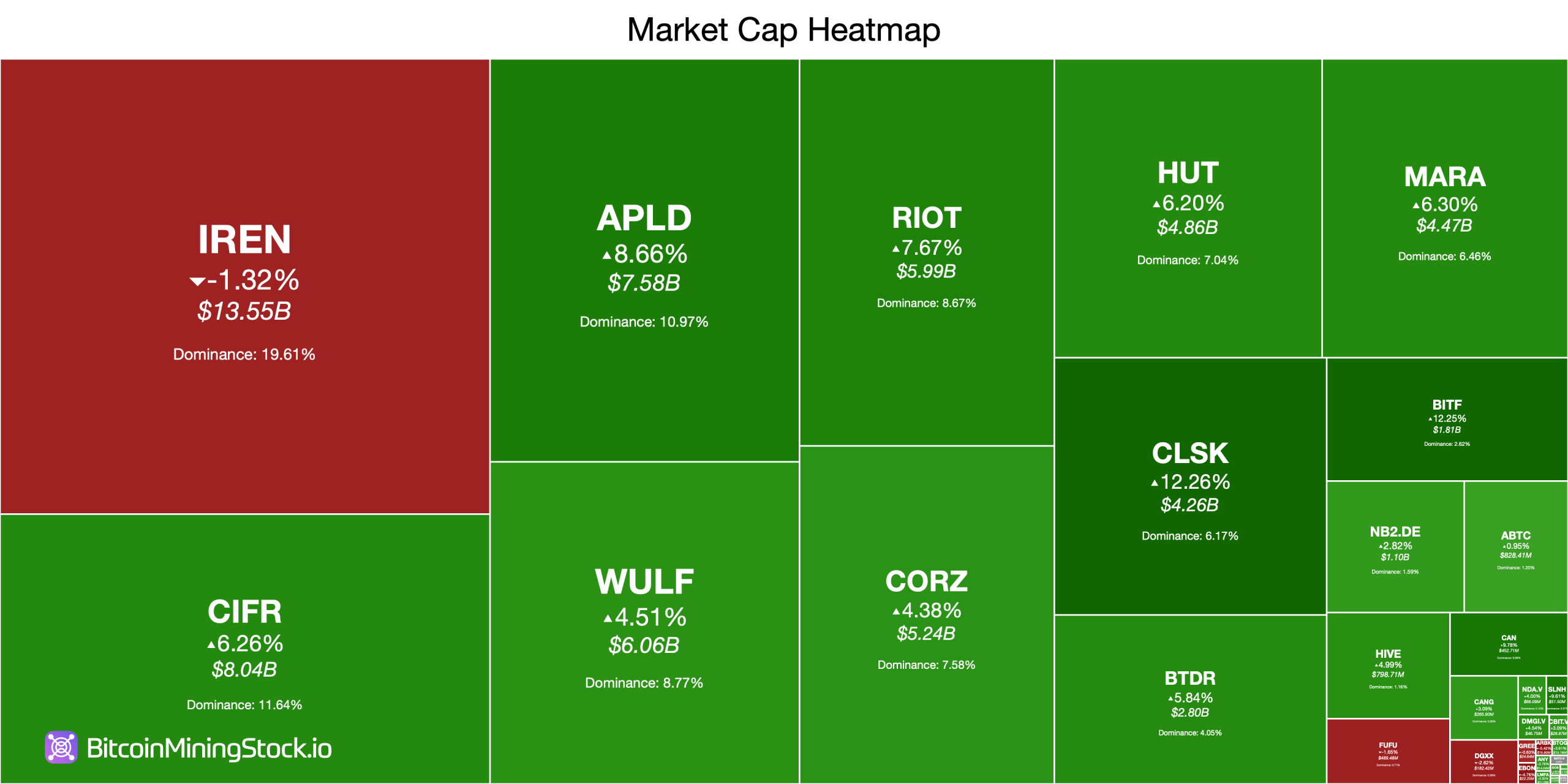

On Friday-and throughout the week-publicly traded Bitcoin miners decided to ditch their previous funk and dive headfirst into a pool of profits. Of the ten largest miners by market cap, every single one of them was happily swimming in green. 🌱

Bitcoin Miners Erupt in Weekly Rally

Over the same stretch, Bitcoin surged 8% against the U.S. dollar, and naturally, the mining sector couldn’t resist hopping on the bandwagon. Meanwhile, U.S. equities, not to be outdone, joined the party with their own blistering run, closing the week looking fabulous. It was like a race to see who could be the most fabulous miner!

Take IREN Limited, for example. IREN was the one who tripped over its shoelaces with a -1.32% dip on the day. But don’t worry, its 13.13% weekly climb and $13.55 billion market cap kept it comfortably in the heavyweight category. IREN’s Q1 FY26 report showed some solid gains, thanks to new AI cloud contracts, including a rather cheeky $9.7 billion deal with Microsoft. Because why not?

According to bitcoinminingstock.io, Cipher Mining rolled into Friday with a bold 6.26% daily increase and a show-off 43.81% weekly surge, backed by an $8.04 billion valuation. This surge followed Cipher’s massive 10-year high-performance computing deal with Fluidstack. Yes, Google has their back, because of course, they do.

Applied Digital wasn’t far behind, showing off an 8.66% daily jump and a dazzling 28.49% weekly climb, supported by its $7.58 billion market cap. Terawulf wasn’t missing out either, adding 4.51% that day and an even more impressive 37.37% for the week, capped at $6.06 billion. Meanwhile, Applied Digital wrapped up Phase II of its Polaris Forge 1 AI Factory Campus in North Dakota-because obviously, that’s a thing.

Riot Platforms pressed ahead with a 7.67% daily boost and a 26.90% weekly climb, resting just under $6 billion. Core Scientific, not to be left behind, chipped in with a 4.38% daily lift and a 14.66% weekly increase, supported by its $5.24 billion valuation. Riot recently delivered record results while Core Scientific had a fun time terminating its merger agreement with Coreweave. Drama! 😏

Hut 8 also joined the celebration, booking a clean 6.20% bump on Friday and a 31.04% weekly surge, backed by a $4.86 billion market cap. They also shared plans to develop four new sites with a total capacity over 1.5 GW, because who doesn’t want more capacity? MARA Holdings added a solid 6.30% in 24 hours and a strong 17.27% for the week, bringing its market cap to $4.47 billion. They reported a 92% year-over-year revenue jump for Q3 2025. Impressive!

Then there’s Cleanspark, which made a statement with a 12.26% daily increase and a remarkable 55.19% weekly climb, pushing its valuation to $4.26 billion. Bitdeer wrapped up the top ten, logging a 5.84% daily increase and a 30.32% weekly rise, capped at a $2.8 billion market cap. Oh, and Cleanspark had a “tiny” 102% revenue growth year-over-year. 😎

The week wrapped up with miners riding a powerful wave of momentum, fueled by expanding AI contracts, new HPC builds, and, of course, a nice, steady Bitcoin boost that kept everyone energized. 🍹

But here’s the kicker: As these companies dive headfirst into AI and high-performance computing, there’s still one big, unanswered question: How is this mix of priorities going to shape the future of the Bitcoin mining market? The industry’s big players are charging ahead, but the balance they strike in the coming months might just define the next chapter. Stay tuned for the drama. 🎭

FAQ ❓

- What fueled miners’ gains this week? Strong Bitcoin price action, expanding AI contracts, and new HPC developments helped lift major mining stocks.

- Which miners led the weekly performance? Companies like Cipher Mining, Cleanspark, Hut 8, and Bitdeer posted some of the strongest seven-day climbs.

- How did broader markets influence mining stocks? U.S. equities advanced alongside Bitcoin, adding tailwinds to miner valuations.

- Why does AI and HPC adoption matter for miners? Their growing focus on AI and HPC raises long-term questions about how these priorities will shape the Bitcoin mining sector.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- KCS PREDICTION. KCS cryptocurrency

- OP PREDICTION. OP cryptocurrency

- If Your Altcoins Were Parties, They’d Be Dead 🥳 – The Cryptocurrency Comedy of Errors

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Shiba Inu’s Zero Removal: A Tragicomedy of Errors

- Bitcoin & Gold: Because Money is Weird

2025-11-29 21:14