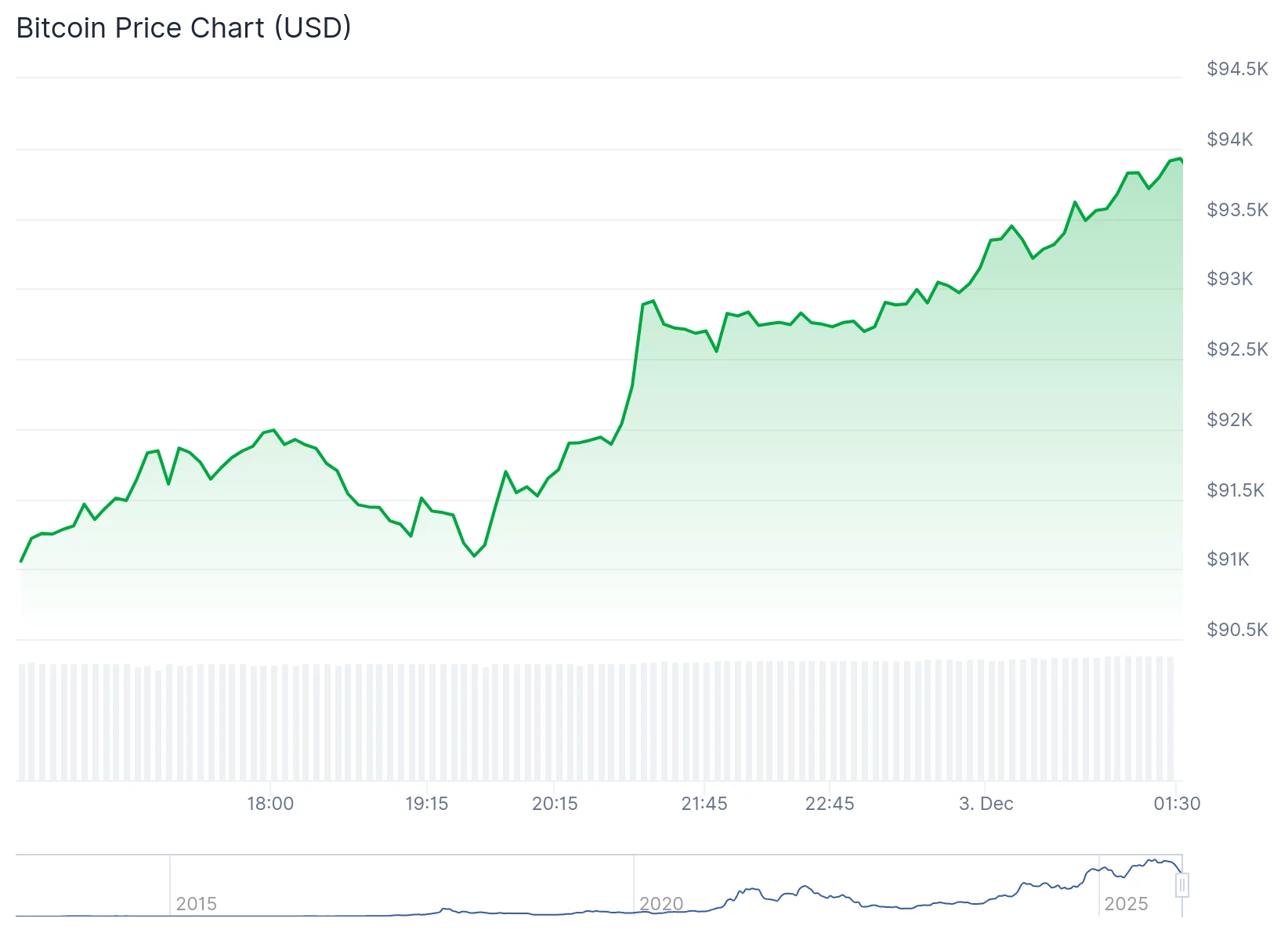

Ah, what a glorious Wednesday afternoon it was! Coinbase Global Inc. experienced an electrifying shock, much like a man who’s just been thrown into a cold pond, as Bitcoin shot up above $93,000, reminding us all that, yes, Coinbase and the largest cryptocurrency on the planet remain as inseparable as a pair of mismatched socks in the laundry. What a beautiful, unbreakable bond!

- Coinbase shares ascended on Wednesday, just as Bitcoin soared to almost $94,000 – what a surprise!

- Despite the market’s collective gasp after a recent downgrade, the ever-optimistic mood persisted, fueled by jaw-dropping Q3 earnings and Cathie Wood’s relentless, undeterred buying spree through Ark Invest.

- Crypto-linked stocks are bouncing back after a broader market tumble. It’s like watching a phoenix rise from the ashes… sort of.

On Wednesday, Coinbase’s stock closed at $276.92 per share, up over 5%. The logic behind this dramatic dance of numbers is simple: when Bitcoin rallies, people trade more. When people trade more, Coinbase profits more. And when Coinbase profits more, investors temporarily forget about things like “valuation multiples” and “price targets.” It’s the most beautiful, if not slightly irrational, cycle. At least on the days when Bitcoin is riding high. 📈

This sudden surge followed a period of doubt and tumult, during which Argus Research decided to downgrade Coinbase to a mere “Hold,” pointing out that the stock’s 39x earnings multiple for 2026 was looking a bit too spicy for comfort. Well, that’s cute, isn’t it? But investors, with the blind optimism that only crypto can inspire, shrugged it off. After all, the company had just obliterated third-quarter expectations with a $1.50 EPS compared to the $1.10 consensus. And what did Cathie Wood’s Ark Invest do in response to the recent dip? You guessed it! They backed up the proverbial truck and stuffed it with more than $7 million in fresh COIN shares to load into their ETFs.

What’s next?

Looking forward, all eyes are on Dec. 17, when Coinbase is expected to unveil a slew of new products – because, of course, who wouldn’t want to add even more features when half of crypto Twitter is already practically living on your app? Prediction markets and stock trading could be the next big things. Move over, Bitcoin, there’s room for more chaos!

Now, on a technical note – Coinbase still has some ground to cover. Its shares are still about 13.9% below the 50-day moving average and 2.7% under the 200-day moving average, reflecting the general slump in crypto-linked equities. But fear not! Ark Invest, never one to be deterred by such trivialities, has been scooping up not just Coinbase, but also Block, Circle Internet Group, Bullish, Robinhood, and even its own Bitcoin ETF, because why not buy everything during a downturn? 🤷♂️

As for Bitcoin itself, it’s still far from its record high from six weeks ago, as liquidity remains as thin as a gossip column, and macroeconomic uncertainty continues to squeeze the life out of trading volumes. See below for more heartache.

But for now, with Bitcoin bouncing like a hyperactive child on a sugar high, and Coinbase happily riding shotgun, investors are getting at least a midweek reminder of just how quickly sentiment – and stock charts – can flip in the mad, wild world of crypto. 🤪

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- Bitcoin Miners Hilariously Boost Reserves by $220M & BTC Plays Hard to Get at $90k

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

2025-12-04 01:09