\n

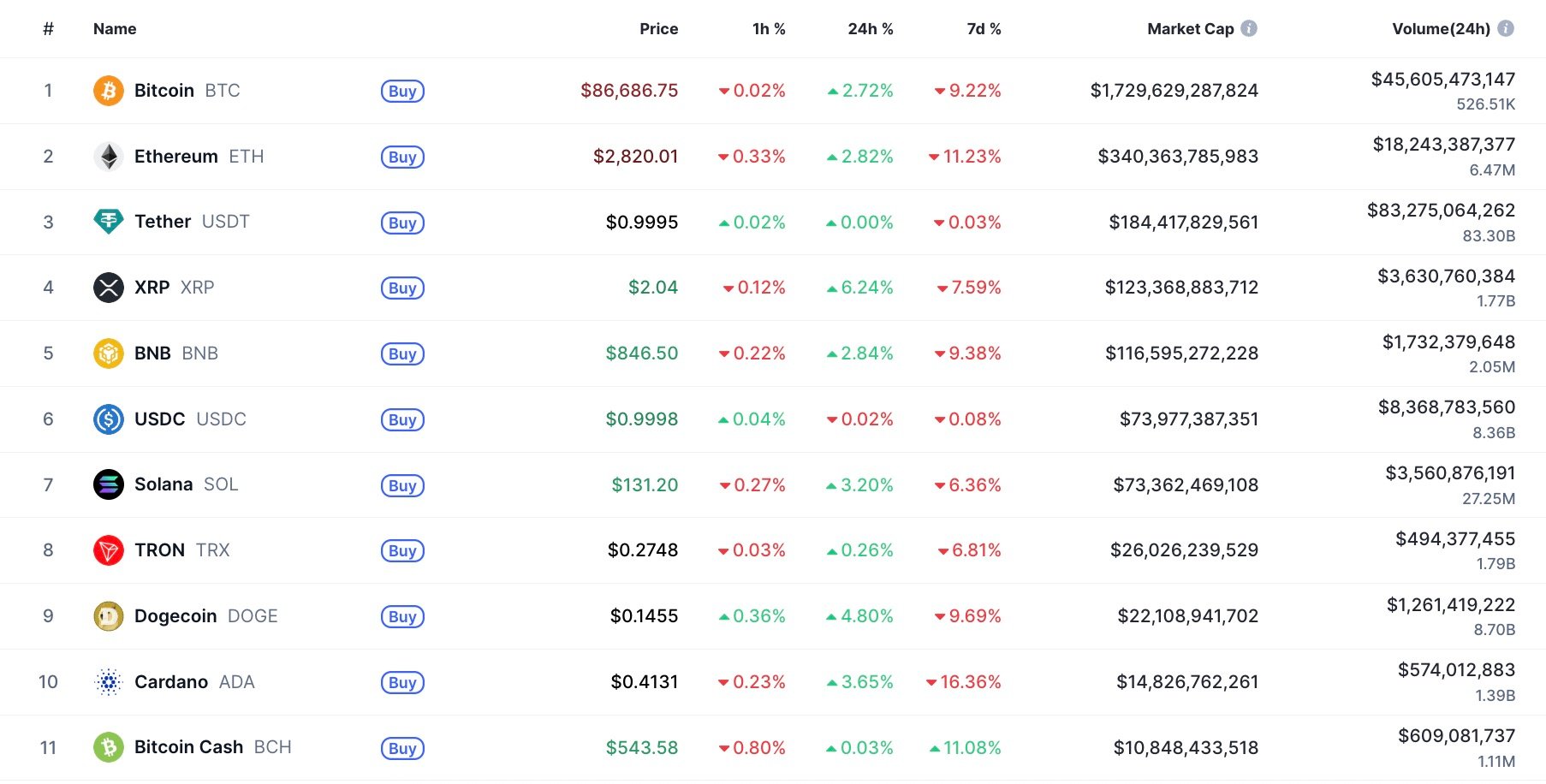

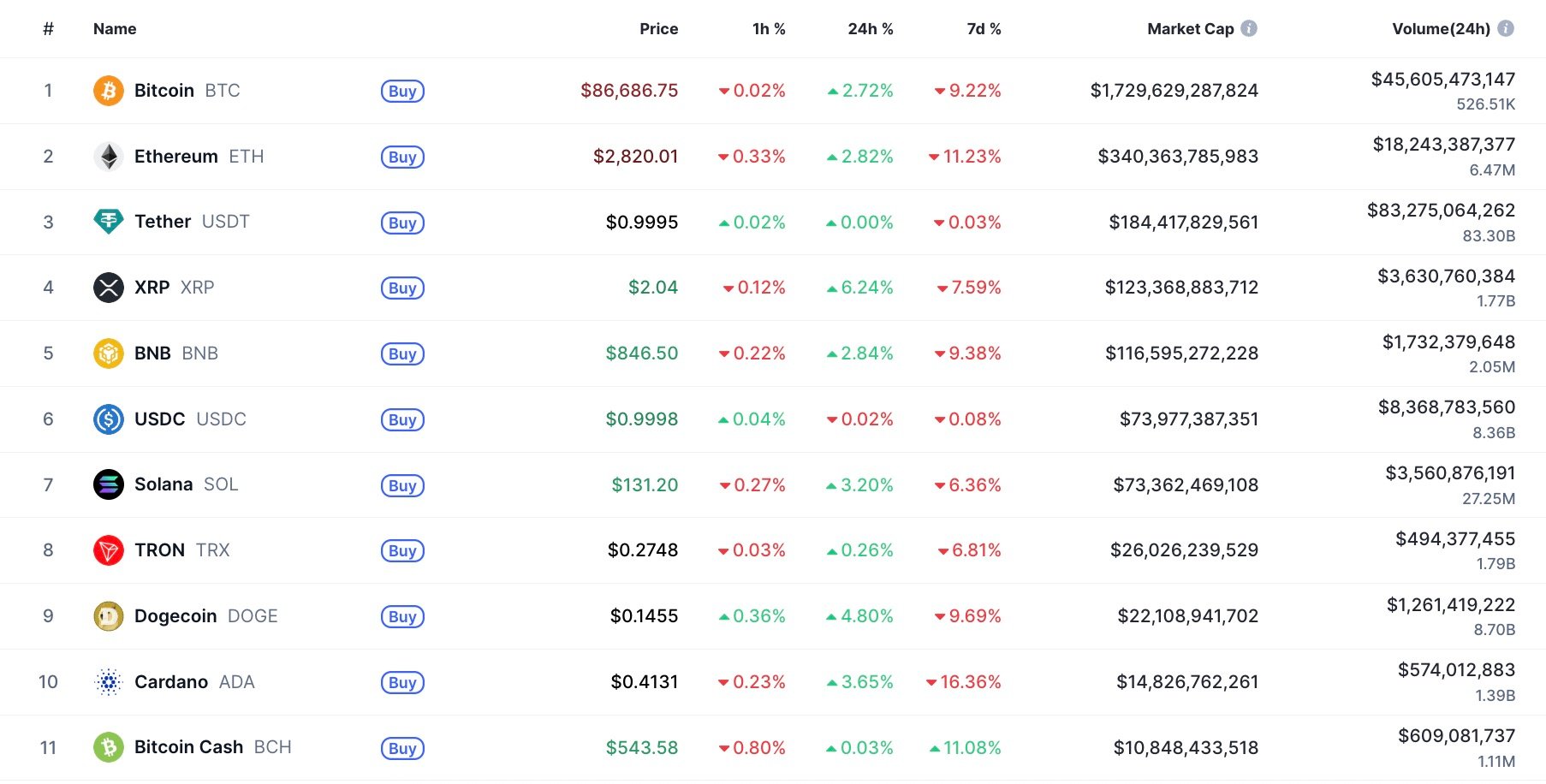

This week, Bitcoin Cash (BCH) suddenly forced its way back into the center of the market conversation after delivering the strongest performance among all major assets 🤯. This move instantly pushed BCH closer to Cardano’s position in the top-10 ranking by CoinMarketCap, turning what used to be a relic of the crypto market into a potential top-10 contestant driven by real capital, not narratives 📈.

\n

Over the past seven days, BCH gained over 10%, while the rest of the large-caps spent the week under pressure 😬. Just look at the contrast: BTC fell 10.54%, ETH lost 13.13%, SOL is down 9.14%, DOGE lost 13.18%, and ZEC plunged by 19.75% 📉. Meanwhile, BCH was out here living its best life, thank you very much 😎.

\n

\n

This means that Bitcoin Cash was not just the best performer, but the only one with a positive weekly return 🙌. With BCH at $544 and a market cap of $10.8 billion, closing the distance on Cardano’s $14.7 billion, the once unreachable gap has begun to shrink in real time 🔥.

\n

A major driver behind this move is unusually tangible 🤑. MFI International Limited announced plans to acquire $500 million worth of Bitcoin Cash as part of its new “digital asset treasury” strategy 💸. Because, you know, $500 million is just a drop in the bucket, right? 🤣

\n

$500 million for Bitcoin Cash

\n

MFI is a small, Hong Kong-based fintech company that operates trading infrastructure in China and Southeast Asia 🌏. No matter how credible the company is, the headline of someone injecting half a billion into the asset everyone forgot about was enough to trigger the bulls 🐂.

\n

Combined with the visible surge on the weekly chart, where BCH experienced one of its biggest upward movements since mid-2024 📊, the result is a market in which Bitcoin Cash is no longer considered a legacy “dino coin,” but rather one of the few large caps capable of delivering weekly gains while everything else trends downward 🚀.

\n

Cardano is now the one defending its position rather than setting the pace 🏃\u200d♂️. Guess you could say Bitcoin Cash is back, and it\’s not just a fleeting moment 😏.

\n

This week, Bitcoin Cash (BCH) suddenly forced its way back into the center of the market conversation after delivering the strongest performance among all major assets 🤯. This move instantly pushed BCH closer to Cardano’s position in the top-10 ranking by CoinMarketCap, turning what used to be a relic of the crypto market into a potential top-10 contestant driven by real capital, not narratives 📈.

Over the past seven days, BCH gained over 10%, while the rest of the large-caps spent the week under pressure 😬. Just look at the contrast: BTC fell 10.54%, ETH lost 13.13%, SOL is down 9.14%, DOGE lost 13.18%, and ZEC plunged by 19.75% 📉. Meanwhile, BCH was out here living its best life, thank you very much 😎.

This means that Bitcoin Cash was not just the best performer, but the only one with a positive weekly return 🙌. With BCH at $544 and a market cap of $10.8 billion, closing the distance on Cardano’s $14.7 billion, the once unreachable gap has begun to shrink in real time 🔥.

A major driver behind this move is unusually tangible 🤑. MFI International Limited announced plans to acquire $500 million worth of Bitcoin Cash as part of its new “digital asset treasury” strategy 💸. Because, you know, $500 million is just a drop in the bucket, right? 🤣

$500 million for Bitcoin Cash

MFI is a small, Hong Kong-based fintech company that operates trading infrastructure in China and Southeast Asia 🌏. No matter how credible the company is, the headline of someone injecting half a billion into the asset everyone forgot about was enough to trigger the bulls 🐂.

Combined with the visible surge on the weekly chart, where BCH experienced one of its biggest upward movements since mid-2024 📊, the result is a market in which Bitcoin Cash is no longer considered a legacy “dino coin,” but rather one of the few large caps capable of delivering weekly gains while everything else trends downward 🚀.

Cardano is now the one defending its position rather than setting the pace 🏃♂️. Guess you could say Bitcoin Cash is back, and it’s not just a fleeting moment 😏.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Breaking News: Fed Bids Adieu to Crypto Oversight! Is This a Good Thing? 🤔

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Shiba Inu Shakes, Barks & 🐕💥

2025-11-23 20:11