Bitcoin clings to the edge of ninety thousand, while the city of markets cough and shudder. The world’s economies press in, whispers of geopolitics in the East grow louder, and the uncertain fiat that powers distant shops trembles. In this weather, BTC reappears on the stage not as a hero, but as a stubborn witness to a storm-a rumor made flesh on a ledger. 😅💼

Bitcoin Price Analysis: The Daily Chart

On the daily chart, BTC has broken free from a long, dreary descent only to meet a stern wall near the 95k line. The ascent from 80k came swift as a strike of a hammer, but now it cools, as if the city’s breath has run out after a fever. The price has yet to reclaim the 100-day and 200-day moving averages, which loom around 99k and 106k, like foremen watching from the edge of the workshop. 💼

The structure strains to shed its gray bearish coat and clothe itself in neutral cloth. If BTC can hold above the 90k psychological line, a higher low might take shape, opening a path toward 95k and perhaps the fateful 100k gate. But slip below 90k, and the old downward corridor may swallow it again, like a shadow swallowing a lamp. 😬

BTC/USDT 4-Hour Chart

In the four-hour frame, BTC moves within a rising wedge, with stubborn support around 90k and the ceiling near 95k. Momentum wanes; RSI slides while the price lingers above familiar ground. The wedge is a heartbeat-tense, waiting for a sign. 🔺

A drop below 90k could accelerate the correction toward the wedge’s lower boundary at 88k. On the other hand, a breakout above 95k might unleash a fresh surge, a bullish eruption from the fallen wedge often delivering aggressive rallies. For now, the market squeezes itself into a tighter circle, waiting for the verdict. 🗳️

On-Chain Analysis

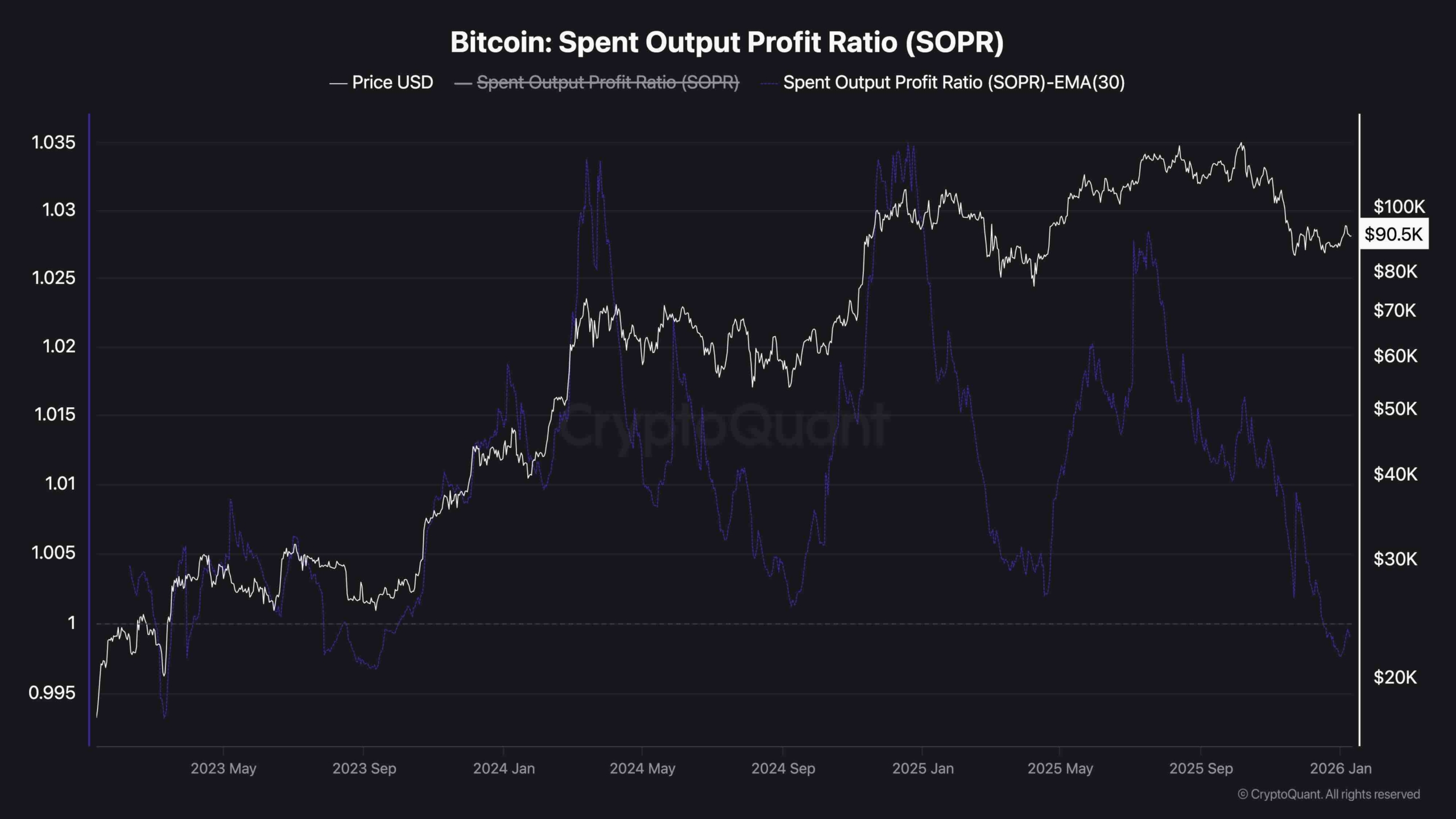

The 30-day EMA of the SOPR (Spent Output Profit Ratio) hovers just below the 1.0 line. In plain terms: a good portion of spent coins are realizing losses, and many short-term holders are cashing out without profit. Historically, when SOPR dips below 1 and flattens, it signals the final chamber of a correction or the moment when stronger hands begin to accumulate. 🧱

The SOPR trend still wears a downward tilt, yet the price itself shows stubborn strength. If BTC can stay above 90k while SOPR resets, a sturdier rally could take shape, based on a more solid crowd. 💪

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- UFC & Polymarket: Fists, Foresight, and Frenzy!

2026-01-10 18:39