MSTR stock price 🚀 by over 1% on Boxing Day as Bitcoin and other cryptocurrencies staged a cautious rebound, resembling a timid rabbit peeking out of its burrow. 🐇

- MicroStrategy’s shares jumped to $160, higher than this month’s low of $157. Still, the stock may be at risk of further downside, a precarious tightrope walk over a chasm of despair. 🕯️

- One reason for the loss of its premium is the ongoing Bitcoin (BTC) crash that has moved it from the year-to-date high of $126,200 to the current $88,800. A descent so steep, it makes a rollercoaster look like a leisurely stroll. 🎢

- Strategy’s stock price will likely continue to fall as sellers target the psychological threshold of $100, a number so sacred, it’s practically a holy grail for short-sellers. 🕊️

MicroStrategy’s shares jumped to $160, higher than this month’s low of $157. Still, the stock may be at risk of further downside as the company’s enterprise value net asset value (mNAV) turned negative for the first time, a feat akin to a phoenix plummeting into a pit of tar. 🐦⬛

Data compiled by Bitcoin Treasuries showed that the mNAV dropped to 0.988. This occurred as its enterprise value fell to $59 billion, while the valuation of its Bitcoin holdings stood at $59.7 billion. A tale of two numbers, one slightly ahead, the other trailing by a hair. 🧵

The basic market capitalization-based net asset value dropped to 0.763. These numbers mean that the premium that the company had a few months ago has disappeared, like a mirage in a desert of regret. 🌵

One reason for the loss of its premium is the ongoing Bitcoin (BTC) crash that has moved it from the year-to-date high of $126,200 to the current $88,800. This decline has led to a sharp decline in the value of its Bitcoin holdings, a drop so sudden, it’s like a cat falling off a couch. 🐱

Another risk is that the company has continued to dilute its shareholders through its at-the-market offerings. In a regulatory filing, the company reported that it still has more than $11.8 billion remaining in its ATM offerings, indicating that further dilution is expected. A relentless deluge of shares, as if the company is trying to drown its investors in paper. 🌊

This dilution has brought its outstanding shares to over 267 million, up from 93.2 million in 2022. A numbers game so convoluted, it’s like solving a Rubik’s Cube while blindfolded. 🧩

The company may also remain under pressure as Bitcoin has formed bearish chart patterns, as we wrote in this prediction. It has formed a death cross and a bearish pennant on the daily chart. This means that the coin may drop to last month’s low of $80,000, a number that sounds like a funeral eulogy. 🪦

MSTR stock price technical analysis 📈

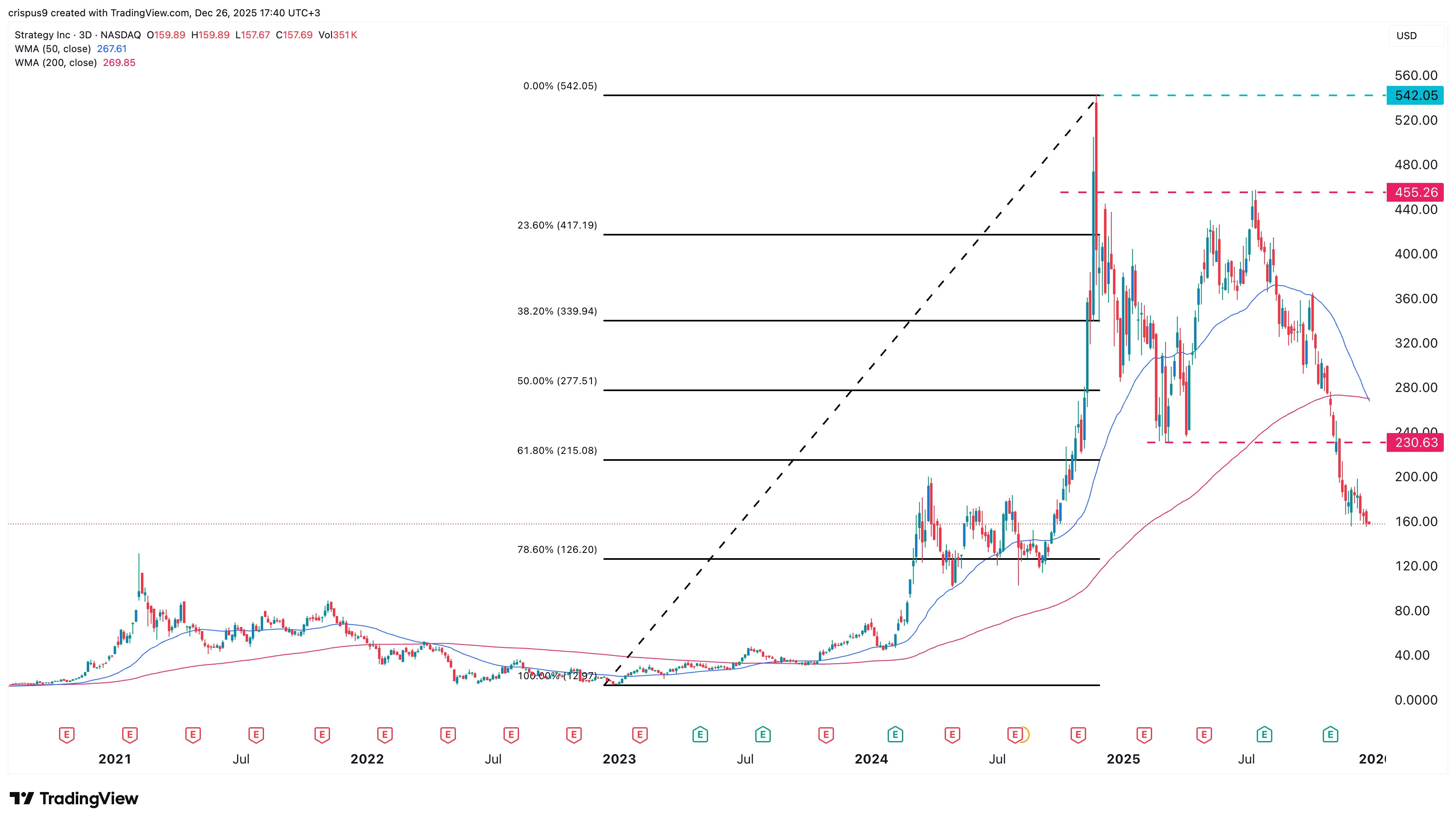

The three-day chart shows that the MSTR share price has been in a free fall in the past few months. It has now formed a death cross pattern as the 50-day and 200-day Weighted Moving Averages crossed each other, a grim omen as foreboding as a thunderstorm in a library. ⚠️

The stock has moved below the important support at $230, its lowest level in March. It also plunged below the 61.8% Fibonacci Retracement level. A descent so steep, it’s like a diver leaping from a skyscraper. 🏙️

Therefore, the Strategy stock price will likely continue to fall as sellers target the psychological threshold of $100. This decline will be confirmed if it moves below the 78.6% Fibonacci Retracement level at $126, a number so ominous, it’s like a haunted house with a “Closed” sign. 👻

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

2025-12-26 21:01