Ah, Bitcoin-that capricious beast-clings stubbornly above $92,000, as if taunting the bears who dared push it toward $90,000 last week. The bulls exhale, but only briefly, for the air is thick with suspicion. The market, ever the fickle mistress, remains draped in bearish gloom, whispering of further descent unless some divine intervention shifts momentum. And lo! The Federal Reserve, that grand puppeteer of finance, prepares to pull its strings once more. Investors clutch their charts, bracing for the inevitable storm of volatility. Oh, the drama! 😏

A CryptoQuant report, that oracle of digital gold, reminds us of Bitcoin’s dance with Fed rate cuts-a waltz of liquidity and risk appetite. Lower rates weaken the dollar, yes, and risk assets rejoice! But here’s the twist, dear reader: Bitcoin, that cheeky trickster, often rallies before the cut, only to shrug indifferently once the news hits. Markets, it seems, have already feasted on the rumor, leaving little meat on the bone for the announcement. Typical. 🙄

So here we stand, teetering on the edge of the FOMC meeting. Macro winds may favor Bitcoin’s long voyage, but the short-term? Fragile as a trader’s ego after a bad liquidation. Sentiment, positioning, anticipation-these are the true puppeteers now.

History’s Lesson: A Fool’s Game Before the Fed

GugaOnChain, that sage of CryptoQuant, dusts off the archives and presents us with Bitcoin’s past flirtations with Fed cuts-a tale of irony and unpredictability. Remember September 2025? A measly 25 basis points, and Bitcoin barely blinked. Another time? A glorious surge… followed by a $2,000 faceplant. Ah, the market’s fickleness! Once the Fed speaks, sentiment flips faster than a pancake on a hot griddle. 🥞

Volatility, that relentless specter, looms large. Pre-FOMC rallies? Check. Post-announcement plunges? Naturally. September’s cut saw leveraged traders scrambling like rats off a sinking ship. Truly, Bitcoin remains a slave to event-driven chaos. Will history repeat? GugaOnChain nods sagely-yes, probably. Keep an eye on leverage, funding rates, open interest. And liquidity! Exchange reserves, ETF flows-these are the tea leaves we must read.

A Glimmer of Hope, But the Trend Still Bites

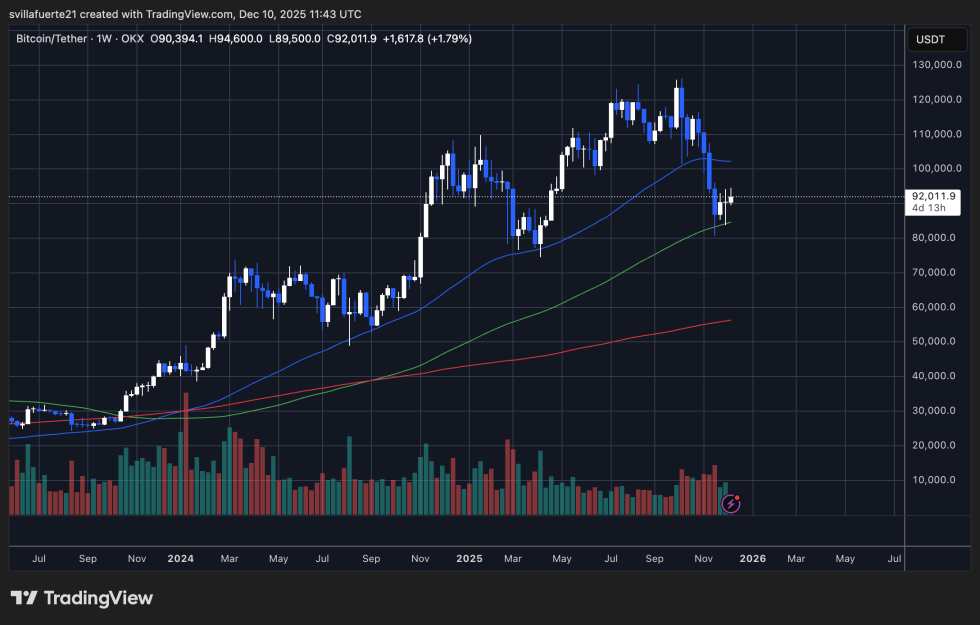

The weekly chart, that canvas of dreams and nightmares, shows Bitcoin clawing back above $92,000 after its brutal fall from $120,000. The 100-week moving average (that green lifeline) holds firm-ah, sweet support! Historically, this line has cradled Bitcoin like a weary drunk against a lamppost. But don’t celebrate yet. The 50-week MA (that smug blue line) still lurks overhead at $100,000, laughing at attempts to reclaim bullish glory. Until then, the trend remains… suspiciously corrective. 🧐

Volume? A timid whisper compared to November’s selling frenzy. Buyers peek from the shadows, but conviction? Still on vacation. The lower highs since the peak whisper one cruel truth: the bears, for now, still hold the leash.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- HYPE PREDICTION. HYPE cryptocurrency

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- Altcoin Frenzy: BANK Soars 60% While MET Plays Catch-Up 😱💸

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- BNSOL PREDICTION. BNSOL cryptocurrency

2025-12-11 03:14