In the labyrinthine corridors of financial prophecy, whispers of a December rate cut echo like the ghostly promises of a bygone era. Yet, will this fiscal balm suffice to hoist the beleaguered Bitcoin back to its six-figure throne? 🧐

The $100K Santa Rally: Is Bitcoin on the Nice List? 🎁

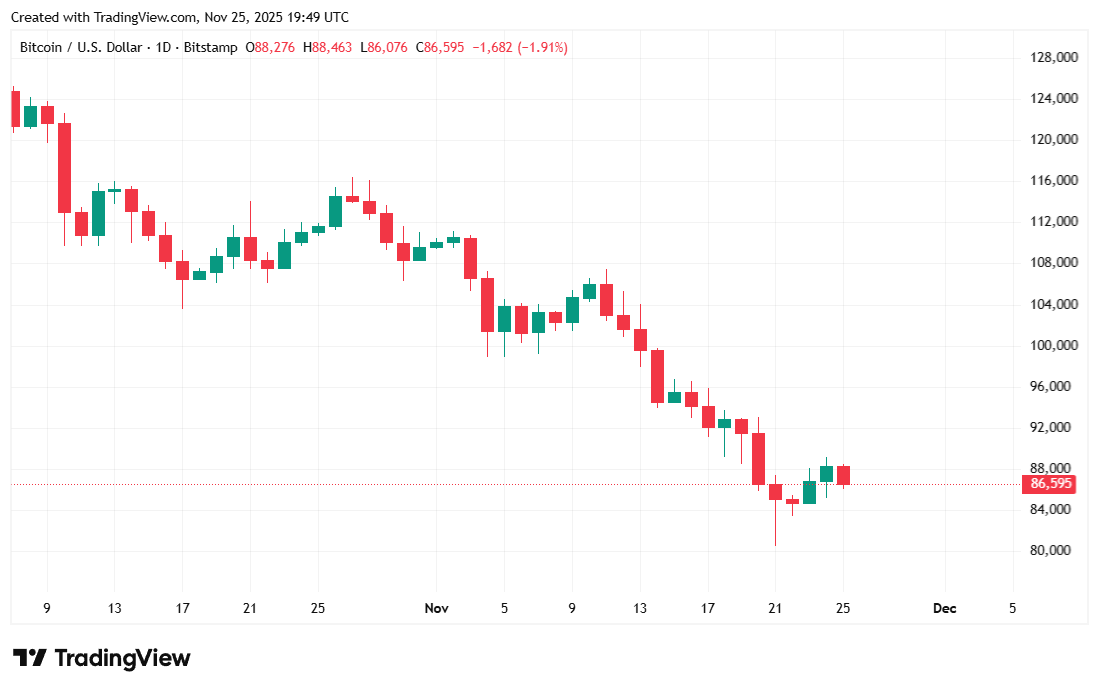

Standard Chartered’s Geoffrey Kendrick, that modern-day Cassandra, prophesied the plunge below $100K with the precision of a man who’s read the tea leaves of doom. Yet, his hubris led him to declare, “It may be the last time Bitcoin is EVER below 100k.” 😂 Alas, the gods of volatility had other plans, as BTC tumbled to $80K, a fall as graceless as a drunkard on ice. Will a December rate cut be the angelic trumpet call to rally the bulls? Or merely a fleeting whisper in the wind? 🌬️

On Friday, New York Fed President John Williams, with the gravitas of a man who’s seen too many spreadsheets, hinted at a rate cut, his words lifting both stocks and Bitcoin like a magician pulling a rabbit from a hat. 🎩 “I still see room for a further adjustment,” he intoned, and the markets, ever the eager pupils, took the cue. 📈

And now, Bloomberg reports that Kevin Hassett, Trump’s economic consigliere, is the frontrunner for the Fed chairmanship. A man who believes rates should be lower than a snake’s belly in a wagon rut. “I agree with the president,” he declared, as if echoing the sentiments of a man who once thought tariffs were a brilliant idea. 🧐 In a separate interview, he admitted, “Rates could be a lot lower.” Lower than what? The morale of a Gulag prisoner? 🥶

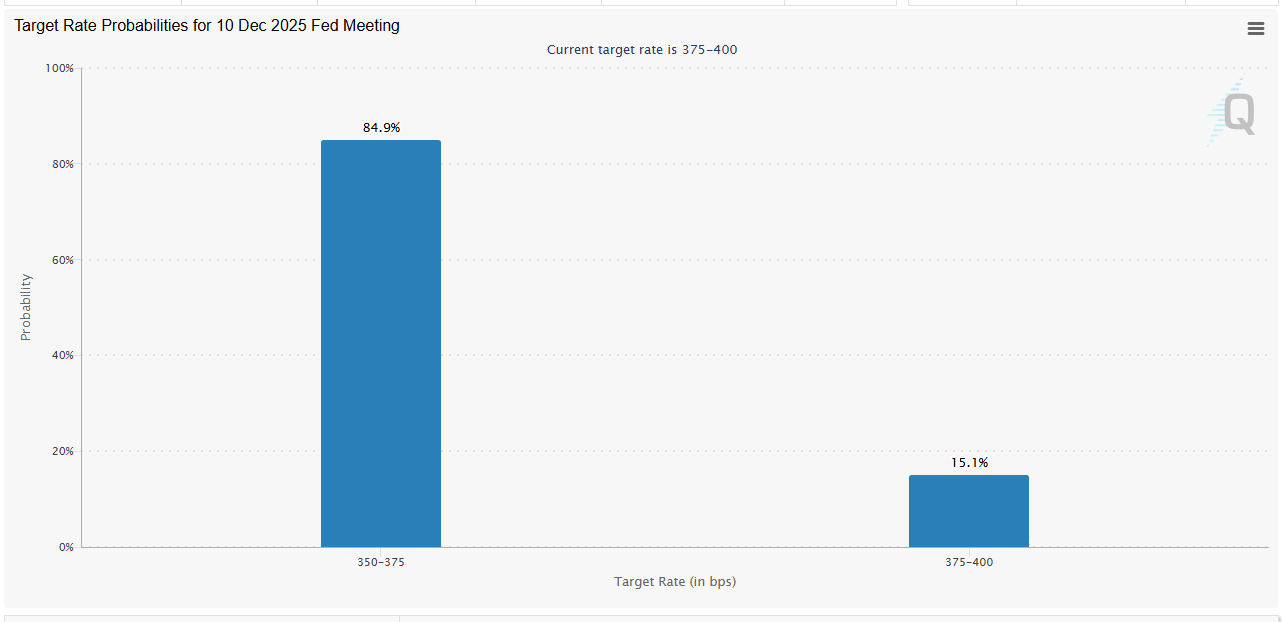

The CME Fedwatch Tool now places the odds of a December rate cut at 85%, a figure as reassuring as a bear market rally. 📉 Meanwhile, Google’s unveiling of Gemini 3, its AI prodigy, has calmed fears of a tech bubble bursting like a cheap balloon. 🎈 All signs point to a risk-on sentiment on Wall Street, a bullishness that might just propel Bitcoin over the six-figure hurdle. Or will it? 🤷♂️

Overview of Market Metrics 📊

Bitcoin has fallen 2.46% in 24 hours, trading at $86,413.29, according to Coinmarketcap. A decline as inevitable as a Russian winter. ❄️ Weekly performance is equally grim, with a 7.29% drop. Volatility, however, has been as subdued as a catnap, with prices fluctuating between $86,131.43 and $89,206.34. 🐱

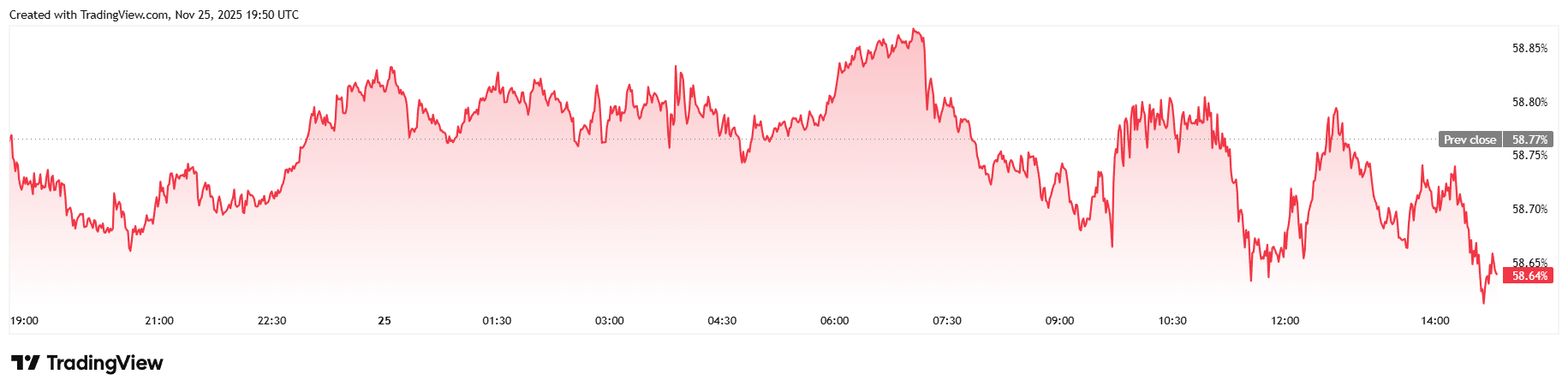

Daily trading volume has plummeted 12.07% to $65.3 billion, a figure as deflated as a punctured balloon. 🎈 Market capitalization stands at $1.73 trillion, while Bitcoin dominance has slipped 0.22% to 58.64%, a sign that altcoins are stealing the spotlight. 🌟

Total Bitcoin futures open interest has dropped nearly 3% to $59.24 billion, a decline as noticeable as a missing tooth in a smile. 😬 Liquidations have eased slightly, totaling $99.26 million, with long and short sellers sharing the pain like comrades in a labor camp. 🛠️

FAQ ⚡

- Why is Bitcoin struggling to stay above $100K?

Macro uncertainty and selling pressure have pinned BTC below six figures, like a prisoner in a cell. 🏛️ - Could a December rate cut push Bitcoin higher?

Markets expect a cut, and cheaper money usually boosts crypto appetite, like a shot of vodka on a cold night. 🍸 - Why does Kevin Hassett matter to Bitcoin investors?

He’s the leading Fed chair contender and a low-rate advocate, a combination as dangerous as a bear with a honeypot. 🐻🍯 - Will Bitcoin hit $100K again by Christmas?

Nothing is certain, but risk-on sentiment, AI optimism, and dovish Fed signals might just work a Christmas miracle. 🎄✨

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Shiba Inu Shakes, Barks & 🐕💥

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-11-26 01:45