Ah, Bitcoin, the digital gold that’s currently lounging around the $84,000 mark like a wizard on a Sunday morning, pondering whether to cast a spell or just have another cup of tea ☕. Meanwhile, the derivatives market is buzzing like a hive of over-caffeinated bees, with traders hedging, betting, and generally making a right old fuss.

Futures OI Hits $58B as Bitcoin Takes a Nap – Options Traders Eye December Like a Dragon Eyes Treasure 🧙♂️

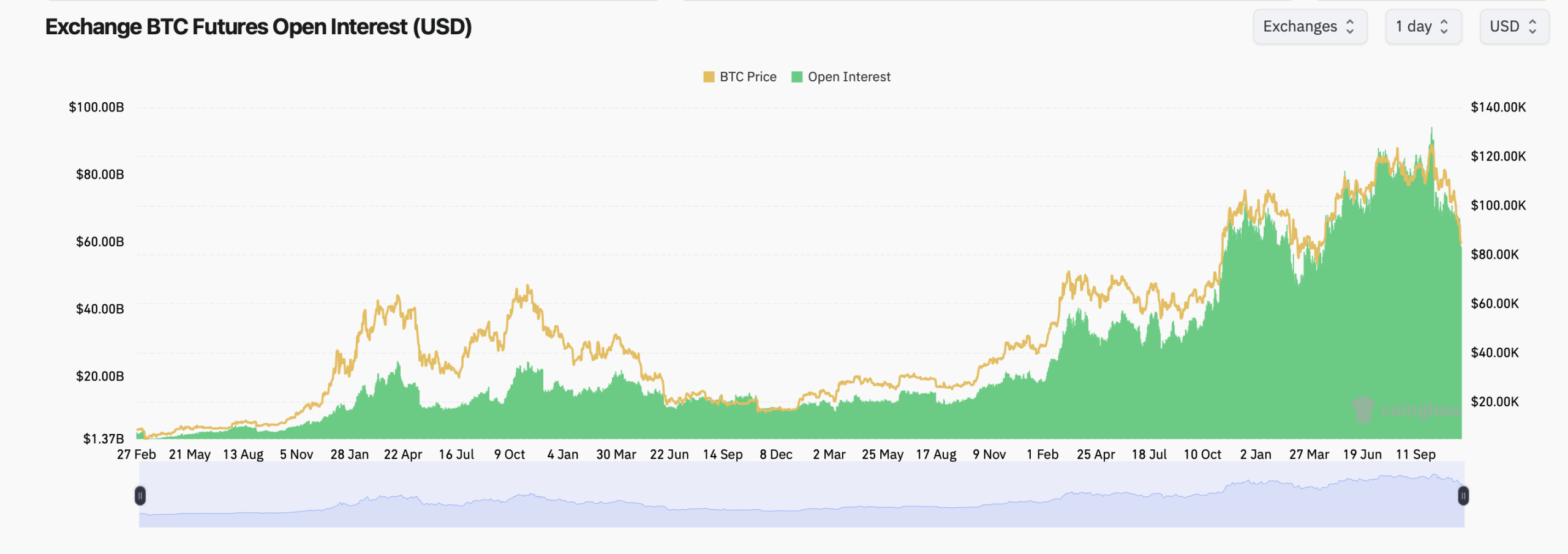

The futures market is hotter than a dwarf’s forge, even as Bitcoin dawdles in its narrow little band. According to Coinglass.com, the total futures open interest (OI) is sitting pretty at 688,880 BTC, or $58.24 billion in real money. That’s right, traders are still levered up to their eyeballs, despite the week’s dramatic theatrics 🎭.

The leaderboard is tighter than a troll’s purse strings: CME holds 135,900 BTC, with Binance hot on its heels with 135,490 BTC. Each claims nearly a fifth of the market, like two wizards dueling over the last pie 🥧. CME’s institutional crowd has seen OI slip 2.56% in 24 hours, while Binance’s book is down 1.95%, suggesting more of a cautious shuffle than a full-on retreat.

OKX follows with 42,550 BTC in OI, down 1.88% daily, and Bybit shows 77,560 BTC, nursing a 3.05% drop. Among the mid-tier exchanges, Gate stands out like a sore thumb (or a glowing amulet): it posted a +1.36% jump in OI, the only green in a sea of red. BingX, on the other hand, took a 37.06% OI nosedive, the kind of move that screams “forced exits” louder than a barbarian at a poetry reading 📉.

Zoom out, and the futures OI chart looks like Bitcoin’s price on a bouncy castle-tightly linked to the buildup of leverage. Open interest followed price like a loyal dog from late 2023 through mid-2025, hitting new peaks as Bitcoin climbed above six figures. But this season’s retracement took the shine off those speculative positions faster than a thief in a jewelry store 💎✨.

Bitcoin’s options sector, however, tells a different tale-one of hedging, fear, and wild December dreams. Total Bitcoin options OI is skating near all-time highs, with 60.24% calls vs. 39.76% puts. Traders, it seems, haven’t given up on their moon-shot fantasies yet 🚀. Calls dominate with 322,221 BTC, while puts sit at 212,708 BTC.

Volume in the past 24 hours is slightly call-heavy (51.52% vs. 48.48%), suggesting traders are nibbling at upside exposure like a goblin eyeing a treasure chest. Deribit, as usual, dwarfs every other venue, with its largest positions stacked around heavy December expirations: the BTC-26DEC25-85,000 put, the 140,000 call, and the 200,000 call hold the highest OI. It’s a mix of deep hedges and moon-shots-a classic Deribit cocktail 🍸.

Max pain levels across exchanges show a market torn between reality and optimism. As of 1 p.m. Eastern time on Saturday:

- Deribit’s max pain clusters in the $85,000-$105,000 zone, like a magnet for unlucky traders.

- Binance suggests gravity around $90,000-$100,000, depending on the expiry.

- OKX paints a similar target, dragging most expiries toward the mid-$80,000s to low-$90,000s.

With Bitcoin holding the low-$80,000s, many contracts are dangerously close to max-pain magnetism-a zone where market makers would love to keep the price pinned to wring out both call and put buyers. It’s like a game of financial tug-of-war, but everyone’s holding a greased rope 🧲.

As consolidation drags on, open interest remains rich, options traders are actively defending downside risk, and max pain hovers close enough to the current price to make next week’s moves feel like they’re under the watchful eye of derivatives gravity. For now, Bitcoin is quiet-but the derivatives market is anything but. It’s like a library where everyone’s whispering, but the whispers are about millions of dollars 💸.

FAQ ❓

- What is futures open interest in this context?

It’s the total number of outstanding Bitcoin futures contracts across exchanges, reflecting how much leverage remains in the system. Think of it as the amount of magical debt wizards owe to the bank. - Why are CME and Binance so important to futures OI?

They hold the largest share of the market, with institutions flocking to CME like moths to a flame and retail-heavy flow driving Binance like a herd of stampeding elephants 🐘. - What does the call-to-put ratio suggest right now?

Calls make up a larger share of options OI, showing traders still have an appetite for upside exposure. It’s like betting on a dragon to fly rather than crash-risky, but potentially rewarding 🐉. - What does “max pain” mean for Bitcoin traders?

It’s the price where the most options expire worthless, often a magnet during major expiries. Imagine it as the financial equivalent of a black hole, pulling in unlucky traders 🕳️.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

- USD CNY PREDICTION

- TIA PREDICTION. TIA cryptocurrency

2025-11-22 22:29