Markets 🤑

What to know: 🤔

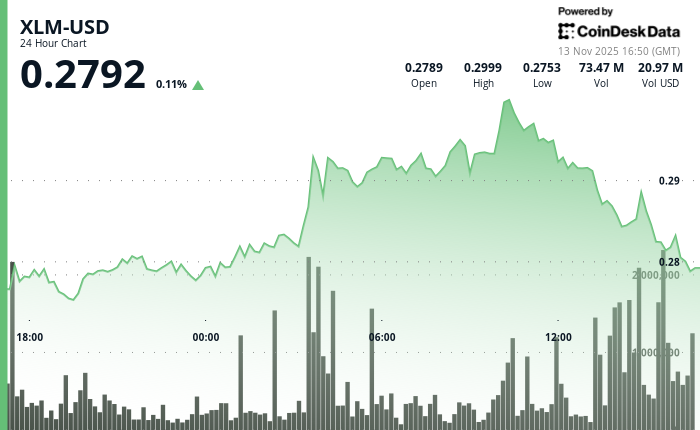

- Stellar took a nosedive from $0.289 to $0.281 in a mere 60 minutes, faster than a wizard losing his hat in a storm. ⚡

- Trading volume hit 76.24M shares, as if the bears had a sudden craving for Stellar snacks. 🐻🍴

- Token now trapped in a trading range between $0.281 and $0.294, like a troll stuck in a too-small hat. 🧢

Stellar faced more selling pressure than a dwarf at a hat sale, with XLM sliding from $0.2846 to $0.2812. Institutional distribution emerged like a bad case of the runs at a fancy dinner party. The token carved out a $0.0189 range, representing 6.7% volatility-traders were more uncertain than a witch trying to read a map. 🧙♀️🗺️

The breakdown hit at 14:00, when trading volume spiked to 76.24 million tokens-115% above the 24-hour average. Price tested resistance near $0.290, but sellers overwhelmed buyers like a mob of angry gnomes. XLM crashed through the $0.285 support zone, which had been as reliable as a Discworld turtle… until it wasn’t. 🐢💥

Recent 60-minute data shows XLM declined from $0.289 to $0.281, a sharp 2.8% drop. Bears took control at 15:44 and 15:47, with volume exceeding 1.9 million-more decisive than a librarian with a crossbow. 📉🐻

Key technical levels signal breakdown risk for XLM 📉

Support/Resistance Analysis: 📊

- Primary resistance at $0.294, as solid as a dwarf’s promise. 💪

- Critical support now at $0.281, about as stable as a wizard’s temper. 🧙♂️😠

- Secondary support in the $0.278-$0.280 range, like a safety net made of wet paper. 🧻

Volume Analysis: 📈

- 24-hour volume climbed 26.06% above the 7-day average, like a sudden rush to the bar at closing time. 🍻

- Peak institutional activity at 76.24M shares, coinciding with resistance rejection-bears were having a field day. 🐻🎉

- Elevated selling pressure above 1.9M during key moments, more relentless than a tax collector. 💼💸

Chart Patterns: 📉

- Trading range between $0.281-$0.294, as predictable as a troll’s breakfast menu. 🥓

- Lower highs and lower lows, a bearish momentum shift clearer than a wizard’s bald spot. 🧙♂️👴

- Failed breakout attempt, validating the distribution thesis like a librarian proving a point. 📚✅

Targets & Risk Management: 🎯

- Immediate downside target: $0.278-$0.280, like falling into a bottomless pit… but with numbers. 🕳️

- Risk level for any bounce attempts: $0.285, now resistance-as welcoming as a dragon’s lair. 🐉

- Volume confirmation required above 2M for sustained moves, or it’s just a troll’s burp in the wind. 🌬️

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- USD THB PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD BRL PREDICTION

2025-11-13 20:52