Behold, dear reader, the tale of Ondo Finance, a mischievous little project that has whizzed its Ondo Global Markets platform onto the BNB Chain. Why? To let non-US investors play with tokenized US equities like they’re marbles in a blockchain-based treasure chest! The move came after Ondo’s grand debut on Ethereum in September, where it sneaked up on the world with $350 million in total value and $669 million in on-chain trading volume-clearly, someone forgot to tell the market to stop clapping.

Launched as a bridge between traditional markets and decentralized finance, Ondo Global Markets now offers over 100 tokenized US stocks and ETFs directly on-chain. Imagine, if you will, a magic door that lets you trade shares while the moon is high and the owls are low. Or not. Your call.

“BNB Chain is home to one of the largest and most engaged global user bases in Web3,” said Nathan Allman, CEO of Ondo Finance, with all the gravitas of a man who’s just discovered that Web3 users are very fond of free airdrops. “Expanding Ondo Global Markets to BNB Chain allows us to bring tokenized US stocks and ETFs to millions of users across Asia, Latin America, and other geographies in an environment that is fast, cost-efficient, and highly interoperable.”

Ondo finance price declines 1.74% to $0.74 on Wednesday, Oct. 29 | Source: Coinmarketcap

The ONDO token, that cheeky little utility coin, trades at $0.74, down 1.7% intraday. Poor thing, tied up in a knot by the broader market’s cautious dance ahead of the US Federal Reserve’s rate decision. 🤯 But fear not! Its 3.2% 24h volatility is just it wiggling free from the Fed’s grip. Probably.

Ondo Finance Strengthens RWA Ecosystem With Institutional Partnerships

Ondo Finance’s latest shenanigans include teaming up with BNB Chain, but that’s just the beginning! Earlier this year, they shook hands with Trump-backed World Liberty Financial (WLFI)-yes, that WLFI-and explored using Ondo’s tokenized assets as treasury reserves. Because nothing says “trust” like a certain former president’s favorite bank. 🤷♂️

In July, Ondo gobbled up Oasis Pro, a US-regulated broker, and Strangelove, a blockchain developer, to boost compliance and infrastructure. It’s like a kid who just learned how to build a sandcastle and decided to buy all the buckets in the toy store. 🏖️

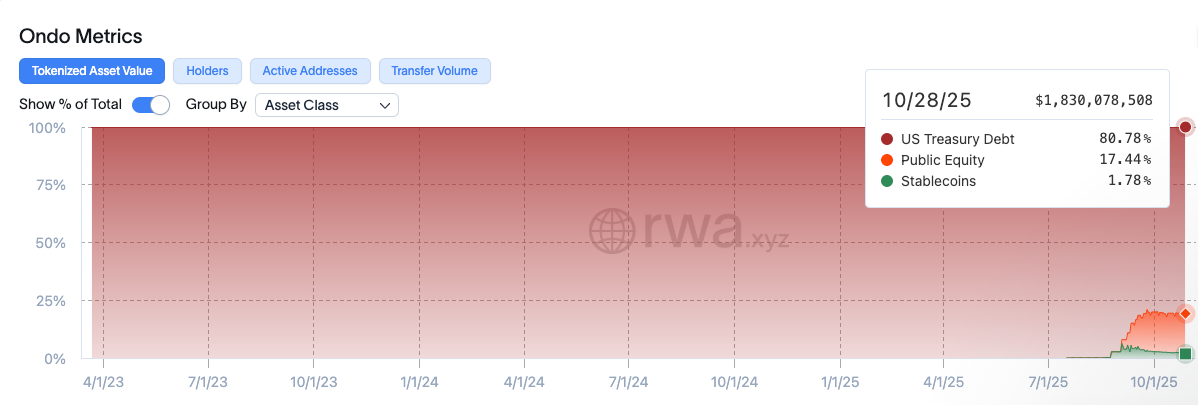

Ondo Finance Total tokenized asset hits $1.83 billion, Oct. 29, 2025 | RWA.XYZ

According to RWA.xyz, Ondo Finance’s total tokenized assets have now hit $1.83 billion-a tidy sum, if you ask me. US Treasuries dominate the portfolio like a boss with a clipboard, followed by public equities and stablecoins. And with a $2.3 billion market cap, Ondo’s network value is as tightly tied to its tokenization ecosystem as a squirrel to acorns. 🐿️

The BNB Chain integration? Well, it’s expected to enhance liquidity and visibility. Which is just a fancy way of saying, “Hey, let’s throw this party on the biggest block in town and see who shows up!” 🎉

Read More

- Altcoins? Seriously?

- Silver Rate Forecast

- Gold Rate Forecast

- USD VND PREDICTION

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Brent Oil Forecast

- USD CNY PREDICTION

- EUR USD PREDICTION

- IP PREDICTION. IP cryptocurrency

- 🚨 Crypto Chaos: PI’s Drama, XRP’s Moon Shot, ETH’s Wild Ride 🚀💸

2025-10-30 01:41