Oh, what a dreadful, no-good, absolutely wretched week it has been for the Bitcoin ETFs! On the 26th of December, they were thunderstruck by a $83.27 million outflow, which is about as cheerful as a soggy sock in a puddle. Poor BTC couldn’t even muster the energy to climb back above $88,000-it’s like watching a toddler try to build a sandcastle in a hurricane.

- The Bitcoin ETFs have now had a five-day outflow streak, which is about as thrilling as a teacup tornado.

- Fidelity’s FBTC led the exodus with a grand total of $74.38 million-because who doesn’t want to throw money into a sinking ship? 🚢🔥

- Total outflows have now surpassed $750 million, while BTC remains trapped below $90,000 like a goldfish stuck in a thimble.

Fidelity’s FBTC was the star of the show (though not in a good way), raking in $74.38 million in redemptions. Grayscale’s GBTC wasn’t far behind with $8.89 million. Meanwhile, the rest of the Bitcoin ETFs decided to nap, recording zero flows. BlackRock’s IBIT? Still hiding under the bed, probably.

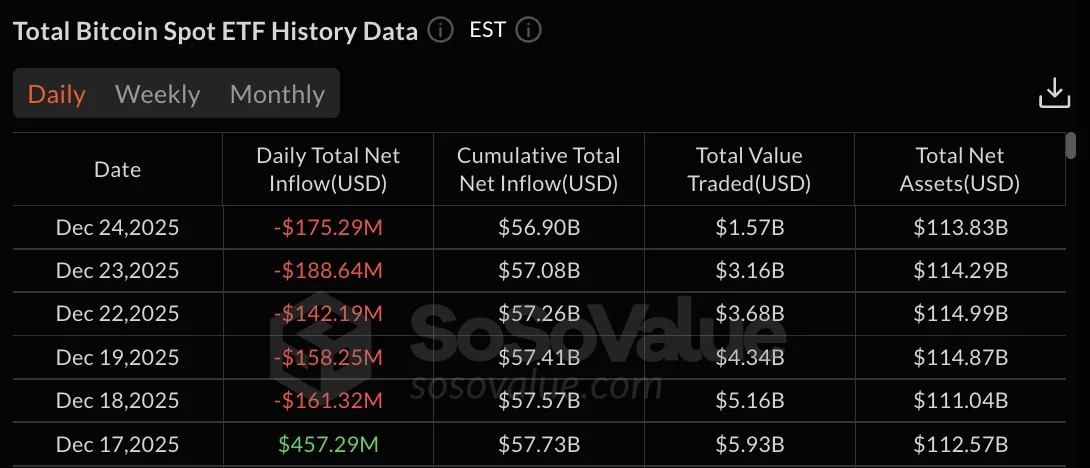

Total net assets under management have plummeted to $113.83 billion, and BTC dropped over 1% in 24 hours. If Bitcoin were a person, it’d be wearing a “Please Feed Me” sign and crying into a bag of crisps. 🥔😢

Five Days of Financial Heartburn

The outflow streak began on December 18 with $161.32 million in redemptions, which is about as festive as a canceled Christmas. The weekend brought a brief pause, but Monday the 22nd kicked things back up with $142.19 million in redemptions. By December 23, the ETFs were begging for mercy with $188.64 million outflows, followed by another $175.29 million on the 24th. And then, on the 26th, they added $83.27 million to the pile. Five days of misery, folks! 🕰️💸

The total value traded has shrunk from $5.93 billion to a measly $1.57 billion. Bitcoin’s failure to break above $90,000 is like trying to fly a kite in a windstorm-it just won’t work!

Fidelity’s FBTC dominated the redemptions again, taking 89% of the blame. Grayscale’s GBTC tried to keep up with $8.89 million, while the rest of the mini BTC trusts and their friends (Bitwise, Ark & 21Shares, etc.) all napped. Literally zero flows. What a snooze-fest! 😴💤

Ethereum ETFs: The Party Poopers Too

Ethereum ETFs weren’t having a better time. On December 24, they lost $52.70 million, and the day before that, they coughed up $95.53 million. December 22 gave a tiny glimmer of hope with $84.59 million in inflows, but it vanished quicker than a snowman in July. Total net assets for Ethereum products dropped from $20.31 billion to $17.86 billion. If Ethereum were a joke, it’d be the one about the bear, the bull, and the empty wallet. 🐻💸

Bitcoin’s inability to hold above $90,000 has sent investors scrambling like ants at a picnic. Profit-taking? More like profit-dropping! It’s a financial circus, and everyone’s left holding the popcorn. 🎪🍿

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

2025-12-27 18:19