In a stunning twist of financial drama that could only be described as a cosmic game of Jenga, Ethereum (ETH) has decided to flex its muscles against Bitcoin (BTC). The large-cap altcoin, currently sporting a fully diluted valuation of about $408 billion (which, for context, is roughly the GDP of a small country that also happens to love cryptocurrency), surged over 3% on Wednesday, December 10, to trade above $3,427. One can only assume the ETH whales are hosting a very exclusive underwater cocktail party, and the rest of us are just trying to get a seat at the bar.

As the Federal Open Market Committee (FOMC) gears up for what is surely the most important meeting of the year (or possibly the millennium), Bitcoin (BTC) has been seen loitering around the $92.4k mark, which, in crypto terms, is basically the equivalent of a goldfish asking, “What’s Tuesday?” Meanwhile, the ETH/BTC pair has edged over 7% in the past three days, hovering around 0.0367 during mid-North American trading. If this sounds like a romance novel, it’s probably because someone’s plotting a sequel to “The Little Mermaid” with crypto twists.

ETH Price Eyes Parabolic Rally Fueled by Whale Investors 🐳🦈

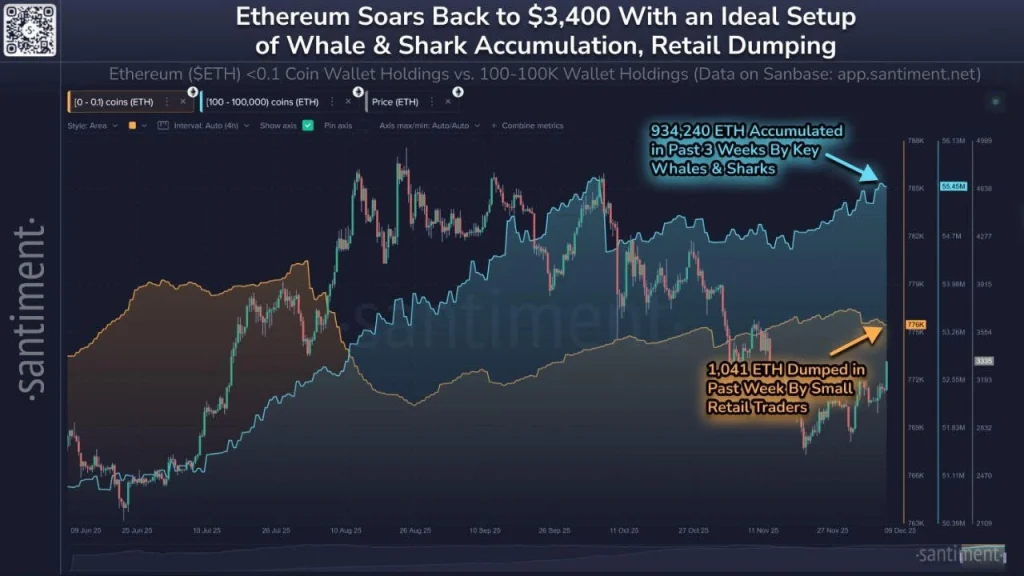

According to the all-seeing eye of on-chain data analysts at Santiment, this surge isn’t just a random act of kindness from the universe but a calculated move by Ethereum whales and sharks-yes, those sharks exist, and they’re very rich. During the past three weeks, these aquatic titans, with account balances between 100 and 100k coins, added 924,240 ETH, now hoarding around 55.45 million coins like it’s the last buffet before the apocalypse. Meanwhile, retail investors, who are presumably the ones who bought ETH after seeing it on a meme or a TikTok, have been unloading their holdings like it’s last week’s gossip.

Is Altseason Next? 🚀

The ongoing bullish thesis for Ethereum has signaled a potential parabolic rally for altcoins in the near term. Capital rotation from Bitcoin to Ethereum and the wider altcoin market has surged, fueled by a clearer regulatory outlook. Or, as one might say, “The whales are dancing, the retail investors are panicking, and the altcoins are probably whispering sweet nothings in everyone’s ears.”

The ratio ETH/BTC is key to watch

– this ratio has been rising the past few weeks, reflecting $ETH fundamentals strengthening

– assume fair value $BTC $200k

– if ratio recovers to 8-yr avg, implies $12k $ETH

– if ratio recovers to 2021 high, implies $22k $ETHSee the…

– Bitmine (NYSE-BMNR) $ETH (@BitMNR) December 10, 2025

As per the sage words of BitMine (@BitMNR), who clearly has all the answers and possibly a time machine, the ETH/BTC ratio is “key to watch.” If this ratio continues its upward spiral, we could see ETH reach $12k on average and $22k on the upside. Such a scenario would trigger a parabolic rally for the wider altcoin market, which is basically crypto’s version of a rollercoaster ride with no seatbelts and a soundtrack of existential dread.

Tom Lee, a man who’s probably had more ETH than he can shake a stick at and still believes in the dream, has boldly predicted ETH could hit $12k on average and $22k if the universe is feeling generous. One can only hope the universe is in a generous mood-or at least hasn’t forgotten its own math homework.

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- BNSOL PREDICTION. BNSOL cryptocurrency

- Heist, Hacks & Tornado Cash: How $2M Evaporated From NGP Protocol

- Altcoin Frenzy: BANK Soars 60% While MET Plays Catch-Up 😱💸

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- USD VND PREDICTION

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

2025-12-10 22:23