The Oracle Known as VirtualBacon Speaks 🥓

In a revelation that may very well topple the dominion of both Bitcoin Halving and ETFs, the enigmatic figure VirtualBacon has decreed that the Federal Reserve\’s liquidity policy is the true harbinger of chaos-or perhaps salvation-for the cryptocurrency realm. After a grueling 18-month tightening spree, whispers abound that the Fed is ready to halt its quantitative tightening (QT) and may slyly reintroduce quantitative easing (QE) into the fold. Ah, the Fed, that great puppet master, ever so coy with its strings.

The Crypto Market: A Theatre of Absurdity 🎭

On the illustrious stage of X (formerly Twitter), VirtualBacon delivered a soliloquy worthy of Shakespeare, drawing parallels between Fed liquidity pivots and the whimsical cycles of altcoins. In 2019, the Fed paused QT, and lo, altcoins flourished. But in 2022, when QT reared its ugly head, altcoins withered like daisies in the desert. Now, with QT slated to end in 2025, VirtualBacon predicts a renaissance for altcoins, for where liquidity flows, crypto grows. The burning question remains: when will QT take its final bow?

And let us not forget the Fed’s flair for semantics. While they may avoid uttering the dreaded words “QE,” the true moment of reckoning will arrive when they erase the phrase “reducing the size of the balance sheet” from their lexicon. Recall the 2019 repo crisis, when banks ran dry and the Fed injected $75 billion into the system. Powell insisted it wasn’t QE, but alas, Bitcoin tripled within months. A rose by any other name, indeed.

Financial Institutions: The Oracles of Wall Street 🧙\u200d♂️

The so-called sages of Wall Street-Goldman Sachs, Bank of America, Evercore-are already painting their prophecies. Goldman sees QT concluding in October, Bank of America foresees its demise by month-end, and Evercore predicts the Fed will signal its end this very week. The same ominous signs that rattled markets in 2019 are back, whispering sweet nothings of distress into the ears of traders. QT is on its deathbed, and stealth QE lurks in the shadows, ready to flood the markets with liquidity once more.

CME FedWatch Tool: The Crystal Ball 🔮

The CME FedWatch tool, that digital diviner of fate, currently predicts a 96.7% chance of a rate cut this month and an 87.9% likelihood of another in December. Powell, ever the tease, has hinted that QT will conclude “in the coming months.” The pivot is nigh, dear reader, and with it, a torrent of liquidity may soon fuel the crypto engine once more.

M2 Money Supply: Bitcoin’s Harbinger of Hope 📈

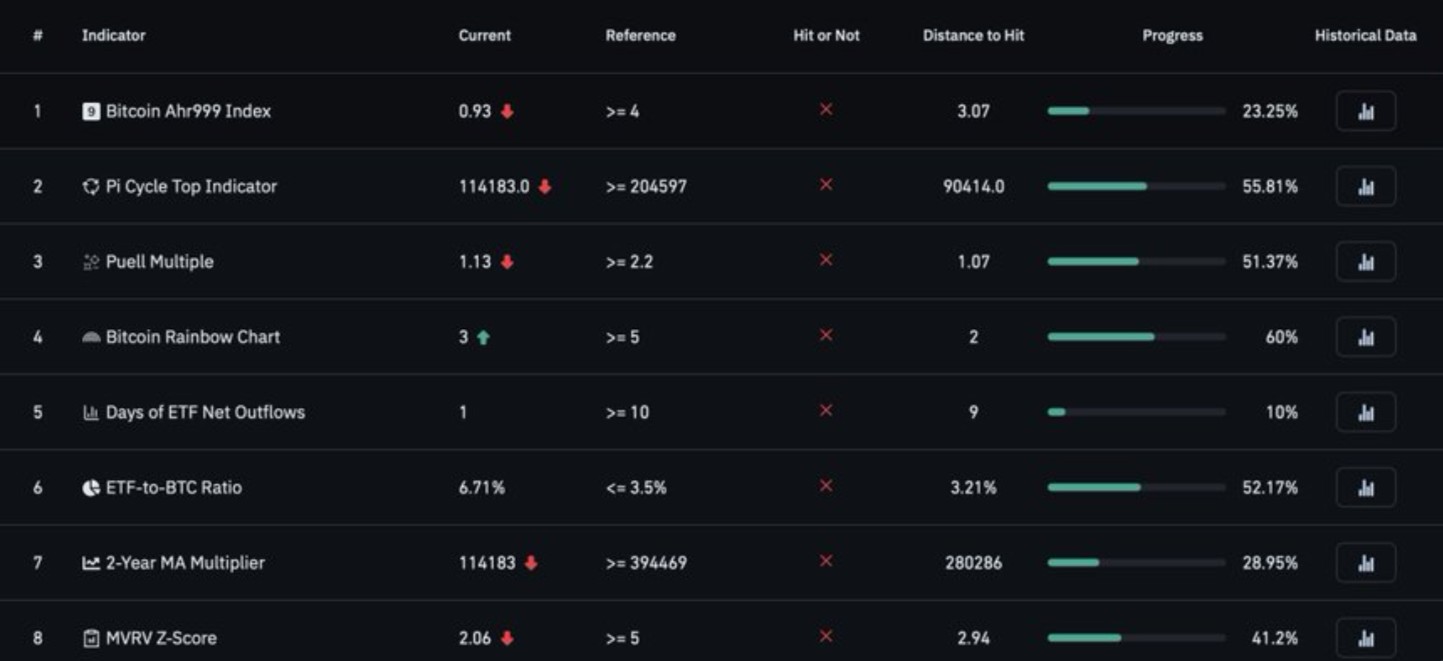

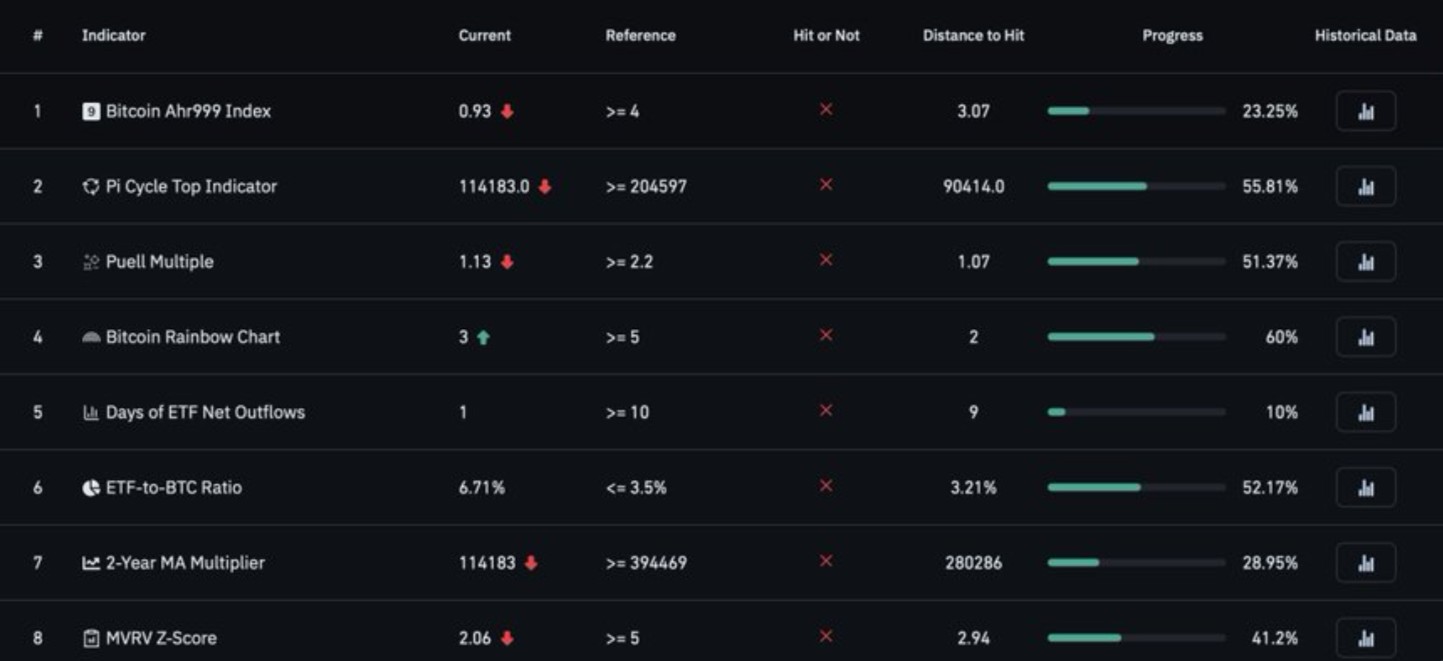

Despite the fog of uncertainty, VirtualBacon insists Bitcoin is far from its zenith. Of the 30 hallowed indicators that herald a bull market peak, none have yet stirred. The global M2 money supply, that steadfast precursor of Bitcoin’s movements, continues to rise, historically leading its prices by 10 to 12 weeks. Since the dawn of this month, the money supply has been ascending, paving the way for Bitcoin’s next ascent. And once the Fed pivots, VirtualBacon heralds the dawn of a new altcoin season. Rejoice, for the circus is far from over.

The Oracle Known as VirtualBacon Speaks 🥓

In a revelation that may very well topple the dominion of both Bitcoin Halving and ETFs, the enigmatic figure VirtualBacon has decreed that the Federal Reserve’s liquidity policy is the true harbinger of chaos-or perhaps salvation-for the cryptocurrency realm. After a grueling 18-month tightening spree, whispers abound that the Fed is ready to halt its quantitative tightening (QT) and may slyly reintroduce quantitative easing (QE) into the fold. Ah, the Fed, that great puppet master, ever so coy with its strings.

The Crypto Market: A Theatre of Absurdity 🎭

On the illustrious stage of X (formerly Twitter), VirtualBacon delivered a soliloquy worthy of Shakespeare, drawing parallels between Fed liquidity pivots and the whimsical cycles of altcoins. In 2019, the Fed paused QT, and lo, altcoins flourished. But in 2022, when QT reared its ugly head, altcoins withered like daisies in the desert. Now, with QT slated to end in 2025, VirtualBacon predicts a renaissance for altcoins, for where liquidity flows, crypto grows. The burning question remains: when will QT take its final bow?

And let us not forget the Fed’s flair for semantics. While they may avoid uttering the dreaded words “QE,” the true moment of reckoning will arrive when they erase the phrase “reducing the size of the balance sheet” from their lexicon. Recall the 2019 repo crisis, when banks ran dry and the Fed injected $75 billion into the system. Powell insisted it wasn’t QE, but alas, Bitcoin tripled within months. A rose by any other name, indeed.

Financial Institutions: The Oracles of Wall Street 🧙♂️

The so-called sages of Wall Street-Goldman Sachs, Bank of America, Evercore-are already painting their prophecies. Goldman sees QT concluding in October, Bank of America foresees its demise by month-end, and Evercore predicts the Fed will signal its end this very week. The same ominous signs that rattled markets in 2019 are back, whispering sweet nothings of distress into the ears of traders. QT is on its deathbed, and stealth QE lurks in the shadows, ready to flood the markets with liquidity once more.

CME FedWatch Tool: The Crystal Ball 🔮

The CME FedWatch tool, that digital diviner of fate, currently predicts a 96.7% chance of a rate cut this month and an 87.9% likelihood of another in December. Powell, ever the tease, has hinted that QT will conclude “in the coming months.” The pivot is nigh, dear reader, and with it, a torrent of liquidity may soon fuel the crypto engine once more.

M2 Money Supply: Bitcoin’s Harbinger of Hope 📈

Despite the fog of uncertainty, VirtualBacon insists Bitcoin is far from its zenith. Of the 30 hallowed indicators that herald a bull market peak, none have yet stirred. The global M2 money supply, that steadfast precursor of Bitcoin’s movements, continues to rise, historically leading its prices by 10 to 12 weeks. Since the dawn of this month, the money supply has been ascending, paving the way for Bitcoin’s next ascent. And once the Fed pivots, VirtualBacon heralds the dawn of a new altcoin season. Rejoice, for the circus is far from over.

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

- EUR HUF PREDICTION

- USD CNY PREDICTION

2025-10-29 09:14