Solana’s price is showing promising signs of a potential rebound. It’s currently holding above the $131 support level and indicates increasing buying pressure, which could lead to a price increase in the near future.

Summary

- Momentum shift emerges as Solana steadies at a long-tested support zone

- Market behavior reflects early accumulation after extended sell pressure

- Divergence hints that downside exhaustion may be forming beneath recent lows

As a crypto investor, I’m starting to see some positive signs with Solana (SOL) after a pretty tough downtrend. I’m noticing a bullish divergence on the daily chart, which suggests the selling pressure might be easing and buyers could be stepping back in. It’s still early, but it’s a potentially encouraging signal.

Solana appears poised for a potential price increase. The price is currently holding at a key support level, several technical indicators are in agreement, and the launch of Wormhole’s new DeFi platform, Sunrise, on Solana – featuring the first listing of Monad’s MON token – all suggest a positive shift is likely.

Solana price key technical points

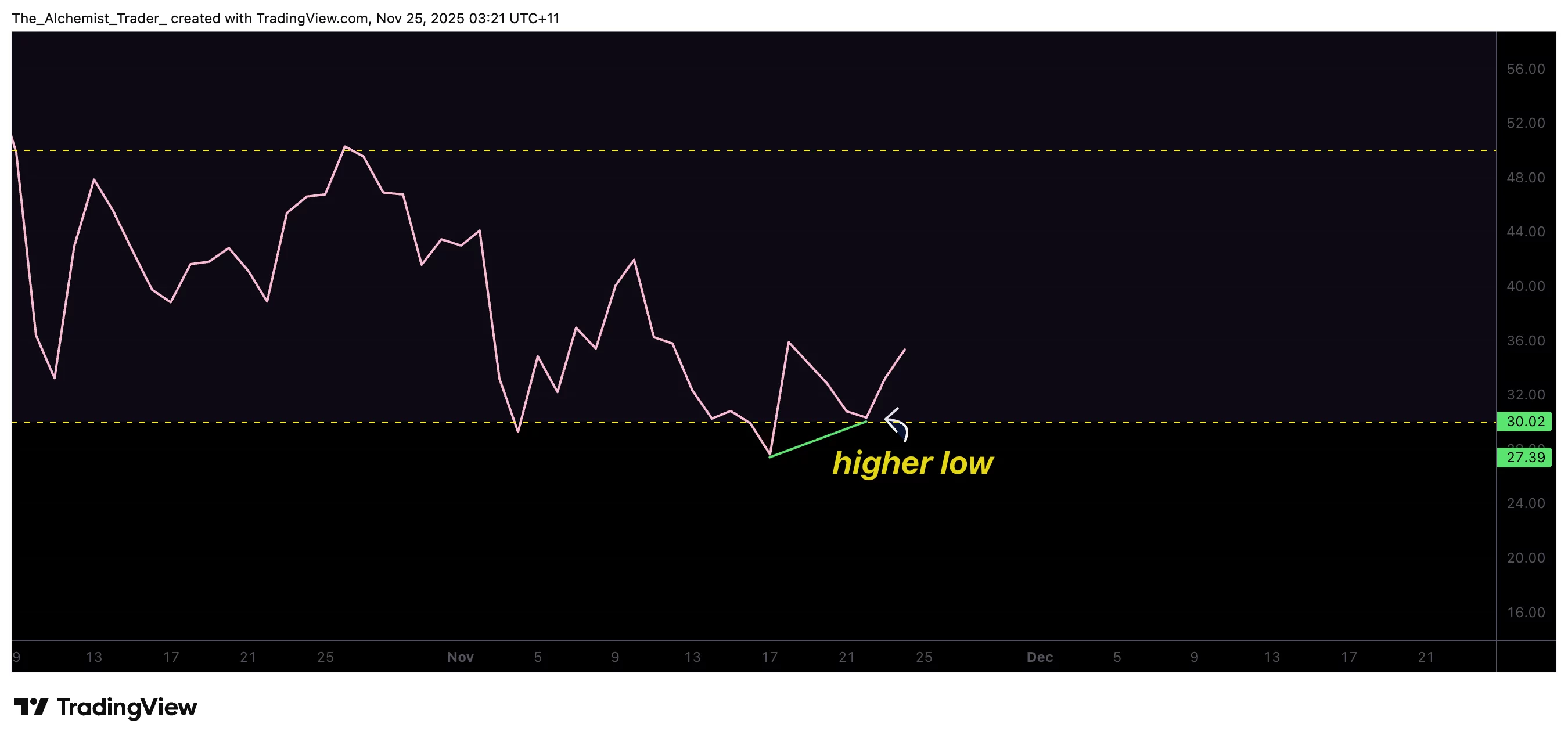

- Daily bullish divergence forming between price and RSI

- Major support at $131 continues to act as a reaction zone

- Key resistance lies at the value area low and later at $167

Solana is showing a strong signal that its price might soon reverse direction. According to technical analysis, the price recently hit a new low, but an indicator called the RSI actually moved *up* during the same period. This difference between price and momentum suggests that selling pressure is weakening, and the price may start to rise soon.

Recently, the price level around $131 has been closely watched. It’s acted as a support level several times, meaning the price has consistently bounced back up from there after briefly falling. This suggests buyers are stepping in to absorb any selling, potentially signaling the start of a price increase.

If the current price support holds, the next important level to watch is the recent low point. If the price rises above this level, it would suggest renewed buying interest and could indicate Solana is heading towards the next major resistance around $167. This $167 level is a historically important price point, often determining whether the upward trend will continue or reverse.

The recent launch of Solana ETFs by companies like Grayscale and VanEck, combined with increased market fluctuations, could significantly influence how the price of Solana responds at this important price point.

Recent price movements and momentum indicators are starting to align, hinting that Solana’s price might soon bounce back. This often happens after a sharp drop, and Solana’s current activity fits that pattern. While it’s not certain yet, initial signs suggest the market could be changing its mind.

Price action

If Solana stays above $131 and shows signs of a bullish divergence, it could rise to $167. However, if it falls below $131, the expected price recovery will be delayed, and the price may continue to fall.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Gold Rate Forecast

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

2025-11-25 03:00