Key Highlights:

- The grand ballet of capital now pirouettes toward XRP, leaving BTC and ETH to waltz with their dwindling Open Interest.

- In the past 72 hours, traders have staged a dramatic de-leveraging farce, abandoning BTC and ETH like overpriced opera tickets.

- XRP’s Open Interest accumulation, meanwhile, hums the tune of a potential ETF symphony-though the conductor may still be drunk on regulation.

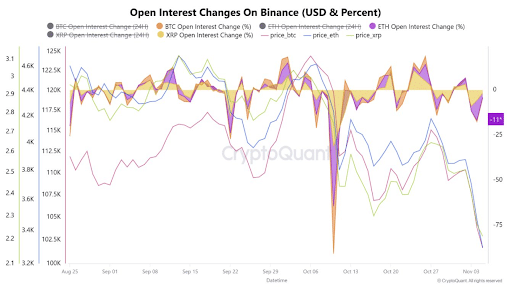

As the derivatives traders of Binance delicately unwound their BTC and ETH positions, the Open Interest data from CryptoQuant revealed a curious migration toward XRP. One might call it a “bet,” though the term feels almost quaint amid the broader market’s tantrum.

With BTC and ETH futures contracts shedding their allure like last season’s fashion, traders have turned their attention to XRP, where bullish positions bloom like daisies in a battlefield of speculation.

Binance Traders Pile into XRP as BTC & ETH Positions Unwind

“Traders are using these slight dips to add positions, showing conviction that contrasts sharply with the fear gripping BTC and ETH markets.” – By @Crazzyblockk

– CryptoQuant.com (@cryptoquant_com) November 6, 2025

CoinMarketCap’s numbers paint a portrait of despair: BTC languishes at $101,404, down 2.44% in 24 hours. ETH? A 3.56% slump, now trading at $3,356. XRP, the eternal optimist, trails slightly at $2.22, down 2.38%. One might assume the altcoin is merely polite to its fallen rivals.

The Great BTC and ETH Exodus

The past 72 hours have been a masterclass in risk reduction, as BTC and ETH futures contracts shed Open Interest (OI) with the enthusiasm of a debtor facing a collection agency. Bitcoin’s OI tumbled $957.43 million (-0.89%), followed by another $59.87 million (-0.56%)-a financial hemorrhage disguised as a “correction.”

Ethereum, ever the drama queen, saw its OI plunge $783.52 million (-11.04%) before a further $148.69 million (-2.36%) collapse. One might say the market is “de-risking,” though “running for dear life” feels more accurate.

Open Interest, that fickle metric, reveals the market’s pulse: rising OI signals fresh capital, while falling numbers whisper of panic. BTC and ETH’s OI has shrunk nearly $1 billion in two days, while XRP’s OI defies gravity, as if buoyed by a secret pact with the moon.

XRP: The Altcoin That Won’t Die

While the crypto world gasps at BTC’s and ETH’s decline, XRP strolls into the spotlight, its Open Interest dipping a mere $8.69 million (-1.71%) after a $30.89 million (-5.73%) stumble. Traders, ever the opportunists, use these dips to add positions, as if XRP were a discounted bottle of wine at a champagne bar.

This bullish fervor, analysts note, contrasts sharply with BTC and ETH’s existential dread. The rotation in capital suggests traders see XRP as the next big thing-or at least the next thing that won’t force them to sell their grandmother’s pearls.

The ETF Mirage

XRP’s OI surge coincides with whispers of Spot XRP ETFs, now louder than a cossack band in a tavern. Bitwise, Grayscale, and Franklin Templeton have filed paperwork, and Bloomberg’s James Seyffart tweets, “They’re looking to launch this month.” One might call it optimism; I call it gambling with a side of hope.

NEW: @FTI_US files updated XRP ETF s-1 with shortened 8(a) language. Looking to launch this month.

– James Seyffart (@JSeyff) November 4, 2025

Ripple’s recent victory over the SEC, after five years of legal duels, adds spice to the stew. With the lawsuit dismissed, XRP’s regulatory fog lifts just enough to let traders peer through-and they see a golden opportunity for institutional cash. Or perhaps they just see a casino.

The Market’s New Script

If XRP’s OI continues its upward spiral while BTC and ETH stagnate, it may signal a capital coup in crypto. Traders, ever adaptable, now favor mid-cap altcoins over the “anchor” giants. For the tactical investor, this means two things: watch OI spreads like a hawk and adjust your portfolio with the precision of a Kremlin courtier.

Derivatives sentiment, once a footnote, now leads the charge in market rotation. A clever trader might call it a strategy; a cynic would call it chaos with a calculator.

Risks: Because Nothing’s Ever Free

While XRP’s OI rises, BTC and ETH’s declines could signal broader crypto skittishness. This rotation may not be bullish-it could simply be a crowd fleeing a sinking ship. Remember the October 2025 episode, where XRP’s OI collapsed 65% in 12 days. Capital, like a fickle lover, can vanish overnight.

Even with accumulation signals and regulatory cheer, price momentum remains a gamble. Liquidity, macro winds, and network fundamentals still hold the cards. But who needs fundamentals when you’ve got a meme and a dream? 🌟

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- IP PREDICTION. IP cryptocurrency

- USD VND PREDICTION

- Oh là là! PancakeSwap’s CAKE Supply Takes a Tasty Tumble 🍰

- Crypto Chaos: Coinbase vs. The White House

- BNB PREDICTION. BNB cryptocurrency

2025-11-06 22:26