Ah, the theater of finance! On this fine Tuesday, the great institutions, those titans of capital, have once again taken center stage. Behold, the $1.69 trillion behemoth, Franklin Templeton, has deigned to expand its EZPZ crypto index, embracing the likes of XRP, ADA, SOL, DOGE, LINK, and XLM. A grand gesture, no? Meanwhile, Strategy, in a move both cunning and perplexing, raises $1.44 billion in cash after selling $1.48 billion in MSTR shares. Michael Saylor, once the unwavering BTC apostle, now finds himself a conditional seller, while Samson Mow, the $1 million BTC evangelist, declares this a “fortress move.” 🏰 And let us not forget Jim Cramer, the court jester of CNBC, hinting at Bitcoin‘s support map after its dramatic October plunge. What a spectacle! 🎭

TL;DR

- Franklin Templeton adds XRP, ADA, SOL, DOGE, LINK, XLM to its crypto index ETF. 🤑

- Mow calls Saylor’s setup an unassailable Bitcoin fortress. 🏰

- Cramer hints at BTC support near the broad $80,000 area. 📉

XRP and Cardano (ADA) boosted by $1.69 trillion Franklin Templeton

Ah, Franklin Templeton Digital Assets, the grand maestro of finance, has confirmed that its Franklin Crypto Index ETF (EZPZ) now includes XRP, ADA, SOL, DOGE, LINK, and XLM. Until this momentous update, the product held only Bitcoin and Ethereum, a binary world indeed. Now, with $1.69 trillion in managed capital, it ventures into the realm of multiasset representation. A bold move, though one wonders if it is but a drop in the ocean of their vast wealth. 🌊 The ETF, with a NAV of $22.27 as of Dec. 1, boasts $6.68 million in net assets and a 15.3% return since its February 2025 launch. A modest sum, yet the narrative it feeds is grand: traditional finance, it seems, is finally broadening its horizons beyond the BTC-ETH duopoly. 🌍

The holdings, a mere whisper in the wind of their portfolio, are as follows: BTC at 74.47%, ETH at 13.04%, XRP at 6.63%, SOL at 3.35%, DOGE at 1%, ADA at 0.8%, LINK at 0.38%, and XLM at 0.33%. Small in dollar terms, yet the sentiment it stirs is immense. For in this gesture, we see the slow, inevitable march of crypto into the hearts of the financial elite. 💼

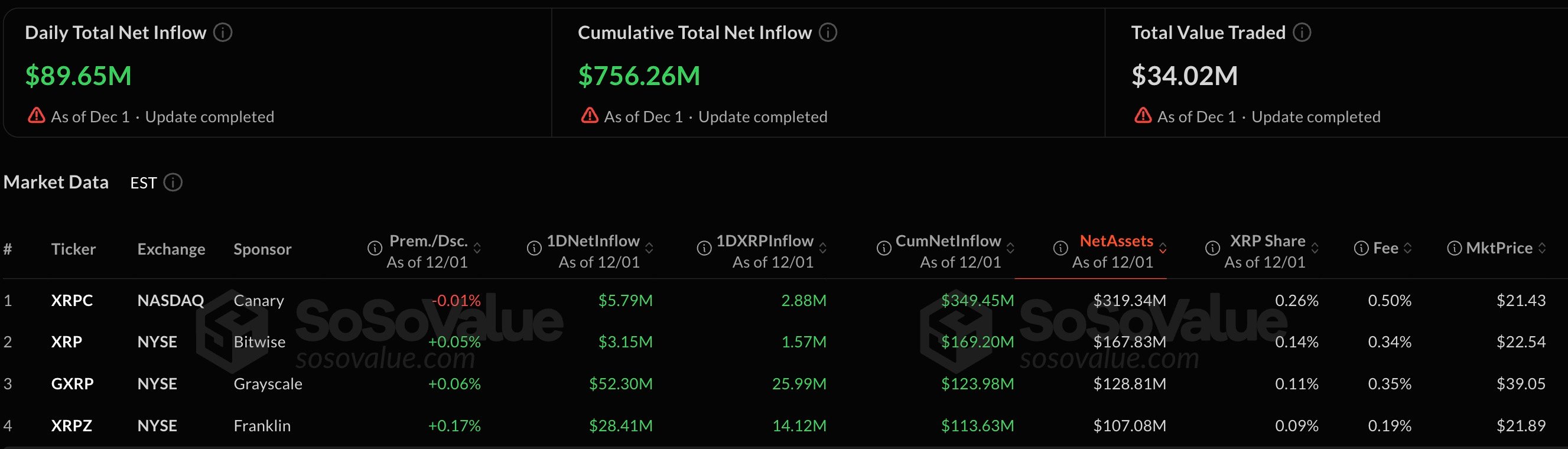

XRP, ever the resilient one, maintains its position with cumulative inflows of $723 million across dedicated ETFs. Daily flows for Dec. 1 reached $89.65 million, a testament to its enduring appeal, even amidst the market’s bloodbath. 🩸

Jim Cramer teases good stuff about Bitcoin

Ah, Jim Cramer, the eternal provocateur, took to his pulpit to proclaim, “Good stuff tonight about where Bitcoin can hold.” A cryptic message, no doubt, following BTC’s 40% fall from its October 2025 highs. The market, once buoyant, now questions whether the $100,000 dream is but a distant memory. 🌙 Cramer, ever the showman, ties crypto to the great AI debate, contrasting “physical AI” with the “chatbot dogfight.” A clever framing, though one wonders if Bitcoin, at the intersection of macro and risk, can stabilize around $80,000 while AI absorbs the capital flows. 🤖

In this grand tapestry, Cramer sees definable levels where buyers may step in, a glimmer of hope amidst the pessimism. Yet, one cannot help but chuckle at the irony of it all. For in this world of finance, certainty is but an illusion, and even the wisest of men are but players on a stage. 🎭

$1 million BTC advocate Samson Mow defends Saylor and Strategy

Samson Mow, the indefatigable BTC advocate, has come to the defense of Michael Saylor and Strategy, following their $1.48 billion sale of MSTR shares. “An unassailable Bitcoin fortress,” he declares, with a dollar moat to strengthen its defenses. 🏰 Yet, the market, ever fickle, panicked at the mere mention of BTC sales, sending MSTR shares tumbling 12%. Saylor, once the unyielding BTC purist, now admits that selling BTC is an option, though not imminent. A pragmatic move, perhaps, but one that has shaken the faithful. 🙏

₿uilding a Fortress

– Atlas Hodl’d 🟧 (@AtlasHodld) December 2, 2025

Strategy assures us that debt coverage is secure for 21 months, and margin-call risk is but a distant specter. Yet, the tension remains. If mNAV drops below 0.8, or even 0.7, the firm may consider selling BTC to stabilize MSTR’s price. A scenario the market is all too eager to test. 🦈 Mow, however, remains steadfast, framing the reserve raise as a defensive maneuver. “Easier to defend than to attack,” he quips, though one wonders if the fortress can withstand the siege. 🛡️

Crypto market outlook

And so, we arrive at Tuesday, a day ripe with possibility. The market, ever indecisive, teeters on the edge, awaiting a decisive move. Bitcoin, trading in the mid-$86,000 band, must push toward $88,000 or risk a slide into the low-$84,000 area. XRP, hovering near $2.05, awaits BTC’s stabilization for its ascent to $2.30. Cardano, stuck at $0.63, remains a mere spectator in this grand drama. 🎭

Key levels to watch:

Bitcoin (BTC): Mid-$86,000 band. Will it rise or fall? The market holds its breath. 🌬️

XRP: Near $2.05. Its fate hangs in the balance, tethered to BTC’s whims. ⚖️

Cardano (ADA): Stuck at $0.63, a mere shadow of BTC’s movements. 🌑

And so, dear reader, we leave you with this: In the grand theater of finance, where fortunes rise and fall with the whims of the market, one thing remains certain-uncertainty. Yet, it is in this chaos that opportunity arises. May your investments be wise, and your humor never fail. 🤑

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Gold Rate Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

2025-12-02 15:04