Despite recent volatility, Hyperliquid HYPE continues to attract the same level of attention as a toddler with a hammer in a china shop. 🧸💥 The asset’s consistent network activity and heavy on-chain fee generation reflect sustained demand, even as price cools near key supports. Because nothing says “sustained demand” like a cryptocurrency that’s basically a 1990s tech stock with a crypto veneer. 📈📉

Hyperliquid’s Momentum Could Turnaround

Market sentiment around HYPE leans bullish, as if the entire market is holding its breath and hoping for a miracle. 🤞 Despite recent pullbacks, this view suggests dips are part of a healthy accumulation phase within a larger uptrend. Or, as I like to call it, “the market’s version of a slow burn.” 🔥

Structurally, HYPE has maintained a strong price structure, and any sustained recovery above $48 to $50 could trigger renewed buying momentum. With volume clustering around these support regions, this phase resembles a textbook re-accumulation zone. Or, as my grandma would say, “This is the part where you pray.” 🙏

Fundamentally, growing ecosystem momentum and consistent trading activity are fueling the optimism that HYPE could soon reclaim its upward trajectory towards new cycle highs. Because nothing says “optimism” like a project that’s basically a crypto version of a never-ending rollercoaster. 🎢

Technical Setup: Dip Zone Aligns with Fibonacci Support

The latest chart shared by Crypto Anbu points out that HYPE’s local top formation has likely concluded, leading to a short-term retracement into the 0.618 Fibonacci zone around $38 to $39, an area that historically aligns with high-probability bounce setups. Because nothing says “high-probability” like a number that’s basically a guess with a fancy name. 🎲

If Hyperlqiuid successfully holds this Fib confluence as support, upside targets reappear near $50 and $58, corresponding to prior swing highs. This HYPE zone not only offers technical alignment but also reflects an area of strong volume accumulation, hinting that buyers could step back in after this cooling period. Or, as I call it, “the market’s version of a hot shower after a long day.” 🛁

Downtrend Structure Still Dominant for Now

Despite the project’s strength, Hyperliquid HYPE remains locked within a series of lower highs (LHs) and lower lows (LLs), characteristic of a short-term downtrend. The chart shows repeated rejections at descending resistance zones, confirming the sellers’ control as long as price remains below $50 to $52. Because nothing says “control” like a market that’s basically a grumpy toddler. 😡

However, this Hyperliquid structure also provides a clear invalidation point for bears, a break above the recent LH would mark the first sign of structural reversal. Until then, participants are likely to view each rally as a retest opportunity. The trend remains corrective in nature, but consistent support reactions near $40 keep the longer-term bullish thesis alive. Or, as my cat would say, “I’m not convinced, but I’ll keep waiting.” 🐱

On-Chain Data Reinforces Hyperliquid’s Leadership

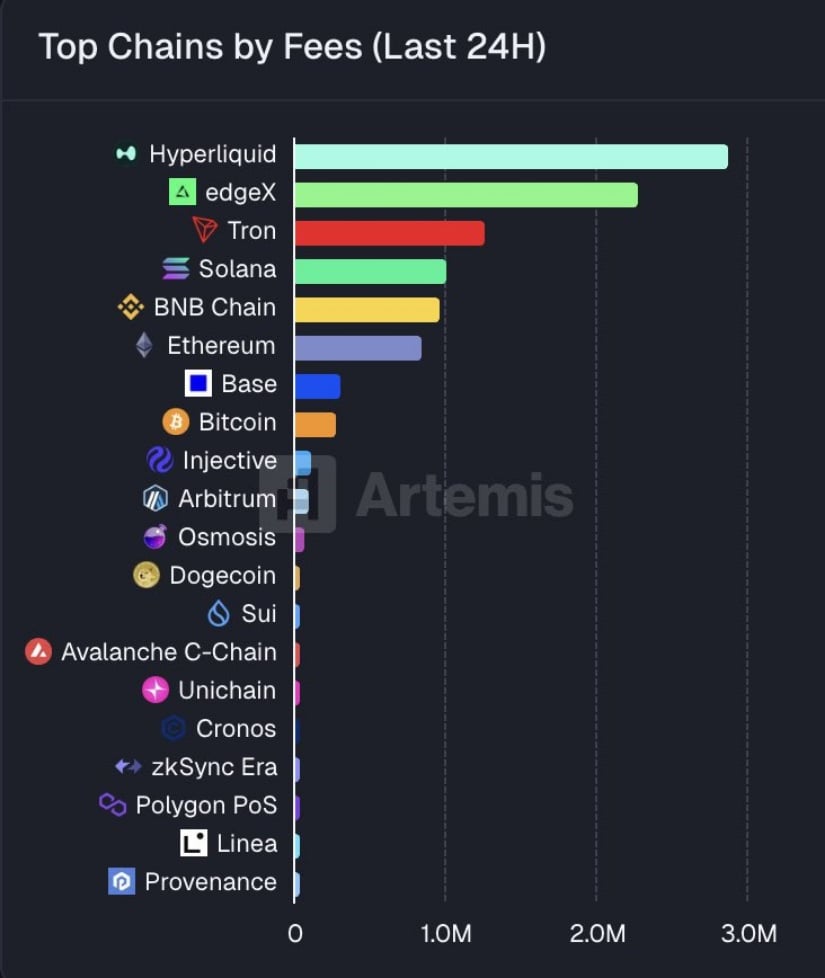

Recent on-chain metrics shared by Hypurr2537 reveal that Hyperliquid currently leads all major blockchains in daily fee generation, surpassing Tron, Solana, and even Ethereum in the last 24 hours. This indicates strong protocol activity and consistent user engagement despite broader market uncertainty. Because nothing says “strong protocol activity” like a blockchain that’s basically the loudest kid in a room full of whisperers. 🎤

From a technical standpoint, HYPE’s strong on-chain performance adds a fundamental layer of support to the price structure. Elevated network fees typically correspond to active trading and sustained liquidity inflows, which often precede price recoveries. As the project continues to top the charts in fee volume, the on-chain data support the thesis that fundamentals are outpacing short-term price weakness. Or, as I like to call it, “the market’s version of a slow burn.” 🔥

Hyperliquid Price Prediction: Inverse Head and Shoulders in Play

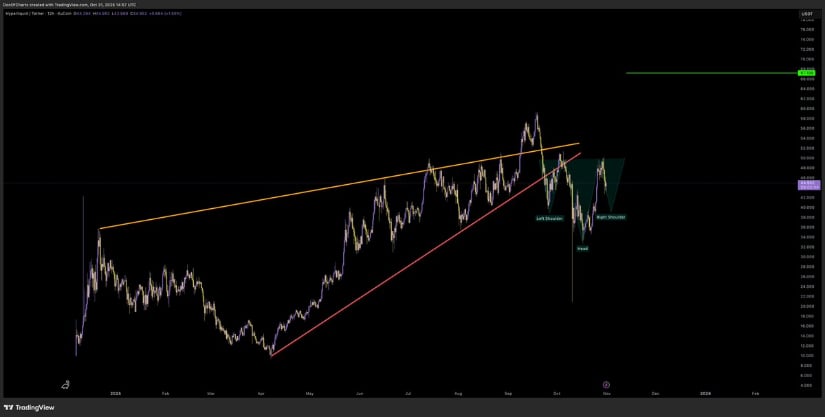

Don’s analysis highlights a clear inverse head and shoulders pattern emerging on the HYPE chart after a breakdown from its rising wedge structure. The left shoulder, head, and right shoulder formations are now visible, with neckline resistance forming near $48 to $50, a critical zone to reclaim for bullish continuation. Because nothing says “critical zone” like a chart pattern that’s basically a crypto version of a bad haircut. 💇♂️

If this reversal pattern confirms with a breakout and volume expansion, the measured target sits near $68 to $70, aligning with the green projection line. Below, the $42 support remains the key defense level for bulls. This technical combination, a bullish pattern following wedge exhaustion, suggests that HYPE may be forming its medium-term bottom, with recovery potential growing stronger as structure matures. Or, as I call it, “the market’s version of a sigh of relief.” 🤯

Final Thoughts

Across multiple analyses, HYPE appears to be at a pivotal point, technically corrective but fundamentally accelerating. On-chain dominance, structural support zones, and early reversal patterns all suggest that the groundwork for the next bullish leg is forming. Because nothing says “groundwork” like a project that’s basically a crypto version of a chess game with no clear rules. 🎲

If buyers defend the $38 to $42 zone and confirm the inverse head and shoulders breakout, Hyperliquid price prediction could quickly target the $60+ levels. The ecosystem’s rising fee generation and continued market share growth provide strong validation for market watchers anticipating a sustained upward cycle. Or, as I like to call it, “the market’s version of a rollercoaster with no brakes.” 🎢

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Silver Rate Forecast

- Brent Oil Forecast

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

- USDe Booms Post-GENIUS Act, But Is Ethena’s Stablecoin the UST of This Cycle?

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

2025-11-02 01:27