While the asset attempts to consolidate around the $0.30 level, market signals remain fragile across open interest, liquidity, and technical indicators. 🤷♂️

Open Interest Holds Flat as Market Sentiment Remains Weak

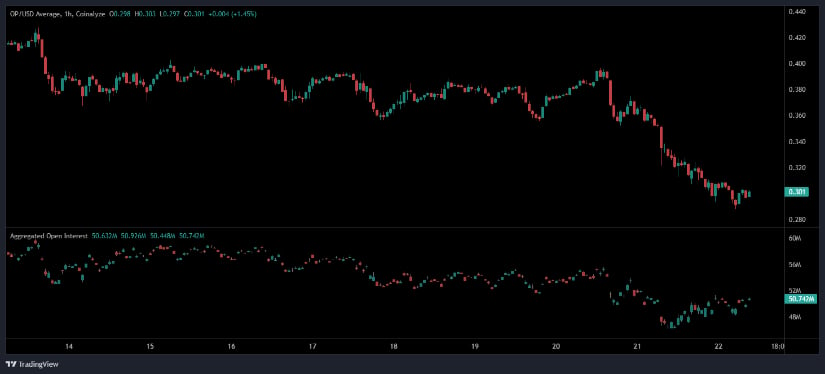

Derivatives positioning for OP shows limited activity following a multi-day decline. The aggregated open-interest chart indicates levels fluctuating around 50.6M-50.7M, marking a period of stabilization after a notable unwinding earlier in the week. The reduction in volatility across open interest suggests that liquidations have cooled, but it does not yet reflect new capital entering the market. 🧢

With price action trending downward for most of the observed period, the flat behavior in open interest implies reduced conviction from both buyers and sellers. It’s like watching a toddler try to walk-no one’s sure if they’ll fall or just stare blankly. 🙃

The absence of new long exposures reinforces the view that derivatives traders are waiting for a clearer direction before increasing risk. Short-term price bounces around $0.30 have not attracted measurable leveraged participation, underscoring the overall caution in the market. Like waiting for a bus that’s clearly not coming. 🚌

Data Shows OP Down 14.62% as Market Cap Drops to $570M

On one hand, BraveNewCoin data highlights the extent of OP’s recent pullback. The coin is currently priced at $0.30, marking a 14.62% decline over the past 24 hours. Market capitalization has slipped to $570,200,216, while 24-hour trading volume stands at $183.59, indicating heightened sell-side activity during the downturn. It’s like a Black Friday sale, but no one’s buying. 🛍️

The price range over the most recent session shows the token oscillating between $0.2801 and the low $0.30 region, with no sustained attempts to push higher. The broader trend underscores weakening sentiment around the token, and the declining market cap reflects reduced confidence among participants. Despite the notable volume spike, most inflows appear tied to exits rather than accumulation. Because nothing says “I’m a winner” like a 14% drop. 💸

This reinforces the broader picture seen in derivatives: the coin remains under pressure, with technical and fundamental indicators both aligned toward a cautious short-term outlook. The consolidation around $0.30 provides a temporary floor, but no significant recovery signals have emerged based on current liquidity and pricing. It’s like a couch potato at a buffet-nothing’s happening, but they’re still there. 🍔

TradingView Chart Shows Persistent Selling Pressure at Lower Bollinger Band

At the time of writing, OP/USDT trades at $0.3024, down 1.85% for the session as the token hovers close to its recent lows. The daily chart reflects persistent selling pressure, with the coin trending at the lower Bollinger Band ($0.3082) and repeatedly failing to reclaim the basis line ($0.3798). Each intraday rally attempt has been met with resistance, indicating limited buyer follow-through. It’s like trying to climb a ladder that’s on a trampoline. 🪜

Momentum indicators remain firmly negative. The MACD sits below the signal line (-0.0329 vs. -0.029), while the histogram reading of -0.0039 confirms sustained bearish momentum. The gradual narrowing of the Bollinger Bands suggests declining volatility, a technical development typically associated with an upcoming breakout. However, with price pinned near support and momentum indicators tilted downward, directional uncertainty remains while sellers retain control. It’s like a game of musical chairs, but the music never stops. 🎵

The coin would need a decisive move above the baseline, supported by a MACD crossover and stronger volume inflows, to challenge the prevailing trend. Until such conditions form, the chart structure continues to show lower highs and lower lows, reflecting ongoing downside risk as the token trades within compressed volatility conditions. It’s like a rollercoaster that’s stuck at the top. 🎢

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- USD CNY PREDICTION

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

- TIA PREDICTION. TIA cryptocurrency

2025-11-23 00:20