Ethereum currently finds itself below the magical $3,000 mark, like a shy debutante at a dance, as the market’s mood turns gloomier than a rainy Sunday. The price has tried to reclaim the throne but keeps stumbling-an elegant ballet of failure. Guess everyone’s fixated on the psychological barrier, a fancy way traders pretend to care about numbers, while the market is about as stable as a house of cards in a hurricane.

Sentiment? Oh, it’s decisively bearish. Fear and apathy are now the charming duets serenading trader wallets. Volatility? Shrunk like my patience on a Monday morning. Participation? Thinner than my grandmother’s patience with her wayward grandson. Analysts are whispering ominous prophecies-“Prolonged bear market into 2026,” they say, as if always predicting the worst was some sort of market sport. 🥱

This isn’t just retail traders crying into their bowls of porridge. No, the whales-those big bad guys of the deep-decided to add their salt to the soup. Lookonchain reports that two massive whales dumped approximately 14,000 ETH, worth around $40.82 million, over just two hours. Who needs a fireworks show when you have such dramatic exits? This move, during a market already looking more fragile than my cousin’s new marriage, only adds insult to injury. 🐳💸

Now, while the dumping might seem like just another Wednesday, timing is everything. Doing this when liquidity is low? That’s like throwing a stone into a still pond and expecting no ripple. Such distribution stretches the downside, spreading negative vibes across the crypto community-like a bad cold, but with more crying.

Ethereum Whale Selling Meets Long-Term Conviction

Arkham’s data, shared by Lookonchain, shows that the big fish are still busy biting off chunks of ETH. One address, 0x2802, sold 10,000 ETH-nearly $29.16 million-at an average of $2,915.5. Think of it as a reckless shopper at the crypto supermarket, grabbing $29 million worth of digital bread and butter and slipping out the back door.

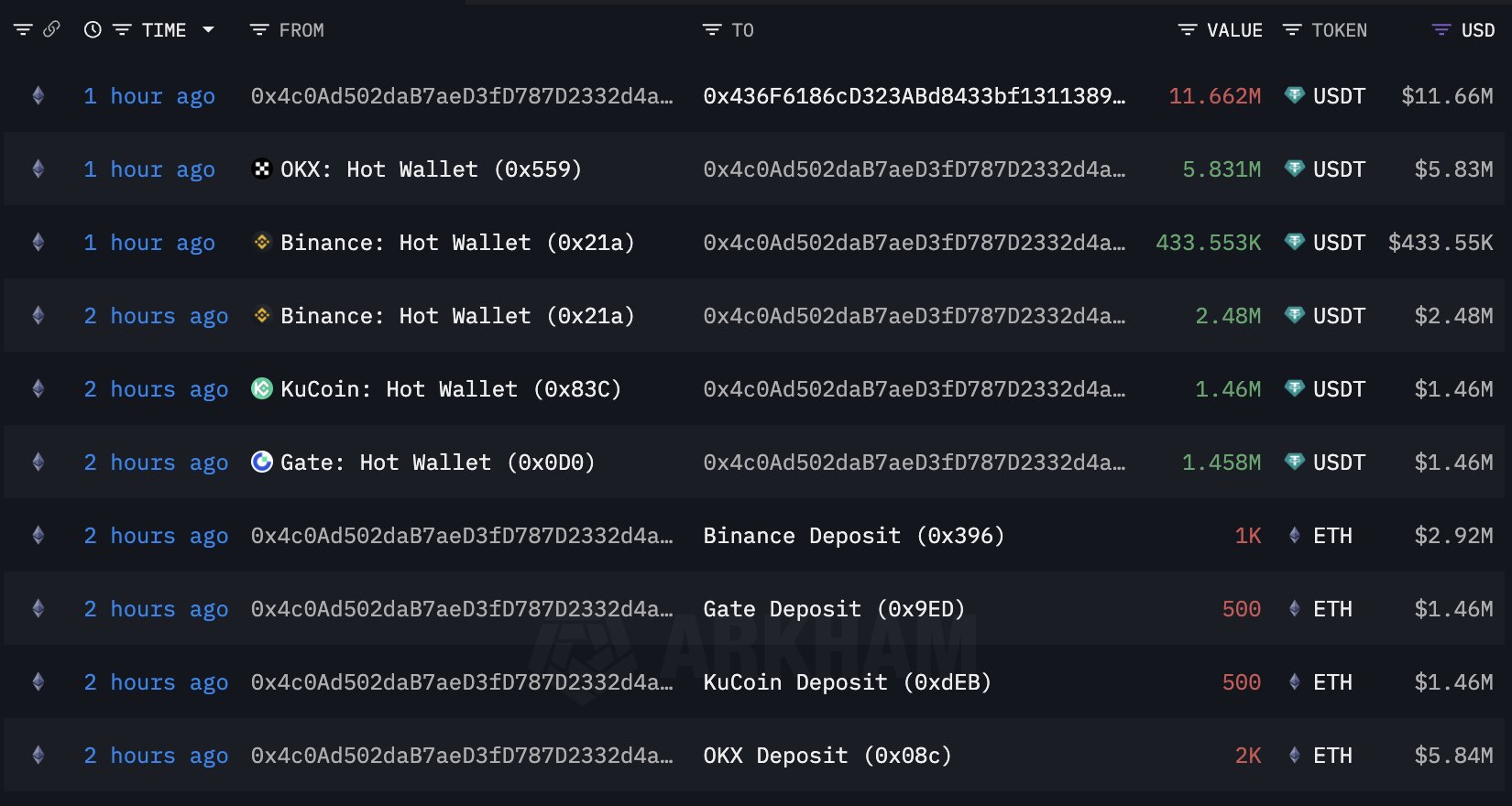

Shortly after, another whale, 0x4c0A, decided to diversify: offloading 4,000 ETH, around $11.66 million, across exchanges like OKX, Binance, KuCoin, and Gate. Talk about a coordinated chaos-a pity party with a full guest list. The timing? Tighter than my Aunt Masha’s corset, reinforcing the idea that everyone’s grumpy and selling at once.

Such antics stir the pot, scaring off small investors who see whale exodus as a siren warning of doom. But don’t get too comfortable. Despite these theatrics, Ethereum’s fundamentals are quietly mending their socks behind the scenes. Institutional adoption? Accelerating faster than my neighbor’s garden gnome collection. JP Morgan even announced using Ethereum for its first tokenized money-market fund-proof that the big boys still believe in this digital beast.

Ethereum Price Struggles to Hold Key Weekly Support

In the weekly dance, ETH is stumbling around the $2,950 mark after a harsh rejection from the $3,200-$3,300 zone. That fancy area was once a hero-now it’s just a stubborn wall, like your stubborn great-uncle refusing to retire. Without reclaiming it, it looks like sellers are reigning supreme, like a bad theater production with a single bad actor stealing the show.

Ethereum is caught between its 200-week moving average, acting as a kind of unenthusiastic referee, and more fleeting averages-50 and 100 weeks-that are all confused and just looking at each other. The volume? Whispering quietly, not screaming like at a rock concert. That’s usually a sign that traders are either too bored to move or too broke to buy. Either way, consolidation reigns between $2,500 and $3,300, like a badly organized closet-full but not very functional.

If ETH dips below $2,800-$2,900, brace for a trip down memory lane to the lower range-but if it dares to reclaim $3,300, perhaps there’s hope for a comeback, or at least a good story to tell at future dinners. Until then, Ethereum remains the delicate teacup of the blockchain world-fragile, unpredictable, and holding on by a thread. ☕📉

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

2025-12-17 04:20