Michael Saylor, the indefatigable CEO of Strategy Inc. (formerly MicroStrategy), has once again proven he’s either a crypto oracle or a man with a very expensive hobby. This week, he dropped a cryptic clue on social media-because why not invent a new language when you can just say “Bitcoin” clearly? 🚨

In a post featuring the company’s Bitcoin portfolio graphic and the caption “₿igger Orange,” Saylor winked at incoming Bitcoin buys. For the uninitiated, “Orange” is his personal code for “buy more crypto,” a secret handshake he’s been using since the 2020s. It’s like a pirate’s “Arrr!” but with more decimal places and less plunder. 🏴☠️

₿igger Orange.

– Michael Saylor (@saylor) January 18, 2026

Strategy’s Bitcoin Hoard & Recent Spending Spree

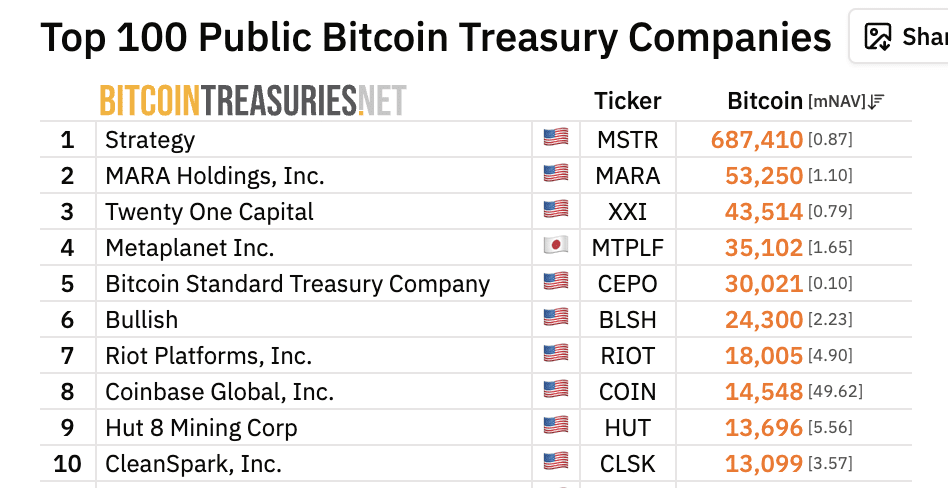

Strategy, now the world’s largest corporate Bitcoin hoarder (kudos to them for mastering the art of “buy the dip” like it’s a Netflix series), currently owns roughly 687,410 BTC. That’s enough to buy a small island, if only Bitcoin could be spent on things besides crypto. The average cost? A cozy $60,000-$70,000 per coin. Nothing says “prudent investment” like buying at the top, right? 😂

Top 10 Bitcoin public treasury holders | Source: bitcointreasuries.net

January’s shopping spree included a 13,627 BTC splurge totaling $1.25 billion. That’s $91,519 per coin, which is either a bargain or a cry for help, depending on your therapist. Earlier in the month, they also bought 1,286 BTC for $116 million, because why not? Saylor even gave a hint beforehand-because nothing says “I trust the market” like a tweet. 📱

Orange or Green?

– Michael Saylor (@saylor) January 4, 2026

Strategy Share Price: A Rollercoaster Named ‘Regret’

Strategy’s stock (MSTR) has been trading around $173-$174, up 5.4% in January. But let’s not forget the 59% plunge over six months. Some Twitter user named Caramel didn’t miss a beat, replying to Saylor’s “Bigger Orange” with a devastating “Bigger Red.” Because nothing unites people like mutual financial despair. 💸

Bigger Red.

– Caramel (@CaramelCoffee8) January 18, 2026

Bitcoin’s 2026 Debut: ‘I’m Back, Bitches!’

Bitcoin itself kicked off 2026 with a $90,000+ rally, flirting with $93,000 early in the year. That’s a 5.45% year-to-date gain, which is impressive if you ignore the fact that it’s still down from its 2024 peak. The crypto market, meanwhile, is dancing to macroeconomic whims like it’s a TikTok dance challenge. 🤸♂️

Crypto Market Implications: ‘This Is Fine’

Saylor’s “Bigger Orange” and Strategy’s Bitcoin buying spree arrive as institutional investors remain as conflicted as a vegan at a steakhouse. The company’s strategy-funded by selling shares and preferred stock-is a masterclass in long-term thinking or a recipe for disaster. Either way, it’s amplified Bitcoin’s price swings, turning MSTR into a leveraged ETF with a personality disorder. 🎢

In short, the world’s most expensive Bitcoin maximalist is still buying, the stock is still volatile, and no one-not even Saylor-has a clue what’s next. But hey, at least we’re all in this together. Or not. 🚀

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD VND PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- IP PREDICTION. IP cryptocurrency

- USD JPY PREDICTION

- Trump’s Fed Pick Chaos: Markets Panic, Gold Plummets, and Bitcoin Cries 😱

- Dash Soars 20% on Privacy Hype! But Will It Crash or Keep Climbing? 🤔

2026-01-19 19:15