Okay, so Uniswap is having a moment. And by “moment” I mean a bit of a slump. It’s down for the fourth day in a row, and honestly, I’ve had better weeks trying to assemble IKEA furniture without instructions. Their Total Value Locked (TVL) is shrinking, fees are doing a disappearing act, and it’s formed this thing called a “double top” which sounds like a questionable dance move, but apparently means trouble. 🤦♀️

- Uniswap’s price did a little swan dive – down 12.5% from its peak. Basically, it peaked and is now…not.

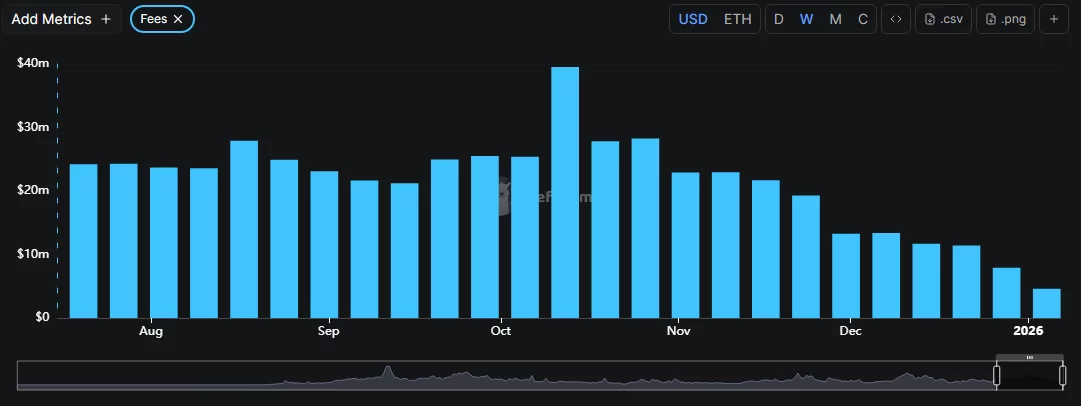

- The TVL? Let’s just say it’s been on a diet since October. A serious diet.

- That double-top thing? Yeah, apparently it’s bad news. Like finding out your dry cleaner shrunk your favorite sweater.

Last I checked (Thursday, Jan 1st – Happy New Year, by the way, let’s hope it’s better than this!), Uniswap (UNI) was chilling at $5.64. That’s down 12.5% from Sunday and a whopping 53% below its August glory days. It’s like, remember when things were good? Pepperidge Farm remembers.

Look, the whole crypto market is feeling a bit blah right now. Everyone’s suddenly decided to be responsible with their money. Me? I’m not judging. But Bitcoin’s been…underwhelming, and that pulls down everything else. It’s a whole domino effect of financial anxiety.

And then PancakeSwap and Raydium decided to show up and steal Uniswap’s lunch money. Competition! It’s fierce in the decentralized exchange world. It’s like a high-stakes bake-off, but with code instead of cupcakes.

DeFiLlama says the total value locked in Uniswap has plummeted from $6.9 billion in early October 2025 to around $4 billion now. And the fees? Don’t even get me started. Let’s just say they’ve significantly declined. It’s a sad state of affairs. 🥺

All this negativity could keep pushing the price down unless… something changes. Which, let’s be real, it needs to.

BUT! Hold the phone! There’s a glimmer of hope. Uniswap is now…deflationary! 🎉 Apparently, they burned $596 million worth of UNI this weekend as part of the UNIfication proposal. It’s like a digital bonfire, only instead of s’mores, you get… potentially increased value? It’s a new concept, even for me.

Burning tokens makes them scarce, and scarcity usually means value goes up. Usually. We’ll see if that holds true.

Uniswap price analysis

Okay, number crunchers are saying Uniswap’s price is forming a “double top” on the 4-hour chart. Apparently, it’s when a price hits a peak twice with a little dip in between. Sounds exhausting. 🤔

The peaks are around $6.50, and the “neckline” (seriously, who names these things?) is at $5.59. Right now, it’s like a very delicate balancing act.

The smart people with indicators and charts are agreeing – things are looking a bit gloomy. UNI is under the 50-day Simple Moving Average, which means the bears are in charge. The Aroon indicators are also screaming “downward momentum”! Clearly, nobody told them about the token burn. 🤷♀️

If it drops below that $5.59 neckline, buckle up. The prediction is it could fall to $4.70. That’s nearly 16% lower than where it is now. Yikes.

But hey, if Uniswap can somehow climb above that 50-day SMA, then we can all pretend this never happened. A girl can dream, right?

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

2026-01-01 11:04