In the delightful theatre of modern finance, Ethereum, that charming digital asset, is clinging precariously above the modest $3,000 threshold. The whole market is embroiled in a tumultuous storm of selling that would make even the sturdiest of investors question their life choices. Fear, that ever-faithful companion, is riding high, liquidity is escaping faster than a juvenile’s sense of decorum, and everyone is bracing for more of this delightful volatility. Yet, amid this chaos, some clever analysts suggest we’re witnessing what they charmingly call an “oversold setup”-a splendid opportunity for the long-sighted to acquire assets at a discount. How very timely.

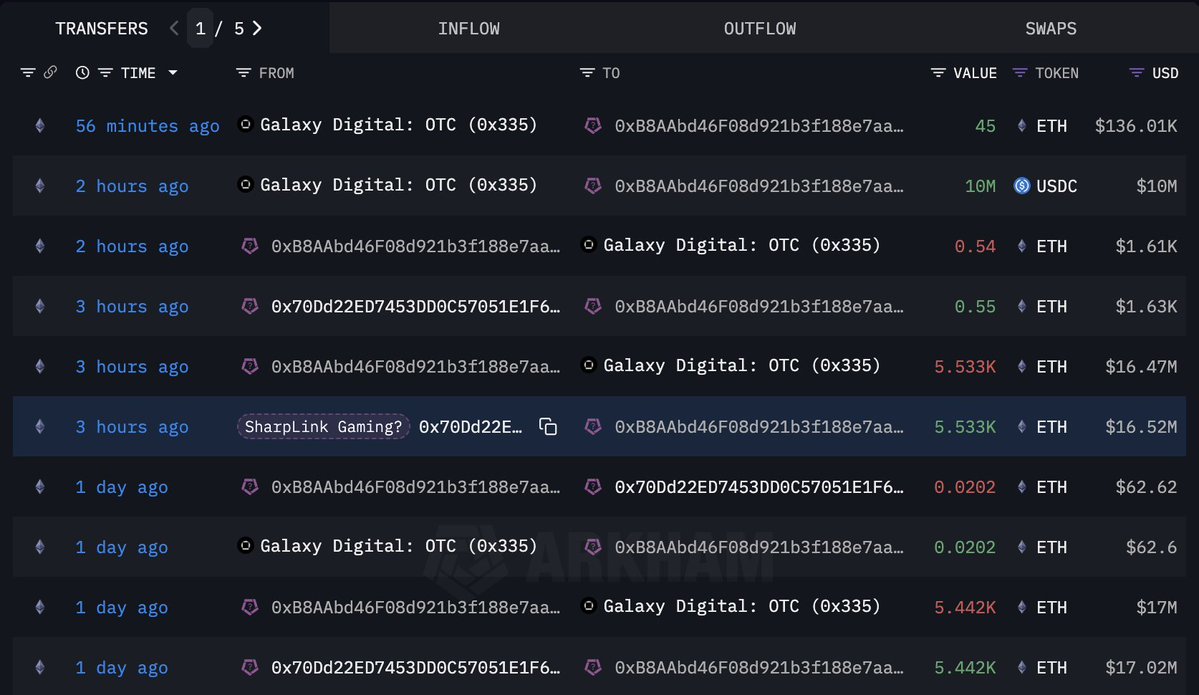

Adding an extra twist to our financial soap opera, fresh intelligence from Lookonchain reveals rather peculiar activity involving a wallet that might be linked to the illustrious SharpLink Gaming. This has set the market aflutter, as such large OTC transactions are often a sign of strategic repositioning by the grandees rather than evidence of imminent panic-because, after all, who enjoys a panic sale when one can orchestrate a more sophisticated exit?

This particular activity emerges as Ethereum teeters on the verge of critical support levels and sentiment turns more sour than a lemon in the rain. The persistent flow of OTC transactions suggests that beneath the surface, the “smart money” is quite actively plotting their next move-even as the average retail investor is busy fretting over every price tick in a manner most unbecoming.

SharpLink’s Wallet Sparks Market Whispers (and Perhaps a Few Lies)

According to the latest whisperings from Lookonchain, a wallet-possibly attached to the charming enterprise of SharpLink Gaming-(address 0x70Dd)-has been quite busy. Over the past couple of days, it dispatched a staggering 10,975 ETH, a sum worth roughly $33.5 million-imagine, almost enough to buy the entire county of Derbyshire-transferred to a Galaxy Digital OTC wallet. Soon after, it received a cool 10 million USDC in return, raising eyebrows thicker than Mrs. Bennet’s at a ball.

Market scribblers and analysts alike are asking the pressing question: Is SharpLink Gaming simply shedding ETH? The transactions appear to be a classic case of OTC movement-large holders offloading assets without disturbing the delicate illusion of order on the public exchanges. But, and here lies the rub, it is by no means confirmed that the funds directly belong to the company-one must not jump to conclusions, even when the timing suggests a certain sense of urgency looking almost theatrical. Ethereum is dancing near a pivotal support level around $3,000, and liquidity is drying up faster than a lady’s patience at a dull soirée. 🤔

Such large OTC flows, whether bearish or merely strategic in nature, have a way of influencing public sentiment. If this was indeed a sale, it plays into the narrative of grand institutions quietly reducing their stake during an embarrassing correction. On the other hand, if it is simply a tidy reshuffling of treasure stored in their vaults, perhaps the sky isn’t falling quite yet-merely taking a brief, dramatic pause. The market, like any good gossip, is watching intently.

The Drama at $3,000-Will Ethereum Hold or Fall O’er the Edge?

Ethereum is currently perched just above the infamous $3,000 line-a battleground where the brave buy to defend the trend, while the reckless press for a deeper decline. The daily chart reveals a persistent downtrend that has been relentless since ETH failed to reclaim its late October dream of smashing past $4,000. Since that glorious failure, the price has been lower highs and lower lows-a pattern as familiar as Mrs. Bennet’s pursuit of eligible suitors. And this decline is compounded by the 50-day moving average stubbornly refusing to budge upward, indicating waning momentum.

Moving averages on the 100 and 200-day scales are joining the melancholic chorus, trending downward-a certain sign of bearish prospects. ETH sits below these major indicators, often a harbinger of further correction, much like a lady’s reputation hanging by a thread. Still, the $3,000 to $2,950 range has served as a reliable demand zone throughout the year, and daring buyers are once again defending their turf. Long lower wicks on the candles suggest some hopeful dip-buyers are poking in, though their conviction remains as fragile as a china vase. Should ETH decisively lose $3,000, next stop might well be $2,750-if not lower. On the bright side, reclaiming the 50-day MA near $3,400 would be a sign of potential revival-“it’s not all doom and gloom,” as the optimists say with a sigh.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Brent Oil Forecast

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- SEC’s Crypto Carnival: Bitwise ETF Joins XRP Frenzy 🎢💰

- HYPE at $32? More Like Hype-ster!

- HYPE PREDICTION. HYPE cryptocurrency

2025-11-21 07:19