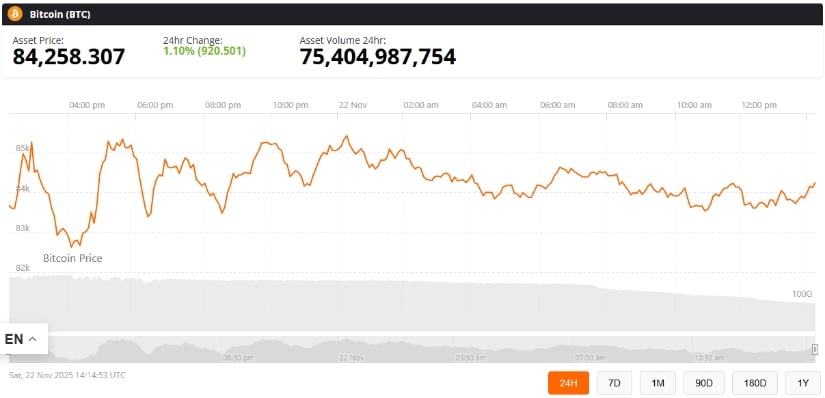

Ah, the capricious Bitcoin, that mischievous sprite of the financial realm, has once again dipped its toes into the murky waters of uncertainty! After a fleeting plunge below the $81,000 mark, it now prances about the $83,800 threshold, as if deciding whether to ascend to the heavens or descend into the abyss. Analysts, those modern-day soothsayers, whisper of a consolidation phase-a grand pause before the storm. The resistance, oh the resistance! Looming like a formidable giant at $85,000-$86,000, it stands as the ultimate arbiter of Bitcoin’s fate. 🧙♂️✨

The Great Balancing Act of BTC and the Whispers of TedPillows

In this theater of the absurd, buying and selling pressures waltz in perfect harmony, neither gaining the upper hand. The venerable TedPillows, a sage of the trading world, proclaims with a flourish: “$BTC is trying to reclaim the $85,000-$86,000 level now. If it doesn’t happen soon, Bitcoin could dump below $80,000.” A dire warning, indeed, wrapped in the cloak of drama! 🕺💼

History, that eternal raconteur, reminds us of similar consolidation ranges in the bygone days of late 2020 and early 2021. Ah, those were the times when Bitcoin, like a phoenix, rose from the ashes of indecision to soar to new heights! Yet, one must tread carefully, for the past is but a shadow, and the future, a riddle wrapped in enigma. 🕰️🔮

Michaël van de Poppe, another oracle of the crypto realm, opines with the patience of a saint: “Things will take time. However, in this area we’re likely going to form a base for $BTC… until that range-bound period is over, we’ll likely have a direction.” Time, that relentless march, holds the key to Bitcoin’s next grand adventure. ⏳🧭

The Technical Ballet: Wave 4 Correction and Fibonacci’s Golden Pocket

Ah, the technical analysts, those masters of charts and patterns, declare that BTC is in the throes of a Wave 4 correction on the weekly timeframe. A Wave 4, you say? But of course! Following the exuberant Wave 3 peak that stretched into 2024-2025, this correction retraces a portion of the advance, aligning with Fibonacci’s mystical levels of 0.5, 0.618, or 0.786. 🌊📐

mohsinsait3, a TradingView analyst with an eye for confluence, observes: “This entire region has confluence with long-term trend structure, making it a high-probability reversal zone for the start of Wave 5.” The golden pocket, that fabled zone between ~0.618 Fibonacci at $60,000 and 0.786 Fibonacci at $45,000, has historically been a haven for accumulation. Will BTC respect this sacred ground, or will it defy the gods of finance? Only time will tell. 🏛️💰

Wave 5, that elusive siren, often heralds a period of strong momentum, driving BTC toward new all-time highs. Yet, one must not be swayed by the siren’s song, for risk lurks in every shadow. Technical patterns, like the Elliott Waves, are but tools in the arsenal of the wise, to be wielded alongside volume trends, on-chain metrics, and the whims of the macroeconomic winds. ⚔️🌪️

The Grand Finale: ATH or Bust?

Should Bitcoin, in its infinite wisdom, break above the $85,000 resistance, analysts predict a speculative upside that could reach the dizzying heights of $110,000 to $140,000. Ah, the sweet allure of new all-time highs! Yet, let us not forget the scenario risk-a failure to reclaim $85K could send BTC tumbling back to the $80K abyss or lower. Caution, dear reader, is the watchword of the hour. 🚀⚠️

Market participants, those intrepid souls, must keep a vigilant eye on:

- Volume changes at key support and resistance zones-the ebb and flow of the market’s heartbeat. 💓📊

- RSI and other momentum indicators-the pulse of overbought or oversold conditions. 📈📉

- On-chain data-the silent whispers of accumulation trends, as BTC holdings on exchanges dance with those in cold storage. 🔗❄️

This balanced approach, a beacon in the storm, reminds us that price forecasts are but educated guesses, not etched in stone. 🌟📜

The Final Act: Bitcoin’s Pivotal Dance

And so, we find ourselves at the climax of this grand drama. Bitcoin, that enigmatic protagonist, consolidates around $83,000, with the $85,000-$86,000 resistance looming like a specter. Technical indicators, from the Wave 4 correction to Fibonacci’s golden pocket, suggest a potential Wave 5 rally. Yet, history teaches us that consolidation ranges often precede decisive moves, keeping traders and institutional investors on the edge of their seats. 🎭🎢

Upside targets near $110,000 and beyond tantalize the imagination, but market volatility and macroeconomic factors cast a long shadow of uncertainty. To navigate these treacherous waters, one must monitor on-chain metrics, price action, and volume trends with the diligence of a detective and the patience of a saint. 🕵️♂️🕊️

In the end, it is not the destination but the journey that matters. Careful observation and understanding of market dynamics are the keys to interpreting Bitcoin’s trajectory during this critical phase. And so, dear reader, we leave you with this thought: in the world of Bitcoin, the only certainty is uncertainty, and the only constant is change. 🌌🔄

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- 🧀 Switzerland’s Crypto Tax Tango: 2027, Anyone? 🕺

- Meme Coins: Madness or Money? 🤡💰

2025-11-22 22:53