Bitcoin and the rest of the crypto circus woke up with a smug little grin after the latest CPI print landed exactly as thrilling as watching paint dry. BTC ripped out of its cage since mid‑November, Ethereum strutted above $3,300, and a merry band of altcoins-Dash, Internet Computer, Pump.fun, Monero, and Zcash-shimmied past key resistance like they’d all just had a coffee with ambition. Even Axie Infinity found a pulse again, because apparently liquidity has a sense of humor and a soft spot for drama. 💸😂

But while traders are staring at $100,000 as the next dramatic chapter in this soap opera, the path won’t be a straight runway. Market structure and positioning signals say Bitcoin might grin and bear it, spending more time consolidating below the big number before making a proper exit. It’s giving us a very British side-eye, with a pint in hand. 👀🍻

Why Is $100K Hard to Break for Bitcoin Price?

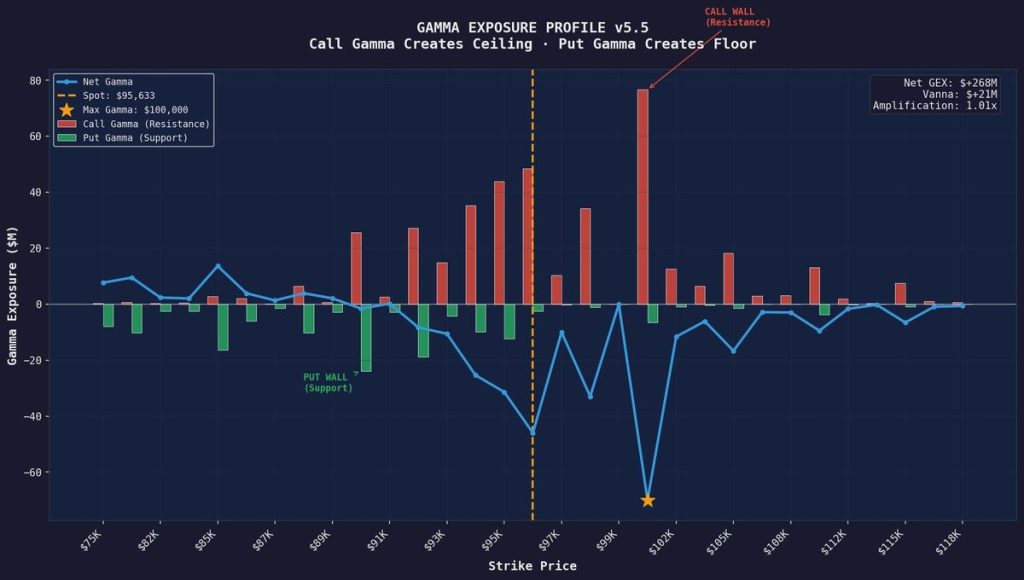

Bitcoin is being stubborn in the way only a finance-bro with a peculiar haircut can be. The culprit? an options‑driven “gamma wall” that behaves like a bouncer at the club of price. According to the Escape Velocity Model (v3.1), there’s a $129.9M call gamma wall parked at the $100K strike. As BTC nudges higher, dealers hedging these options often have to sell Bitcoin, which bleeds away buying pressure and keeps volatility kinder and gentler-almost frustratingly polite for a market that loves chaos. 🧊💁♀️

The model estimates the market needs around $574M in net buying (CVD) to chew through this resistance and the sell orders stacked above it. Smaller liquidation pockets near $98K ($43M) and $99K ($36M) may not provide enough fuel. Given current liquidity, the odds of generating that “escape velocity” are a mere 2.2% in one day, 57.4% over a week, and 80%+ over 30 days, meaning BTC may stay range-bound while everyone recalibrates their popcorn and patience. 🥱🍿

What Would Actually Break $100K Cleanly?

Bitcoin may be tantalizingly close to $100K, but a clean breakout usually needs more than hype and a buzzword or two. Sellers love a good round number, and options hedging adds its own level of dramatic resistance. Here are the triggers that could actually push BTC through and keep it there.

- Sustained Spot Buying: BTC needs steady net buying for multiple sessions, not a one-off spike fueled by reckless optimism or a lucky meme. 💪

- Strong Close And Hold Above $100K: A proper breakout is when BTC flips $100K into support instead of just wicking higher and ghosting you the next day.

- Options Reset (Expiry/Rollover): If the $100K wall is mainly options-driven, it often weakens when contracts expire or roll to new strikes. Houdini tricks, basically. 🎭

- Fresh Institutional/ETF-Style Flows: Bigger inflows can absorb the sell orders near $100K and push the price into discovery land. 🚀

- Macro Catalyst Tailwind: Softer inflation or a dovish tilt can give investors the confidence to carry the move through the door, not just poke it and run. 🪟🪀

- Tariff Ruling Headlines Could Add Volatility: A U.S. Supreme Court tariff decision could swing risk sentiment fast-risk-on could fuel a breakout, or risk-off could trigger a pullback before the next go. 📜⚖️

What To Expect Next

Bitcoin is bullish, but the market is tiptoeing into the “hard part” of the move. The next phase may look less exciting than a breakout because high levels tend to slow the pace down, like a guilty friend who’s run out of energy after a night out. 😅

If BTC grinds below $100K, that’s not automatically weakness-it can be consolidation as liquidity builds. If BTC breaks and holds above $100K, the barrier flips into a launchpad and price discovery can accelerate faster than your last group chat confession. 🚀

For now, expect higher volatility, headline-driven swings, and a tug‑of‑war near $100K-until either demand overwhelms the sell wall or the market needs a little more time to refuel. 🔥💬

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- GBP MYR PREDICTION

- EUR USD PREDICTION

- BNB PREDICTION. BNB cryptocurrency

- USD VND PREDICTION

- XMR PREDICTION. XMR cryptocurrency

2026-01-14 21:53