Oh. My. God. The crypto market just had a meltdown that would make a toddler on a sugar rush look calm. Bitcoin? Yeah, it went from $92,000 to $86,000 like it lost its keys and a sense of self-worth. Over $637 million in liquidations? That’s basically crypto’s version of a group therapy session. And guess what? It’s all because the global economy decided to play hot potato with interest rates. Not crypto’s fault! Blame Japan, robots, and cosmic alignment of bad vibes. 🌌💸

Why the Crypto Crash Happened

Japan’s Rate Shift Sparked Global Panic

The Bank of Japan just dropped a bombshell: “Hey, we might raise rates on December 19!” And suddenly, everyone’s like, “Uh-oh, my yen carry trade is a hot mess!” Traders are now scrambling like they’re in a reality TV show elimination round. Borrowing costs? Up. Risk assets? Down. Bitcoin? Just trying to survive. 🤷♂️🇯🇵

Trading Algorithms Accelerated the Sell-Off

It’s 12:00 AM, and the robots are awake. They’re not crying, they’re just… rebalancing portfolios and reducing risk. Automated selling? That’s not a crash, that’s a robot uprising. Welcome to the future, where machines decide your life savings are trash. 🤖📉

Capital Returning to Japan and China Tightened Liquidity

Japan’s 2-year bond yield is now 1.84%-because 2008 was clearly a low bar. Meanwhile, Japan and China are like, “Nah, we’re done buying U.S. debt.” So now the whole world’s liquidity is tighter than a toothbrush after a dental lecture. Risk assets? Uh, crypto’s the emotional support pet here. 🐾🇨🇳

Technical Volatility Made the Crypto Crash Worse

Monthly and weekly candle closes? That’s not trading-it’s witchcraft. No actual crypto news today, just a global/macroeconomic conspiracy to make you panic-sell. It’s like the stock market’s Halloween party and crypto got dressed in clown makeup. 🎃🕯️

$637M Liquidated as the Crypto Crash Deepens

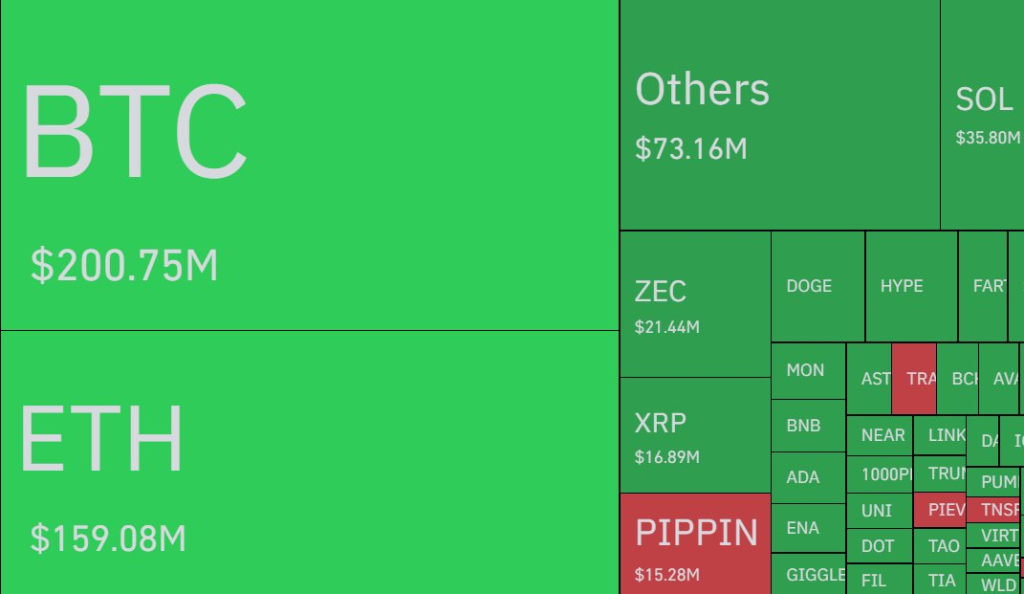

Over $637 million in liquidations? That’s enough to buy a small island… if you could still afford sand. Long positions lost $567 million-congrats, you’re now a short-term investor. Bitcoin? $200 million down the drain. Ethereum? $159 million. Solana? $35 million. And ZEC and PIPPIN? Oh sweet summer child, they’re just getting started. 🏝️🔥

Liquidations spiked from $15M to $578M in 12 hours. That’s not a crash-it’s a crypto car crash. And you’re the one holding the popcorn. 🍿

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. Because if you don’t, you’ll end up like these poor souls. 🚨

FAQs

Why did the crypto market crash today?

Blame Japan’s rate drama, yen carry-trade meltdowns, and robots doing their evil robot thing. Not crypto’s fault-it’s just collateral damage in the global economic soap opera. 🧼

What role did liquidations play in the drop?

Longs got liquidated like they were on a diet. Shorts? Well, they’re just here for the chaos. It’s a crypto version of “The Hunger Games,” and no one wins. 🎬

Is this crypto crash a sign of long-term weakness?

Nope! It’s a temporary hiccup caused by macroeconomic drama queens. The fundamentals are fine-just ask the robots. They’re not crying. 😭🤖

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- The Tragicomic Descent of Pi Network: A Token’s Lament

- ONDO PREDICTION. ONDO cryptocurrency

- IP PREDICTION. IP cryptocurrency

- They Swapped Charts for Cheap Carbs! CEA Just Gorge-Bought BNB, Guts Still Sparkling 🤯

2025-12-01 14:54