivatives Playground! 🥂

2025-10-25 19:18