The price of this… digital curiosity, this Bitcoin, stood at $88,195 as of the twentieth of December, in the year of our Lord 2025. A market capitalization of $1.76 trillion, they tell us. And yet, the day’s trading, a paltry $37.07 billion’s worth, suggests a strange inactivity. It is, one might say, a restless energy contained – the asset is awake, yes, alert even, pacing like a gentleman awaiting an invitation to a ball, but quite unsure if he desires the waltz or a scandal. 🙄

Bitcoin Chart Outlook

Upon examining the hourly chart, one finds Bitcoin trapped, as a fly in amber, in a state of low volatility. The price shuffles between $88,000 and $89,500, a brief attempt at a surge to $89,349 quickly rebuffed – a pathetic little breakout attempt, swiftly and unceremoniously corrected. It reminded me of young Petrov, always promising grand things and then… nothing.

The dwindling volume only reinforces this impression of stagnation. It seems the participants are awaiting some grand signal, some dramatic event, rather than attempting to force the issue. Such a suppression of activity rarely lasts, of course. When it finally breaks, it will do so with a touch of… temperament.

Looking at the four-hour chart, the structure appears a touch more… robust, shall we say? A rather precipitous decline found support near $84,398, a fortunate stumble, followed by a recovery accompanied by a noticeable uptick in volume – a capitulation, perhaps, or merely a temporary spasm of panic. The price now gently climbs toward a resistance zone near $90,317, where previous attempts were met with a stony silence. The outlook is not dreadful, but the resistance remains watchful, like an old aunt scrutinizing a potential suitor.

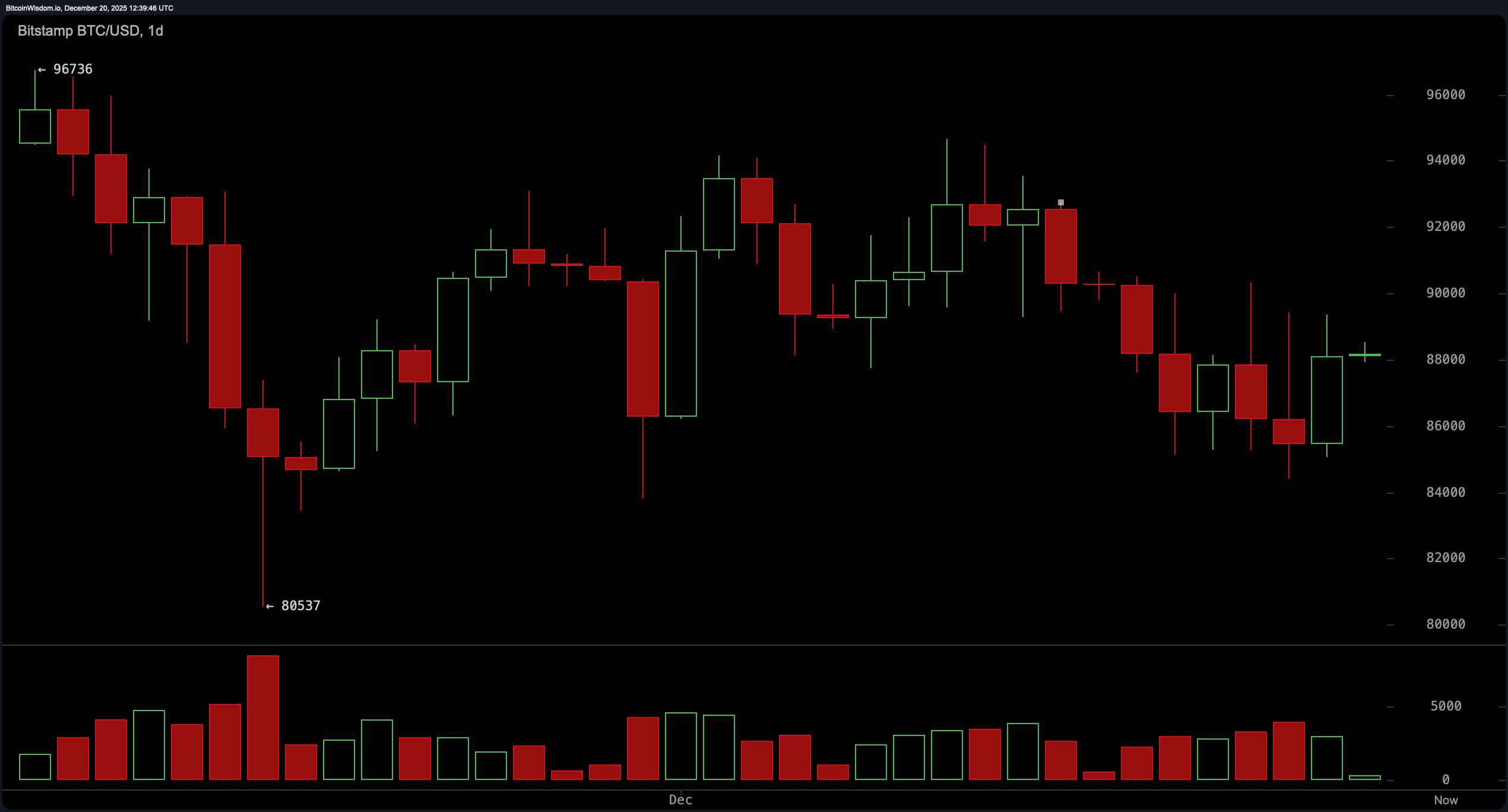

The daily chart lends a measure of perspective – and a dash of realism. Bitcoin is attempting to extract itself from a longer downtrend, having descended from the lofty heights of $96,736 to the more modest sum of the high $80,000s. A significant dip near $80,537 proved to be a turning point, followed by a slow, deliberate stabilization around $87,500 to $88,500. The volume is healthy enough, but the market responds with a recovery, not a further descent, suggesting that those with a longer view are cautiously accumulating, while the headlines shout their usual alarm.

The various indicators offer a decidedly mixed bag. The relative strength index (RSI) at 44, Stochastic at 28, the commodity channel index (CCI) at minus 53, and the average directional index (ADX) at 26 reveal nothing conclusive – a frustrating neutrality. The Awesome Oscillator remains stubbornly negative, while momentum (10) and the moving average convergence divergence (MACD) hint at improving internal pressure, despite the overall indecision. The technicians, naturally, are enthralled by this subtle drama, even if it leaves the short-term traders chewing their fingernails.

The moving averages, however, play the role of stern custodians. The price remains below all those tiresome exponential and simple moving averages – the 10, 20, 30, 50, 100, and even the venerable 200-period. This alignment reinforces the corrective structure and suggests that any upward momentum will require considerable effort to overcome the layered resistance. Bitcoin may be fluttering its eyelashes coquettishly, but the long-term trend is not yet ready to declare a triumphant return.

Bull Verdict:

Bitcoin demonstrates nascent signs of structural repair, not overwhelming strength. The rebound from $84,398 on the four-hour chart, paired with the improving momentum and the constructive MACD histogram, indicates that downward pressure has diminished. With the daily chart establishing a base between $87,500 and $88,500 and volume supporting recovery, the market appears increasingly composed. Should consolidation break upwards, it would suggest that prudence, not panic, is currently holding sway.

Bear Verdict:

Despite the somewhat improved undercurrent, Bitcoin remains constrained by a formidable wall of resistance and a regiment of declining moving averages. It continues to trade below all major EMAs and SMAs, reinforcing a defensively inclined broader trend. Neutral readings across the RSI, Stochastic, CCI, and ADX confirm a distinct lack of conviction. Until the price decisively surmounts higher levels, the risk lingers that consolidation will resolve into a continuation of the downtrend, reminding traders that hesitation, like a poorly timed joke, can fall flat.

FAQ

- What is the current bitcoin price on Dec. 20, 2025?

Bitcoin is trading at $88,195, oscillating within a narrow range that suggests a period of consolidation rather than a clear trend. - Why is bitcoin consolidating near $88,000?

The price is compressing due to neutral momentum indicators and dwindling volume, indicating market indecision and a waiting game amongst participants. - What do technical indicators say about bitcoin right now?

Most oscillators are neutral, while the momentum and MACD offer faint hints of improvement. A rather ambiguous picture, wouldn’t you agree? - What are the key bitcoin levels traders are watching?

Traders are eyeing resistance near $89,500 to $90,000 and support in the mid-$80,000s, based on recent chart behavior.

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- 🚀 LINK Leaps as Grayscale’s ETF Debuts on NYSE Arca! 🤑

2025-12-20 17:00