Silver’s like, “Hey, I’m the star of the show, everyone else is just backup dancers!” 🎉 And now we’re all wondering if it’ll hit $100? Please. It’s 2026, not 2008. 🤔

CME is like, “We’re not ready for this chaos, let’s add more rules!” 😅

What Is Driving the Silver Price Surge?

Silver’s back to making sharp gains after stabilizing above $80. As of this writing, it’s trading at 83.59% per ounce. Just shy of its $85.94 all-time high. Because nothing says “I’m a top-tier metal” like being 1.34% away from your peak. 🤯

Industrial demand? Silver’s the MVP of EVs and solar panels. Who knew? 🚘☀️

Interesting enough, we’ve been seeing momentum across asset classes. Despite the US invading Venezuela and capturing a president? What’s next, a global dance-off? 🕺

While one would expect a flight to safe havens, even equities and Bitcoin saw a boost. So now we’re in an “everything rally”… because why not? 🤷♂️

Peter Schiff’s like, “Bitcoin? That’s for people who can’t handle real money!” 🤬

Schiff claims we’re in the “biggest precious metals bull market in history.” Sure, because nothing says “historic” like a 3% jump in silver. 📈

All the action tonight is in precious metals. Gold is up 1.35%, silver is up 3%, palladium is up 3.5%, & platinum is up 5%. We’re early in what will likely be the biggest precious metals bull market in history. Yet all attention remains on Bitcoin, despite that mania being over.

– Peter Schiff (@PeterSchiff) January 5, 2026

Is silver really set up for further gains or is it due for a cooldown? Let’s see… it’s like a toddler with a sugar rush. 🍬

Is silver going to hit $100 per ounce?

US intervention in Venezuela is the primary catalyst. Trump’s like, “I’m just here to make sure everything’s under control, folks!” 🇺🇸🔥

Trump suggests further military action if Venezuela doesn’t comply. Because nothing says “stability” like a potential war. 🕵️♂️

So, we’re all in a “safe haven” mood. Because nothing says “safe” like a geopolitical crisis. 🤯

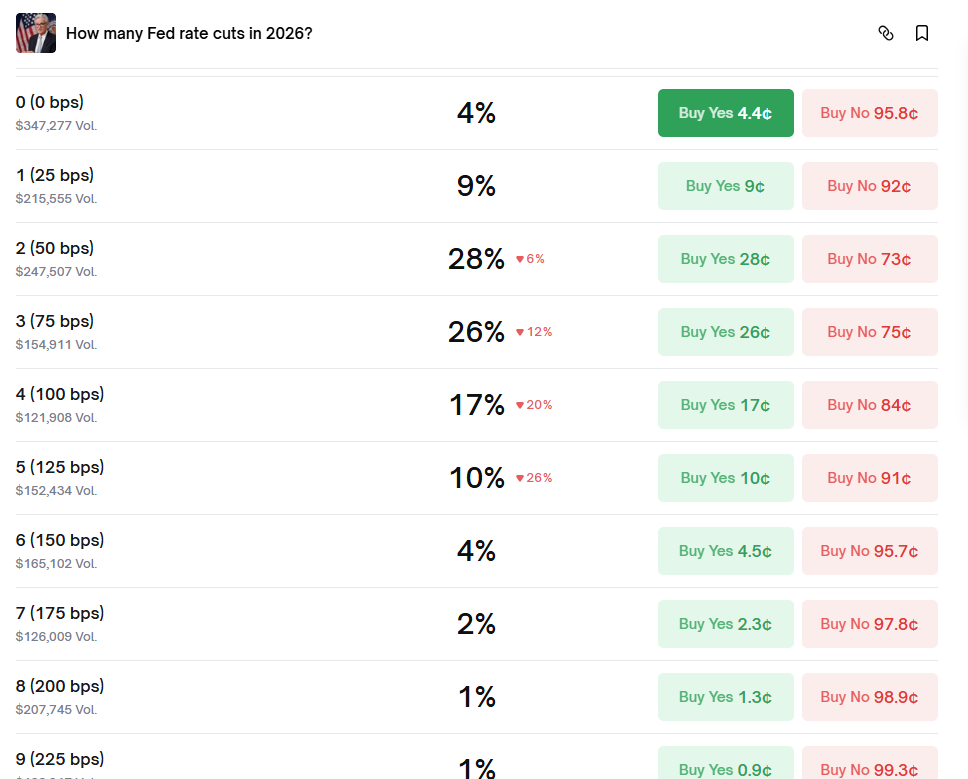

Long-term, investors are betting on Fed rate cuts. Because nothing says “confidence” like hoping the Fed will lower rates. 😅

Weaker jobs mean more rate cuts. But if inflation spikes? “Oops, sorry, no cuts for you.” 🤷♀️

Low rates are good for non-yielding assets like silver. Because nothing says “investment” like holding a metal that doesn’t pay dividends. 🧾

For silver to hit $100, multiple forces need to align. Like, “Hey, let’s all agree on something!” 🤝

Industrial demand? Check. Supply? Not so much. Investment interest? Let’s hope. 🤞

Prices above $100? Only if we get runaway inflation, a financial crisis, or a currency shock. Because why settle for $100 when you can have chaos? 🌪️

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Brent Oil Forecast

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- USD THB PREDICTION

- Gold Rate Forecast

2026-01-13 14:34