Look at Bitcoin, drifting under $100,000 like a middle schooler trying to decide between band or detention. So, is this the start of a bear-hug cycle or just a pit stop before the next big bull fest?

Why Bitcoin Could Recover – And Why It Might Keep Dropping 🎢

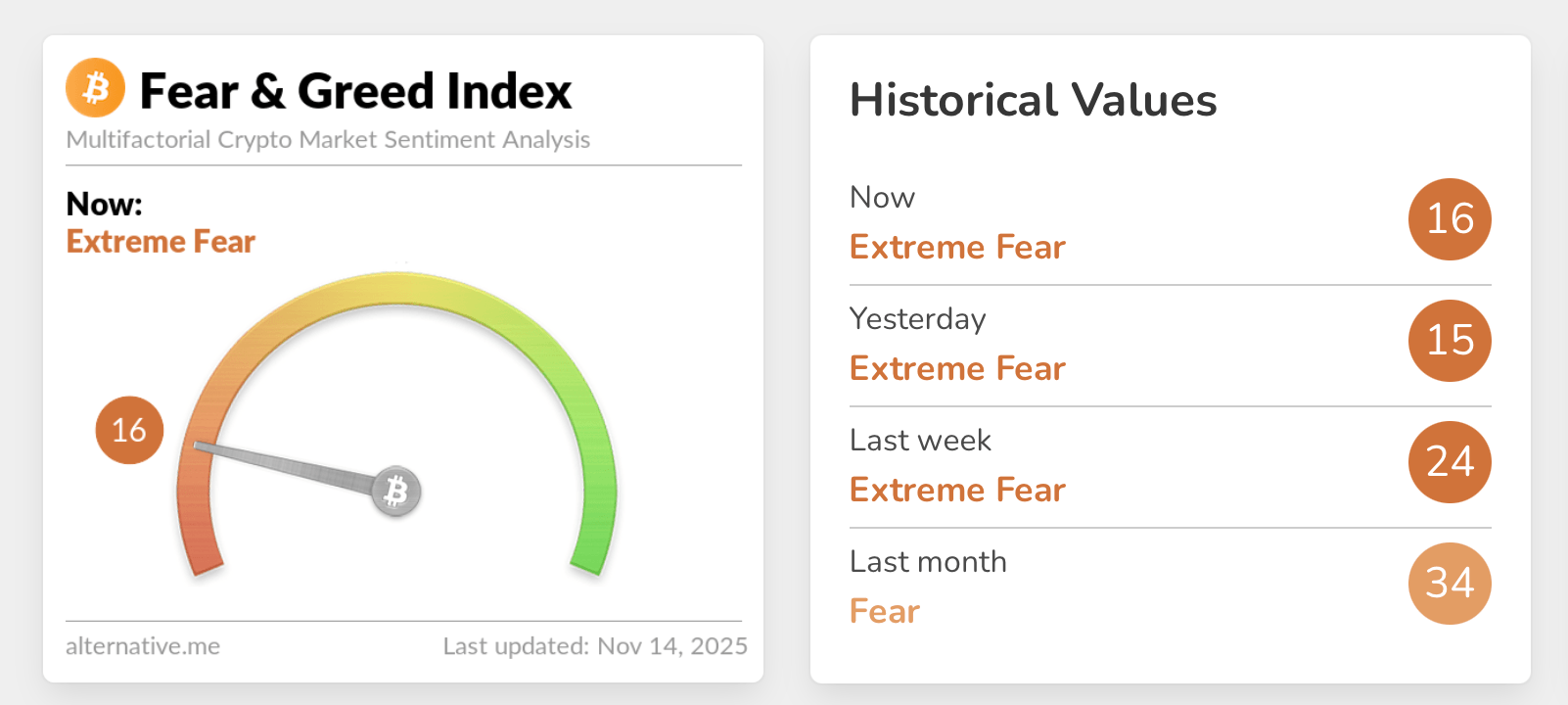

Let’s be real, everyone’s trading their Pollyannas for their doomsday preppers lately. The Crypto Fear and Greed Index is doing the “deep breath” struggle right there in “extreme fear” territory. But wait, not everyone is sobbing into their pillows. Some say this crypto cooldown is just a mini-break from the roller coaster – because you know, the world doesn’t revolve around crypto.

So let’s stir the pot a bit about what could lift that bitcoin price off the floor – or smash it even further. It’s like deciding whether to spice up your wardrobe… again.

5 Reasons Bitcoin Could Still 2025-Finish in a Blingfit

Institutional Buyers Jumping in at Discount Prices 🏫

You know institutional involvement? It’s the tuxedo-wearing equivalent of randomness in crypto this year. Bitcoin’s price is like a puppet dancing on the strings of ETFs and corporate treasuries. With pocketfuls of Bitcoin stacked up, they might still keep buying these “bargain” prices as though they’re cute used leotards.

What Are You Doing, U.S. Crypto Policies? Stop Being a Joke…Or Do It Better! 🇺🇸

President Charming Trump’s policies might act like a breath of fresh grandma perfume on markets, okay? Announcements related to the Strategic Bitcoin Reserve (SBR) could pop up and give BTC a lift. Meanwhile, a friendly SEC might open up more market lanes, because who wouldn’t want that?

The Classics Never Die: Cycle Behavior 🔄

This dip could just be a “shakeout” before the “final leg up.” After all, isn’t post-halving bull market history the chaos auntie at Thanksgiving dinner? Historically, big bull moments show up 12-18 months after a halving, meaning we’re about due for some fireworks. Some say this sell-off is just the market shedding its dead weight before rocketing off into space like a daredevil.

Liquidity Conditions Now, With More Sprinkles! 🌡️

Global money supply is looking up, and the Fed might ease if things get too Neanderthal. This could fuel Bitcoin with some rocket boosters. We might just see this downturn as a quick-change artist, flipping Q4/Q1 assumptions on their heads.

Oversold Technicals and Bearish Feelings on Steroids 🏀

Bitcoin hit a sweet $126,000 in October, but now it’s like the new kid standing alone at lunch. Long-term holder selling probably will dry up, and bearish sentiment might be so rancid that traders are feeling oversized leaps of opportunity rather than risk. If history repeats like an annoying TikTok trend, this setup might set the scene for Bitcoin’s comeback fantasy.

5 Reasons Bitcoin Could Finish 2025 Like a Questionably Successful YouTube Experiment 💣

Long-term Holders Spreading Their Love (And Coins) Around 💔

Imagine your savings account being old news as old Bitcoin moves around like restless people in a waiting room. It looks like 2025 is like trying on outfits from a decade ago. This might be the same dramatic dress rehearsal that happened in 2018 and 2022, putting a cap on any expected rebounds.

The World Just Keeps Getting More Scary, Right? 🪐🔥

Bitcoin might channel its inner high-beta tech stock. If the economy heads to a not-so-chic recession or the Fed goes into tough-love mode, Bitcoin could take another nose dive. Other wrinkles into Bitcoin’s party plans include global trade confusion, AI schooling days over, and the financial system wobbling like a toddler.

Bitcoin’s 4-Year Cycle: Does It Have Grounds for an Existential Crisis? 🌀

Bitcoin crested above $126,000 in October 2025, and it’s been a downhill scare ride since. The 4-year cycle whispers “game over” chants early this time. If investors misread the market’s need for a breather as the quiet intro to bigger celebrations, they’re in for a surprise.

Year-End Jazz: People Selling Bitcoin Like They’re Back at Trading Post Elementary 🎭

After a run from $35,000 to over $100,000 in 2025, Bitcoin investors are starting to cash out. This could make the correcting trend look like a ridiculous Beatles music video. Some traders might even swap their crypto lives for safer assets this festive season as liquidity plays an unofficial Ghostbuster. More selling could make the market giggle like it’s mezzanine-weighting time.

Momentum in Bearish Mode: Do We Need More Downside Targets? 🦅

Bitcoin scraped beneath key zones ($95k-$100k), hitting the roughest patch since March 2025. $84,000 could be next on this bucket list. A slip below $90,000 would solidify a bear market, leading to a quick trip to 2025’s dustbin. Buckle up, folks, if buyers don’t show up.

In essence, Bitcoin’s fate in 2026 depends on whether optimistic forces for a reboot will win over pessimistic grips that scream chaos. The stakes are high, and whether we’re talking bounce-back or breakdown, the next move will reveal just how sturdy Bitcoin really is.

FAQ ❓

- Why is Bitcoin trading under $100,000?

Mixed macro signals, profit-taking, and entering bad zones have made Bitcoin the shy kid at the prom. - Why do some think Bitcoin could recover?

Cycle behavior, improved liquidity, and fear at max levels are like the surprise guests who could save the party. - What risks could push Bitcoin lower?

Coins moving, looming recession fears, year-end selling, and technical bearish faeries could deepen the downturn. - What’s the deal with institutions and Bitcoin?

Spot ETFs and corporate treasuries packing more Bitcoin could be the lifeline if the demand don’t drop.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- USD THB PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

2025-11-16 03:09