So, Bitcoin, bless its volatile heart, has managed a bit of a rally – a pathetic 12% since briefly flirting with the $80,000 abyss. One might almost call it ‘relief,’ if one weren’t quite so cynical. The air, naturally, remains thick with the scent of panic. Apparently, a great many individuals, clever chaps all, surrendered their holdings recently in what the analysts (those oracles!) are calling the largest capitulation in the history of the thing. 🙄

One is left to wonder if this brief respite is merely a ripple in the inevitable tide of doom, or a genuine sign of…something. A pulse, perhaps? A desperate gasp? These are the questions that keep a sensible investor awake at night.

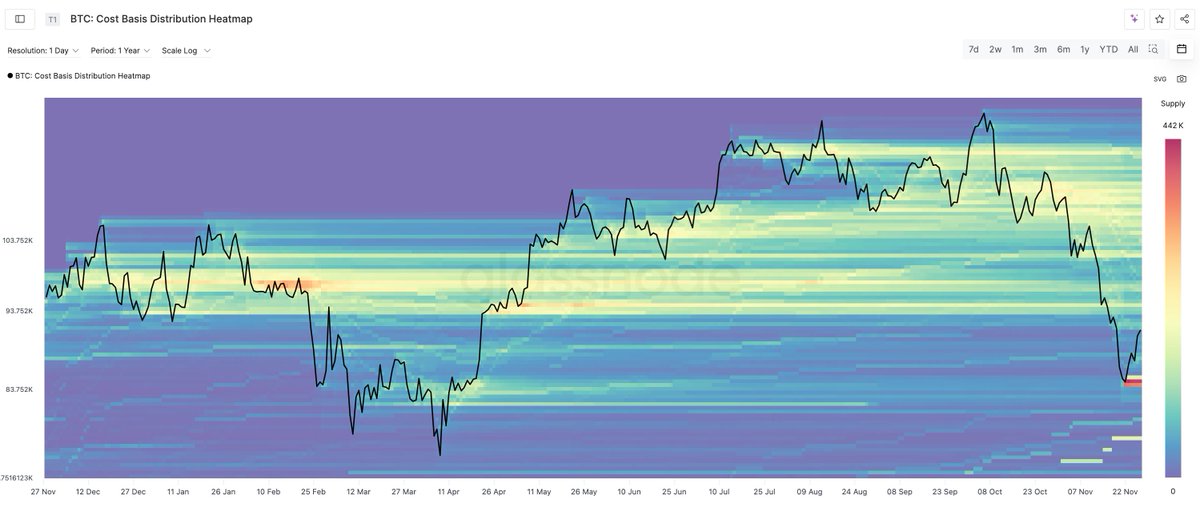

The learned gentlemen at Glassnode tell us the path forward is, as always, ‘challenging.’ The cryptocurrency must somehow overcome these ghastly ‘supply clusters’ – areas where people, in a fit of optimism, bought the wretched stuff at far higher prices and are now hoping to break even. One can scarcely blame them. It’s a vicious cycle, really.

These clusters, you see, represent a potential avalanche of sell orders. Oh joy. As the price creeps upwards, these erstwhile bulls will suddenly remember their better judgement, and unload their digital hoard. One anticipates an abundance of ‘heavy sell-side pressure’. How frightfully dramatic.

Bitcoin’s Impenetrable Fortresses

Apparently, Bitcoin is now approaching two particularly egregious clusters. The first, a mere inconvenience, between $93,000 and $96,000. The second, rather more imposing, spanning the truly ambitious – and dare one say, optimistic – range of $100,000 to $108,000. Zones of despair for those who bought the hype. 😩

These zones, formed by past exuberance, will naturally act as ‘strong resistance’. Because, really, who wants to watch their investment inch back into the black? Far better to cut one’s losses and decry the whole thing as a bubble. It’s terribly fashionable.

The outcome, naturally, hinges on Bitcoin’s ability to breach these fortifications. A successful assault would be heralded as ‘renewed confidence’. Failure? Well, one shudders to imagine. More corrective structures, no doubt. It sounds terribly painful.

A Brief Respite From the Bloodbath

The weekly chart, as if to mock our anxieties, shows Bitcoin attempting a semblance of stability after a ‘sharp multi-week selloff.’ A rebound to $91,500, accompanied by a ‘long lower shadow’ (whatever that is). The professionals, you see, are noticing things.

However, let us not get carried away. The price remains stubbornly below the 50-week moving average – a level previously deemed ‘reliable’. Losing that was, apparently, a ‘significant technical break.’ One wonders if the analysts have a thesaurus. And the 100-week moving average, around $85,000, seems to be the last line of defence before utter pandemonium.

Volume is, predictably, ‘elevated’, and the market is in a ‘decisive phase.’ A close above $92,000-$94,000 would be ‘strengthening.’ A rejection? Well, let’s not discuss that. It’s simply too bleak. 🥂

Read More

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- If Your Altcoins Were Parties, They’d Be Dead 🥳 – The Cryptocurrency Comedy of Errors

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- OP PREDICTION. OP cryptocurrency

- They Swapped Charts for Cheap Carbs! CEA Just Gorge-Bought BNB, Guts Still Sparkling 🤯

2025-11-29 04:25