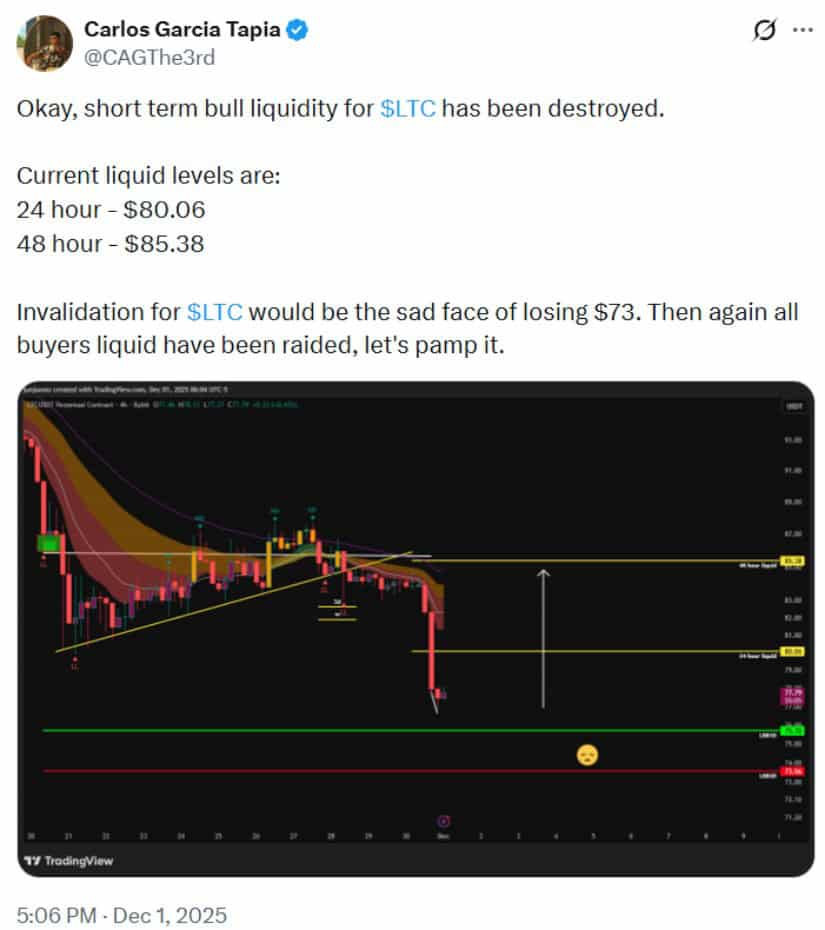

In a move that could only be described as part of Litecoin‘s ongoing drama, the 4-hour Bybit perpetual futures chart has thrown us a juicy plot twist. The price cleared a key pocket of short-term buy-side liquidity, unveiling new upside markers at $80.06 and $85.38. Now, traders are scratching their heads, asking: is this the beginning of a long-awaited recovery, or just another brief interruption in a wider downtrend? Well, grab your popcorn, folks. This is crypto, after all.

At the time of this masterful analysis, Litecoin (LTC) was lounging around the $77.50-$77.80 mark. But let’s be real-the moment to worry is when LTC falls below $73. If it does, it’s like opening a trapdoor to the abyss, triggering forced liquidations in overleveraged positions-something every short-term trader keeps a paranoid eye on during volatile periods. No one wants to be the one who gets stuck holding the bag when it drops, right?

Analyst Insights and Long-Term Value Models

While short-term traders stare nervously at their screens, some long-term thinkers are taking a deeper dive into Litecoin’s future. One such researcher, the ever-cryptic @MASTERBTCLTC, has been comparing Litecoin’s network fundamentals to Bitcoin’s historical valuation trends. His findings? Litecoin, at least at $82, is supposedly “undervalued” relative to network usage. But, of course, this is not a universally held belief. Some people still insist Litecoin’s value is like that one friend who insists on bringing over the same bottle of wine to every dinner party. Not everyone’s buying into it.

Now, don’t get too comfortable with that “undervalued” label, because things get a little wilder here. The same researcher projects that Litecoin could hit a mind-boggling $240,000 by 2030, provided we see capital inflows to the tune of $4 to $8 trillion. You know, just a few trillion shy of what’s currently in circulation. Analysts, however, caution that these projections are more based on mathematical extensions of past cycles than on any sort of actual economic fundamentals. But hey, who’s counting?

Experts in digital assets have a few words of warning: don’t get lost in these theoretical charts. The cryptocurrency world is more like a toddler with a crayon, just scribbling away. Relying purely on trendlines or fractals is like betting your life savings on a game of Monopoly. So, maybe take a minute to consider real-world factors like transaction activity, market liquidity, regulatory conditions, and how the macroeconomy is behaving. Spoiler: It’s not behaving well.

Trading Outlook and Market Sentiment

As for the short-term traders, they’re focusing on the usual: support and resistance levels. They’ve recently zeroed in on a known support region, making it a “potential interest zone for long positions.” But, in true risk-averse fashion, stop-loss orders are, of course, recommended. You know, just in case things go sideways. Again, this is crypto, not a retirement plan.

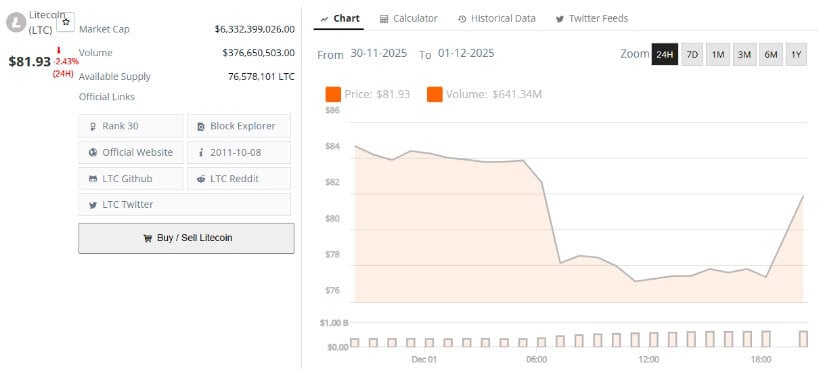

So, what’s the damage as of December 1, 2025? Litecoin traded between $77.03 and $84.75 within 24 hours. The downside? Well, it’s been a rough ride:

-

−7.75% over 24 hours

-

−6.88% over 7 days

-

−20.66% over 30 days

-

More than −20% year-over-year

These declines are no surprise, given the broader “risk-off” conditions in the crypto market. And don’t even get us started on the regulatory uncertainty. It’s like trying to trade on a foggy morning, with no GPS and a broken compass.

Market Factors: ETF Withdrawal and Institutional Behavior

To make things even juicier, Litecoin’s ETF dreams were dashed in late November. CoinShares withdrew its application for a Litecoin ETF, citing regulatory hurdles and low margins for single-asset products. The decision, though unsurprising, definitely stung. This fueled a dip in investor confidence, especially among those who had pegged their hopes on an LTC ETF as the key to a breakout. Spoiler alert: It’s not happening anytime soon.

But hey, it’s not all doom and gloom. Some institutional investors are still dipping their toes into Litecoin, albeit very cautiously. Small corporate treasury disclosures reveal that a few companies have added LTC to diversify their digital assets. But let’s be honest, these are small potatoes compared to the big players like Bitcoin and Ethereum.

On the technical side, Litecoin continues to evolve. The 2025 rollout of LitVM enhanced its smart contract capabilities, and the ongoing adoption of MWEB strengthened its privacy features. Litecoin is positioning itself as a fast, low-fee settlement layer, something that businesses are beginning to take seriously for everyday transactions. Who knew, right?

Outlook and Conclusion

Looking ahead, Litecoin’s near-term price direction hinges on whether that recent liquidity sweep above $80 leads to sustained accumulation or if it just fizzles out. The key markers for the bullish brigade? $80.06 and $85.38. But the real test is $73. If it dips below that, it’s game over for the bulls.

Investor sentiment is mixed. Some analysts believe Litecoin is undervalued thanks to steady network activity and ongoing development. Others, however, point out the technical and macroeconomic hurdles that could limit upside potential. So, as always in crypto, take your predictions with a grain of salt-and maybe a shot of tequila.

This analysis is purely for informational purposes and should not be construed as financial advice. Conditions can change faster than you can say “market crash,” so always do your own research and assess your risk before diving into this wild world of crypto.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- AI, Crypto, and Gen Z: The Future of Holiday Shopping is Here (And It’s Ridiculous!)

- Brent Oil Forecast

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

2025-12-02 00:55