Ah, the grand ballet of the markets! Behold, the noble UNI token, trapped in a tedious minuet between $6.00 and $6.20, like a courtier stuck in a stuffy salon, neither advancing nor retreating. The momentum, my dear readers, is as feeble as a fop’s handshake, and the technical indicators? A veritable farce of mixed signals! 🕺💹

Open Interest: A Yawn in Numerical Form

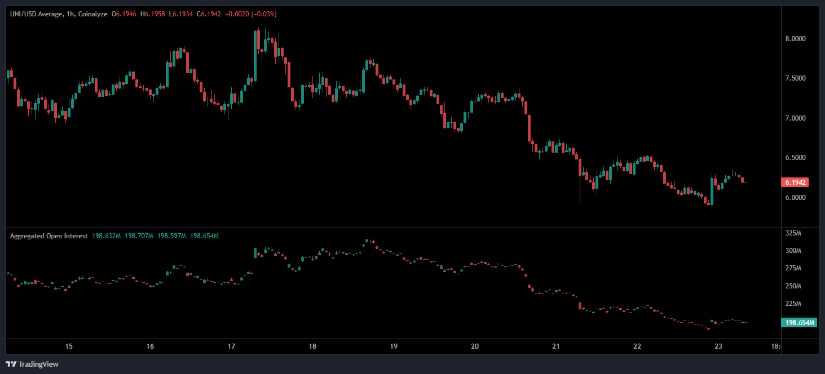

UNI, poor soul, oscillates like a pendulum in a clock that has lost its spring, confined to its narrow band of $6.00 to $6.20. The candles, alternating between teal and red, scream indecision-a market as undecided as a bourgeois choosing a wig. Since November 18 to 23, a slight downward tilt, like a nobleman’s hat after a night of revelry, reveals the soft selling pressure. Alas, no strong directional momentum here! 🕯️🤷♂️

Open Interest, that fickle mistress, remains flatter than a courtier’s flattery, hovering between 198.6M and 198.7M. Traders, it seems, are neither opening new positions nor unwinding old ones-a market in equilibrium, as exciting as a silent dinner party. No speculative leverage, no panic-driven exits, just a collective shrug. 🤏💤

This stability, my friends, is the very essence of consolidation-a market waiting for a catalyst, be it macro developments, ecosystem updates, or a technical breakout. Until then, expect low volatility, like a noble estate in winter slumber. 🏰❄️

Daily Decline: A Mild Cough in a Grand Opera

BraveNewCoin, ever the chronicler, lists UNI at $6.20, a modest 2.38% decline over 24 hours. With a market cap of $3.90 billion and a daily trading volume of $444.9 million, UNI remains a top-tier asset, even in this subdued sentiment. The circulating supply of 629.89 million tokens keeps it firmly in the upper echelons of the DeFi market. 🏆💰

Higher-timeframe charts reveal UNI trading within a $5.90 to $6.40 range, a tight consolidation that mirrors the hourly windows. The market, like a lost traveler, seeks direction, but spot liquidity fails to inspire decisive movement. Trading volume remains healthy, yet sideways-traders prefer to wait, like guests at a ball awaiting the first dance. 💃🕴️

This aligns with recent DeFi behavior, influenced by macro uncertainty and hesitant capital flows. Ah, the hesitance of capital-as predictable as a nobleman’s reluctance to part with his gold! 🏦🤔

Technical Indicators: A Comedy of Weak Momentum

Technical readings from TradingView paint a picture of neutrality, with UNI trading near $6.20, close to the Bollinger Band basis at $6.804. Price movement within the bands signals consolidation, neither trend expansion nor collapse. Sellers lack the vigor to push the token to the lower band at $4.726, while buyers are as feeble as a sickly poet, unable to reach the upper band at $8.883. 📉📊

Momentum indicators, those harbingers of fate, remain slightly bearish. The MACD line, like a timid suitor, sits below the signal line at -0.007, with a histogram showing a mild negative value of -0.121. Weak downward pressure, but no dramatic sell-off-just a lack of bullish vigor. Until UNI closes above the Bollinger band or generates a MACD crossover, the market remains directionless, with risks tilted slightly downward. 📉🤦♂️

In conclusion, my dear readers, UNI’s dance is as dull as a sermon on a rainy Sunday. Will it break free from this tedious waltz? Only time-and a strong catalyst-will tell. Until then, let us observe this comedy of indecision with a glass of wine and a hearty laugh. 🍷😂

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Breaking News: Fed Bids Adieu to Crypto Oversight! Is This a Good Thing? 🤔

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

2025-11-23 23:04