Ah, Bitcoin. The digital gold that’s more unpredictable than a Vogon at a poetry recital. Right now, it’s slipping faster than a hoopy frood without his towel, thanks to a risk-off sentiment that’s as fashionable as a pair of mismatched socks. Traders are staring at $90,000 like it’s the ultimate question to life, the universe, and everything-only this time, the answer might not be 42.

Table of Contents

Without exaggeration (though, let’s be honest, exaggeration is my middle name), the risk is as real as a three-headed Zarkov. But is it guaranteed? About as much as a hitchhiker’s guide to actually being useful.

The pullback? Blame it on risk-off vibes, Trump’s tariffs (because why not?), and a market weaker than a leaf in a hurricane. Short-term support levels are crumbling faster than a poorly built sandcastle. Bulls? They’re looking as confident as a man in a pink spaceship.

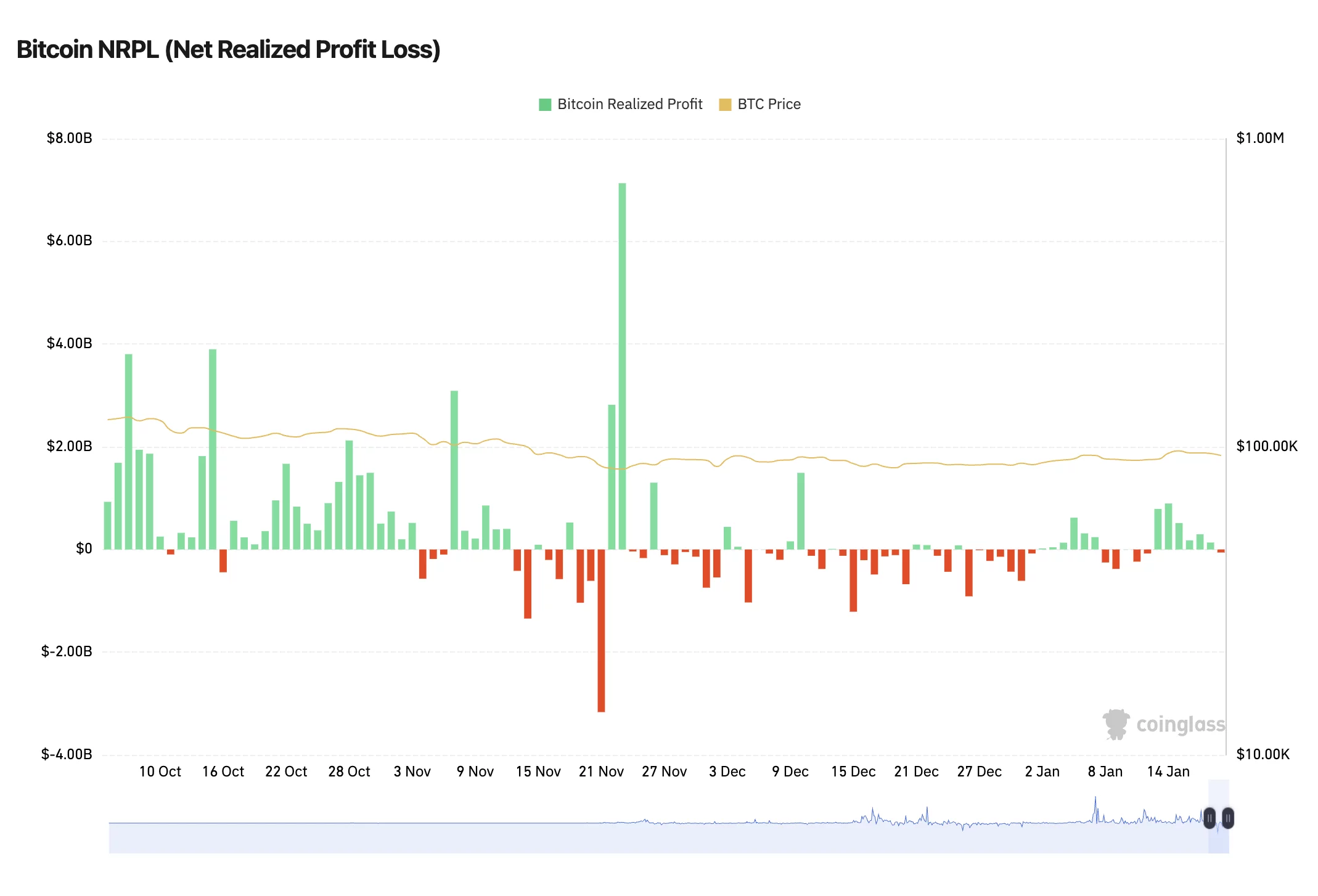

On-chain data? Profit-taking has slowed to a crawl. Caution is the name of the game.

Brandt: The Bearish Prophet

Enter Peter Brandt, the trader with more followers than a cult leader. He’s predicting Bitcoin could nosedive to $58,000-$62,000. Why? A rising wedge, of course-the chart pattern that’s as bearish as a grumpy cat on a Monday.

58k to $62k is where I think it is going $BTC

If it does not go there I will NOT be ashamed, so I do not need to see you trolls screen shot this in the future

I am wrong 50% of the time. It does not bother me to be wrong– Peter Brandt (@PeterLBrandt) January 19, 2026

He’s also quick to point out he doesn’t trade diagonal patterns, leaving those to the Elliott Wave guys who, he claims, always have it figured out after the fact. Classic.

Bitcoin has now become a diagonal pattern. I do NOT trade diagonal patterns. I leave these for the Elliott Wave guys who without fail after the next big move will tell us how they had it all figured out $BTC

– Peter Brandt (@PeterLBrandt) January 20, 2026

Despite his 50% accuracy rate (which, let’s face it, is better than most), his warning has traders on edge. Short-termers? They’re sweating more than a robot in a sauna.

Bitcoin’s still struggling to reclaim major resistance, keeping the forecast as cloudy as a Magrathean sky.

On-Chain Data: Cooling Faster Than a Cup of Tea in Space

CoinGlass’ NRPL metric (yes, another acronym to confuse you) shows trader profits slipping into the red after months of positivity. It’s like the market just realized it left the oven on.

This usually happens when buying interest cools off and the market’s busy absorbing selling. Meltdown imminent? Not necessarily. But Bitcoin’s as fragile as a glass hammer right now, waiting for fresh buyers to save the day.

Bitcoin’s Crystal Ball: Key Levels to Ponder

Push above $97,000-$98,000? Bulls will be popping champagne. Dip below $90,000-$91,000? Bears will be high-fiving. $62,000? Possible, but not as certain as the fact that Arthur Dent is hopelessly lost.

The Bitcoin forecast? Haze central. Bearish charts and slowing on-chain activity are flashing warning signs, but Bitcoin has a habit of surprising everyone. The next moves? As crucial as finding a decent cup of tea in the galaxy.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Are ETH Holders Chasing Fool’s Gold with Ozak AI’s Promises?

- They Swapped Charts for Cheap Carbs! CEA Just Gorge-Bought BNB, Guts Still Sparkling 🤯

- EUR AUD PREDICTION

- ONDO PREDICTION. ONDO cryptocurrency

- IP PREDICTION. IP cryptocurrency

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

2026-01-20 19:16