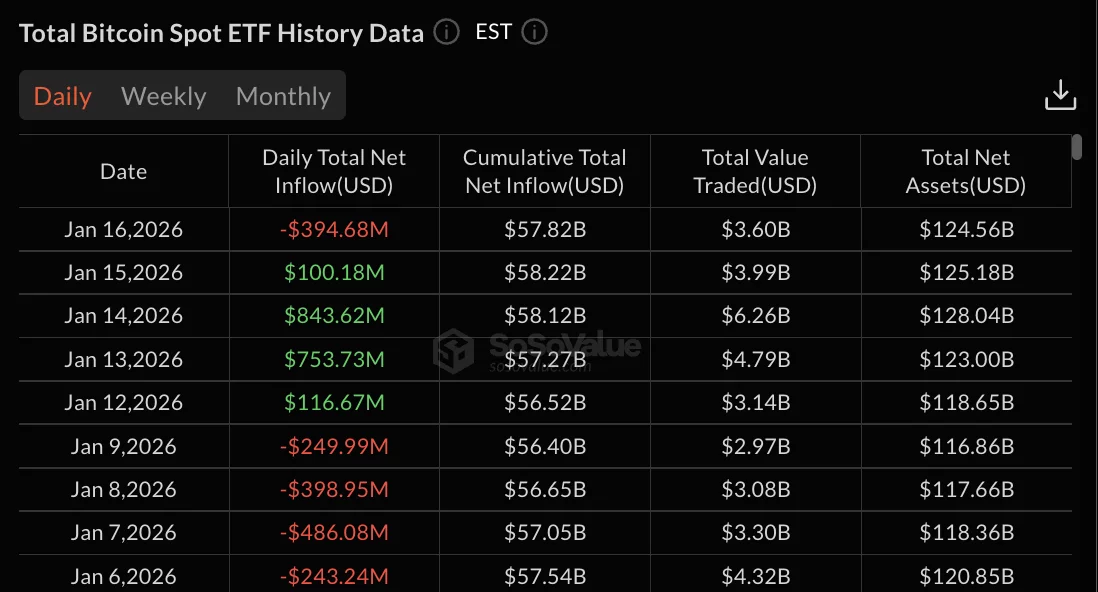

Bitcoin ETFs, in a twist of fate that would make the Luggage feel inadequate, turned crimson on January 16 after four days of inflows. The grand total? A staggering $394.68M outflow. One might say the market’s been playing a game of “hot potato,” except the potato is now a blockchain and the rules are written in hieroglyphics. 🤷♂️

- Bitcoin ETFs lost $394.68M on Jan. 16, ending a four-day $1.81B inflow streak. (Like a four-day feast followed by a diet of regret.)

- Ethereum ETFs added $4.64M, extending a five-day run that brought in $478M. (Clearly, ETH’s got more stamina than a Discworld bar wench at closing time.)

- Flows show selective profit-taking in BTC while institutions continue favoring ETH. (Because nothing says “confidence” like selling Bitcoin and buying Ethereum. Priorities.)

BlackRock’s IBIT, the lone wolf of the pack, managed a meager $15.09M inflow. Meanwhile, Fidelity’s FBTC led the exodus with a whopping $205.22M in withdrawals. One might call it a “bank run,” but with blockchains and a suspiciously timed disco ball. 💃

Ethereum spot ETFs, ever the optimist, attracted $4.64M in net inflows on January 16. This marks their fifth consecutive day of positive flows-a streak that began on January 12. (If you’ve got five days of good news, maybe it’s time to consider retirement from doomscrolling.)

Total net assets under management for Bitcoin ETFs fell to $124.56B, while Ethereum ETF assets climbed to $20.42B. (The market’s clearly decided which cryptocurrency is the “cool kid” at the party. Spoiler: It’s not Bitcoin.)

Four-day Bitcoin ETFs rally brings $1.81B before reversal

Bitcoin ETFs opened January with selling pressure, posting outflows from January 6 through 9 totaling $1.38B. The trend reversed on January 12 with $116.67M in inflows, followed by the strongest week of 2026. (Or, as some might call it, “the week before the apocalypse.”)

January 13 brought $753.73M in net inflows, while January 14 posted the largest single-day total at $843.62M. (For a moment, it seemed like the market had forgotten how to panic. Then it remembered. Hard.)

January 15 added $100.18M before the January 16 reversal. The four-day inflow period nearly erased early January’s redemption wave. (Like a particularly aggressive snowplow clearing a path through a blizzard of bad decisions.)

Fidelity’s FBTC accounted for 52% of January 16 outflows at $205.22M. Bitwise’s BITB posted $90.38M in withdrawals, while Ark & 21Shares’ ARKB saw $69.42M in redemptions. Grayscale’s GBTC recorded $44.76M in outflows. (It’s like a particularly expensive game of musical chairs, and everyone forgot the chairs.)

Grayscale’s mini BTC trust, along with VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero flows on January 16. (Perhaps they were busy writing haikus about the market’s emotional instability.)

Total value traded reached $3.60B on January 16, down from $3.99B the previous day. Cumulative total net inflow dropped to $57.82B from $58.22B as the single-day outflows offset recent gains. (Progress, folks! Or, as some might call it, “not falling apart completely.”)

Ethereum extends rally to five consecutive sessions

Ethereum ETF inflows began January 12 with $5.04M, accelerating through mid-week. January 13 brought $129.99M, followed by $175.00M on January 14 and $164.37M on January 15. (ETH’s clearly been training for this. Bitcoin’s still in the gym.)

The January 16 inflows of $4.64M represented the weakest day of the streak but maintained positive territory. Total net assets climbed from $18.88B on January 12 to $20.42B on January 16. (A 1.54B increase. Because nothing says “growth” like ignoring Bitcoin’s midlife crisis.)

Cumulative total net inflow reached $12.91B, recovering from December’s outflow pressures. Total value traded hit $1.19B on January 16. (And the market thought this was a rollercoaster.)

The divergence between Bitcoin and Ethereum flows suggests selective institutional buying rather than broad-based crypto redemptions. (Translation: Someone’s got a plan. Or they’re just really good at bluffing.)

XRP spot ETFs recorded $1.12M in net inflows on January 16, while Solana spot ETFs saw $2.22M in outflows. (XRP’s clearly the underdog, and Solana’s just here for the drama. 🐾)

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- USD VND PREDICTION

- GBP MYR PREDICTION

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- IP PREDICTION. IP cryptocurrency

- USD RUB PREDICTION

2026-01-17 18:45