Ah, the markets! 🤑 That grand theater of human greed and folly, where numbers dance like drunken sailors and fortunes are made and lost in the blink of an eye. Behold, the latest spectacle: the mighty Bitcoin ETF, a beast of burden for the institutional giants, has roared back to life! 🐉

What to know (or pretend to know at cocktail parties):

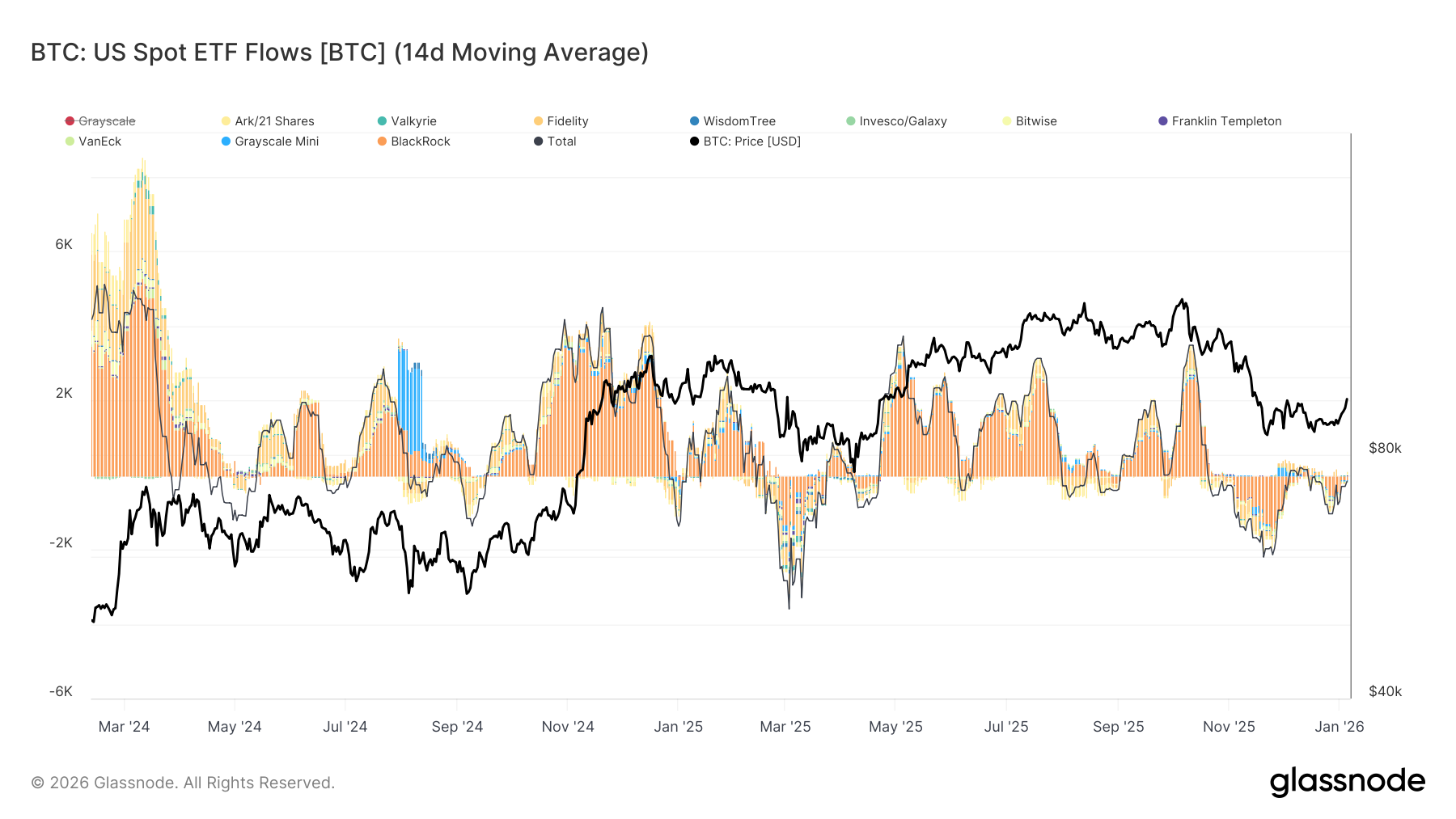

- U.S. spot Bitcoin ETFs gulped down $697.2 million on Monday, the biggest feast since Oct. 7. 🍖💸

- In just two trading days of 2026, these ETFs have gobbled up $1.2 billion. The fat cats are back at the trough! 🐷

- Historically, when ETFs cry out in pain, the market whispers, “Bottom’s up!” 🥃 Now, the tears have dried, and the Coinbase premium is no longer wailing like a banshee, signaling the end of capitulation. 🎭

Oh, the Bitcoin ETFs! Those shiny new toys of the financial elite, have seen their largest daily inflows since Oct. 7, a whopping $697.2 million, according to Farside data. 📈 Meanwhile, the plebs are left to marvel at the charts, dreaming of the day they too can afford a whole Bitcoin. 😢

Since the dawn of spot Bitcoin ETFs in January 2024, periods of outflows have coincided with market bottoms, like old friends meeting at a dive bar. 🍺 Glassnode data tells us this tale: August 2024, the yen carry trade unwind sent Bitcoin tumbling to $49,000, and April 2025, the tariff tantrum, saw it hit $76,000. But fear not, for the outflows have turned tail, and the Coinbase premium is no longer screaming “Sell! Sell! Sell!” 🚀

So, as the institutional bidders return to the feast, the rest of us can only watch, forks in hand, hoping for a few crumbs to fall from the table. 🍞🤡

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- USD CNY PREDICTION

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2026-01-06 14:36