Well, slap my knee and call me astonished! The market cap of them bitcoin mining stocks done jumped 9.43% on Friday, and every single one of the top ten miners ended up in the green. 🤑 Even three of ’em logged double-digit advances-that’s what I call a hootenanny! With just one week left in this circus of a year, nearly the whole mining gang is fixin’ to wrap up 2025 with a smile, except for a couple of laggards who probably lost their pickaxes. 🪓

Friday’s Fireworks Set Bitcoin Miners Ablaze for a Rowdy 2026 🎆

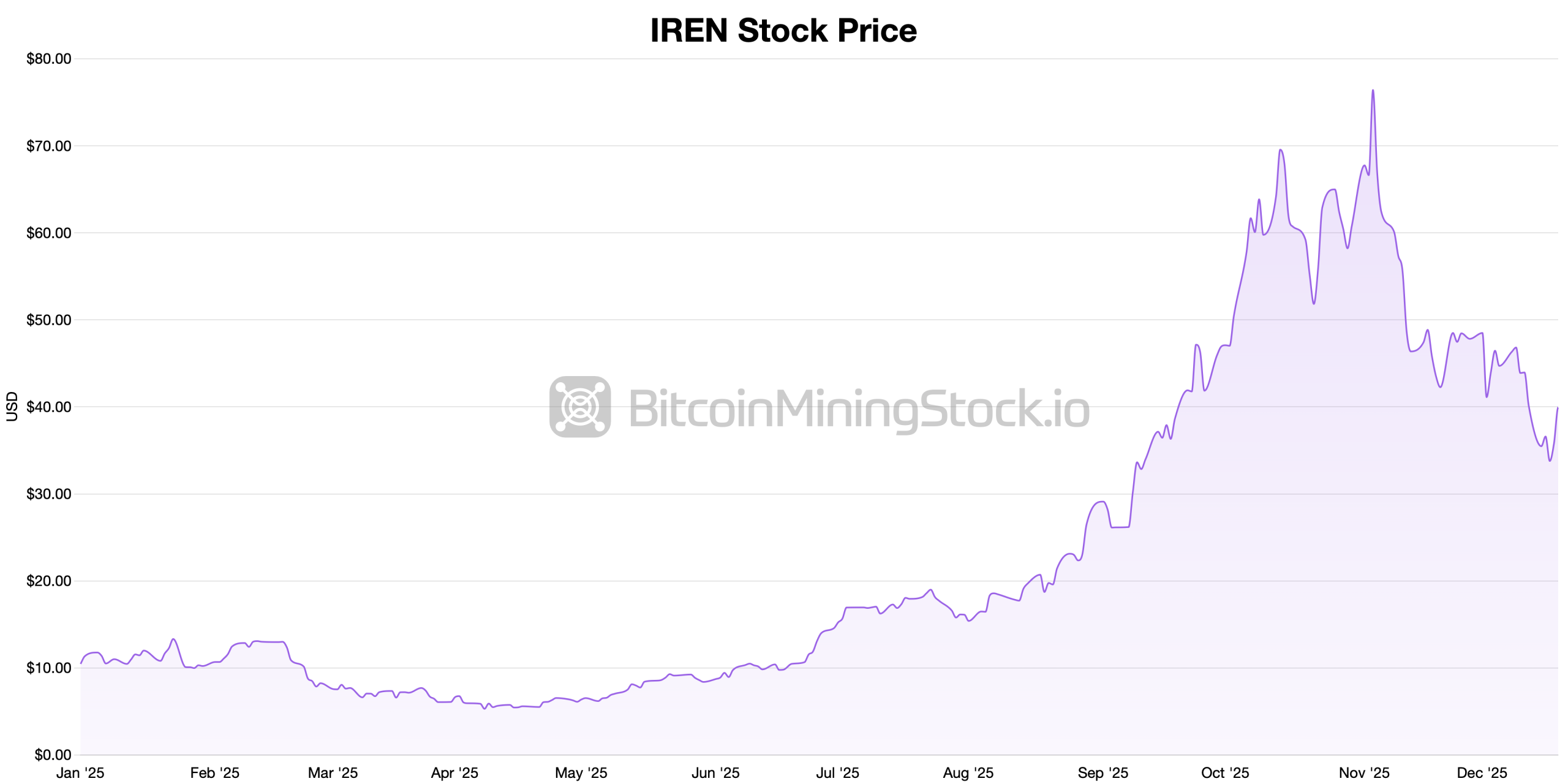

Them Bitcoin miners traded on U.S. exchanges had themselves a right solid Friday, keepin’ up with the big boys of the stock market. IREN Limited, the biggest dog in the yard with a market cap of $11.31 billion, closed at $39.92, baggin’ an 11.50% gain. Over the past five days, it slipped 0.52%, but who’s countin’ when the year-to-date gain is a whopping 306.51%? That’s what I call a gold-plated performance! 🏆

Applied Digital ended Friday at $27.85, tackin’ on a 16.52% gain. Still, it barely moved over the five-day stretch, easin’ just 0.03%. But zoom out, and APLD’s havin’ a banner year, up 264.52% YTD with a market cap of $7.8 billion. Just below, Cipher Mining closed at $16.21, chalkin’ up a 6.99% gain.

That pop didn’t fully erase the recent drag, with the stock still off 4.92% over the past five sessions. Still, CIFR’s got plenty to crow about, with shares up 249.35% YTD and a market cap of $6.4 billion. Riot Platforms Inc. closed at $14.50, climbin’ 8.37% on the day. Over five days, it slid 5.22%, but on a YTD basis, RIOT is still ahead 42.01%, valued at $5.39 billion.

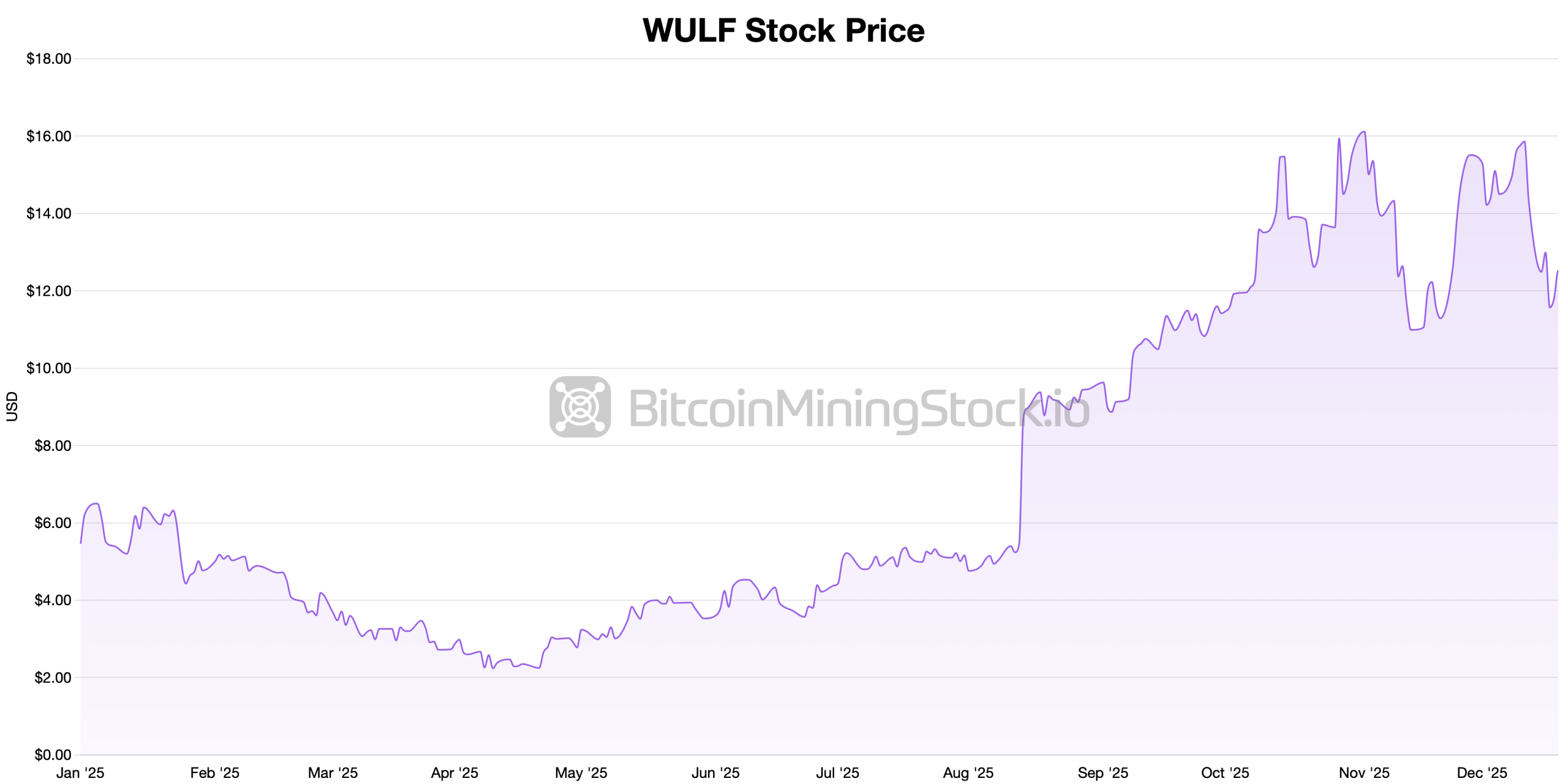

Terawulf Inc. ended the week at $12.52, closin’ Friday with a 6.19% gain. Short-term tradin’s been rough, with the stock down 12.63% over five days. Even after that dip, WULF’s up 121.20% YTD, with a market cap of $4.89 billion as December winds down.

Roundin’ out the top ten, Core Scientific closed at $15.60, addin’ 7.14% and liftin’ its YTD gain to 11.03%, valued at $4.84 billion. Hut 8 Corp. closed at $44.12 after jumpin’ 14.33%, pushin’ its YTD return to 115.32%, worth about $4.77 billion.

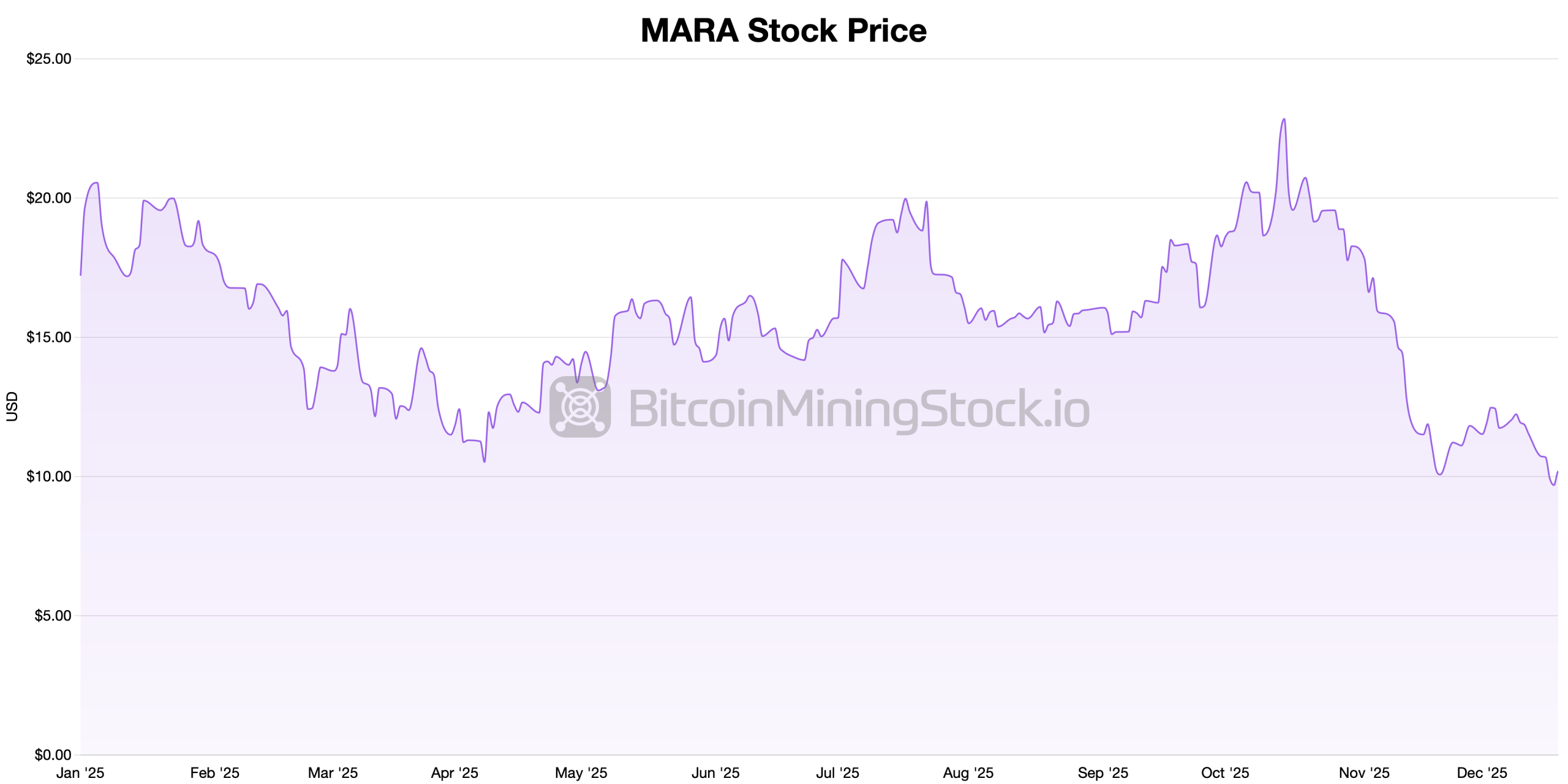

MARA Holdings closed at $10.18, up 5.05% but still down 39.29% since Jan. 1, valued at $3.85 billion. Cleanspark Inc. ended at $12.03, advancin’ 7.41% and sittin’ 30.61% higher YTD. Bitdeer Technologies Group closed at $11.01, gainin’ 9.99% but down 49.19% for the year, valued at $2.3 billion.

Friday’s gains put a shiny bow on the year for these bitcoin miners, with most headin’ into 2026 on solid ground, despite a few stumbles. The contrast between choppy week-to-week tradin’ and eye-poppin’ YTD results shows investors are still bettin’ on scale, execution, and balance-sheet discipline. Not every miner’s makin’ it to the finish line unscathed, but that’s the name of the game! 🎲

The final week of December’s likely to be a wild ride, with thin holiday tradin’ exaggeratin’ moves while investors square their books. As 2026 begins, all eyes’ll be on balance sheets, expansion plans, and bitcoin’s price action. It’s anybody’s guess who’ll carry the momentum and who’ll face a reset. 🌪️

FAQ ⛏️

- Why did bitcoin mining stocks rise on Friday?

Most miners moved higher alongside U.S. stock indexes as investors marked up equities ahead of year-end positioning. 🎉 - Which bitcoin mining stocks led the gains?

Large-cap miners like IREN Limited, Applied Digital, and Hut 8 posted some of the strongest single-day advances. 🏇 - What should investors watch in the final week of December?

Thin holiday liquidity and book-closing activity could amplify price swings. 🎢 - What factors matter most for bitcoin miners heading into 2026?

Balance sheets, expansion plans, and bitcoin’s price action will guide performance early in the new year. 🔮

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- LINK Soars 20%-Will It Reach $100? 🚀📈

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Aster’s 2026: The Mainnet Masquerade 🎩

2025-12-21 01:33