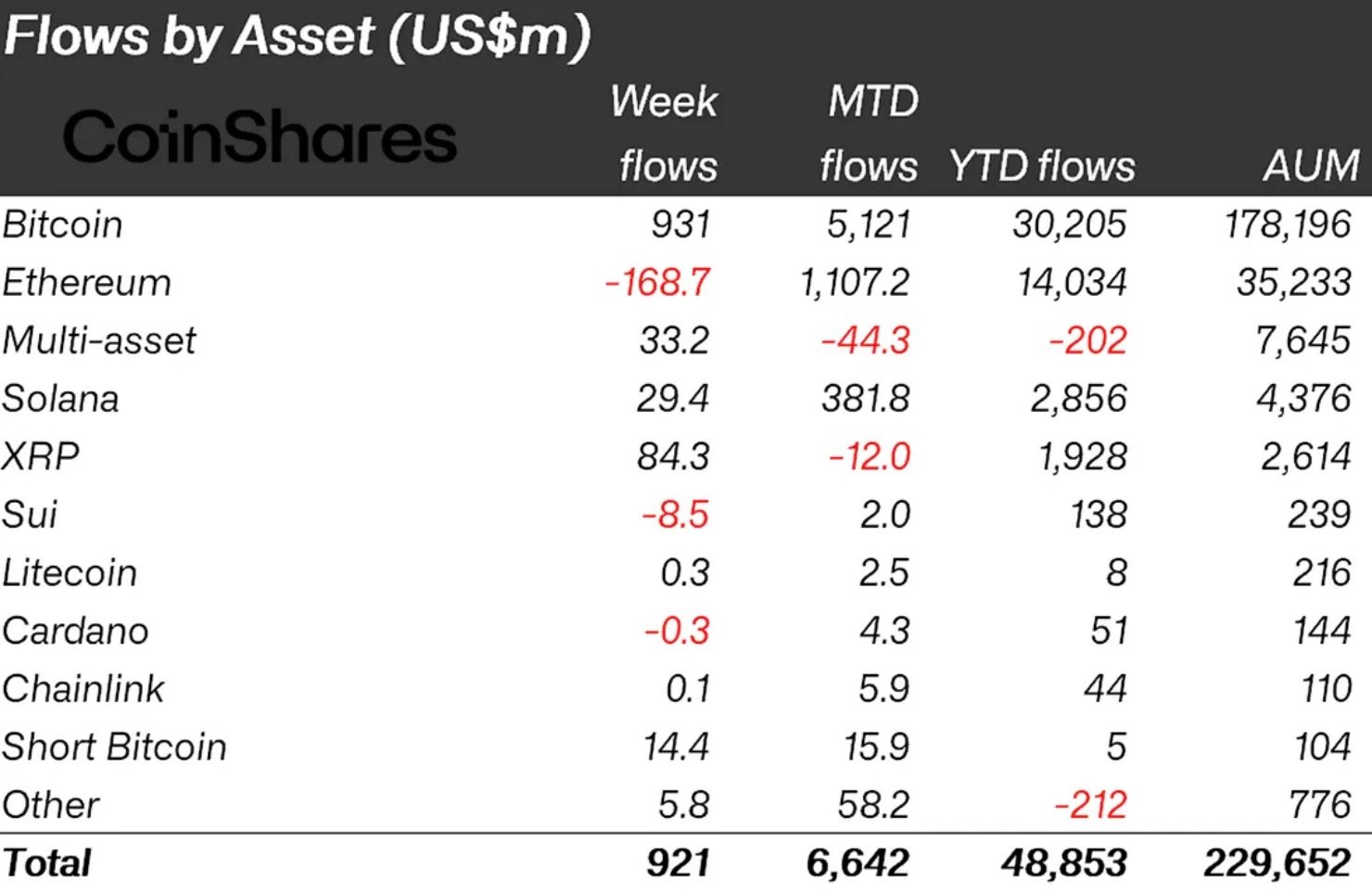

Ah, the labyrinthine world of digital mammon! According to the so-called sages at CoinShares, the ETPs-those ethereal vessels of wealth-have gorged themselves on a $921 million banquet last week. And who was the glutton at this feast? Why, Bitcoin, of course, the omnipresent czar, devouring $931 million as if it were mere crumbs. Even in the cacophony of fragmented macro signals, the professional managers-those high priests of finance-bow before BTC, their default idol for immediate market exposure. 🧙♂️✨

But let us turn our gaze to the more grotesque spectacle: XRP, that beleaguered token, has slurped up $84.3 million-nearly 11% of the total! Ah, the whispers of a U.S. spot ETF have cast their spotlight on this institutional phoenix, rising from the ashes of regulatory purgatory. XRP’s YTD tally now stands at $1.9 billion, a testament to its resilience, despite the chains of legal strife. For comparison, Ethereum, that once-proud titan, suffered its first outflows in over a month, hemorrhaging $169 million. And Solana? A mere $29 million, though its yearly hoard remains above $2.8 billion. 🦄💼

Thus, XRP has guzzled nearly three times more than Solana’s meager sip last week, yet it still trails on the yearly chart. Ah, the irony of fate! 🏆🤡

When, Oh When, Shall the XRP ETF Descend?

The ETF filings, those sacred scrolls of crypto investment, remain the beating heart of this saga. According to the oracle Bloomberg’s Eric Balchunas, there are 155 active applications across 35 assets, with XRP boasting 20 of them. Yet, none have received the divine greenlight, thanks to the absurdity of the U.S. government shutdown. Analysts like Nate Geraci liken the situation to a dam holding back a torrent-once the shutdown ends, XRP’s $1.9 billion in inflows this year may not be its zenith but the foundation for a grander institutional odyssey. 🌊🚀

And let us not forget the ETP volumes, which soared to $39 billion last week, dwarfing the $28 billion average. Ah, the institutional capital-ever circling, ever waiting, like vultures above a battlefield, for the clarity that eludes them. 🦅🔍

In this theater of the absurd, where tokens rise and fall like tragic heroes, one cannot help but marvel at the human condition. For in the end, are we not all but players in this grand farce, chasing shadows of wealth and meaning? 🃏🎭

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Brent Oil Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD THB PREDICTION

- Gold Rate Forecast

2025-10-27 19:01