Ah, the fickle dance of the markets! Bitcoin, that darling of the digital age, has taken a tumble to the tune of $87,895, and lo, the vultures of speculation descend with their pet theory du jour: quantum computing, the bogeyman of the blockchain. How quaint! As if the whims of the wealthy and the machinations of the market could be distilled into so neat a narrative. Yet here we are, with the masses clutching their pearls over the supposed “existential threat” to Bitcoin, while gold, that ancient relic, gleams at a record $4,888.

The chorus was led by none other than Nic Carter, that doyen of Castle Island Ventures, who proclaimed with a flourish: “Bitcoin’s ‘mysterious’ underperformance (due to quantum) is the only story that matters this year.” Ah, Nic, ever the dramatist! And let us not forget Christopher Wood, the Wall Street strategist, who, with a flourish of his quill, banished Bitcoin from his model portfolio, citing quantum fears. How very prudent-or is it merely theatrical?

Yet not all are swayed by this quantum hysteria. Vijay Boyapati, that stalwart of Bitcoin advocacy, waves away the notion with a dismissive hand. “Quantum computing? A concern, yes, but hardly the culprit for Bitcoin’s stall,” he opines. “No, no, the real villain is the unlocking of supply, the whales breaching the surface at $100k, sending chunks of their hoard crashing onto the order books like so much digital flotsam.” A glacier, indeed, beset by waves of greed and fear.

James Check, that astute on-chain analyst, adds his voice to the chorus of reason. “Quantum risk? A background hum, perhaps, but hardly the maestro of this divergence,” he muses. “Gold’s ascent is the work of sovereigns, not qubits. And Bitcoin? It has weathered sell-side storms that would have sunk lesser bulls.” Ah, the wisdom of the trenches!

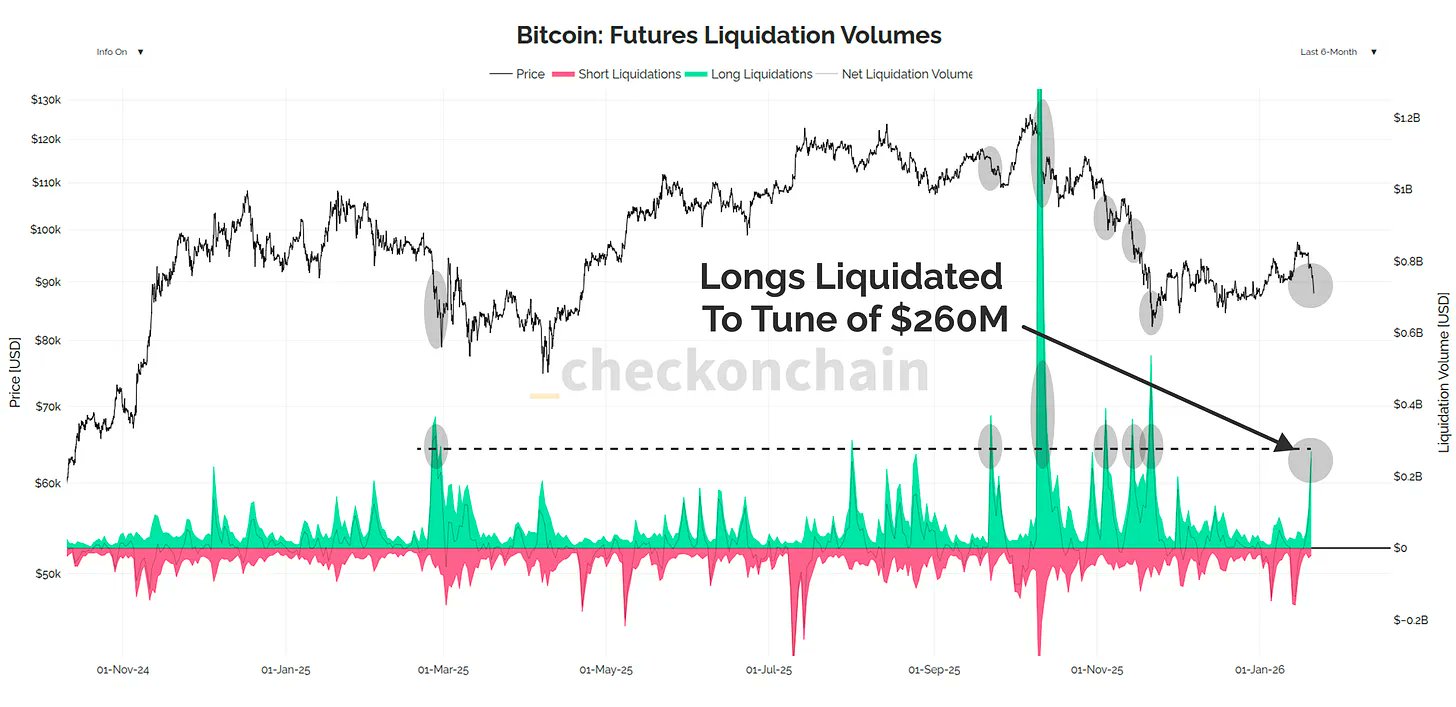

And what of the immediate trigger? Leverage, that double-edged sword, strikes again. “The bears took the longs out to the woodshed,” quips Checkmate, with a grim chuckle, noting the $260 million in liquidated longs. A bear flag, they say, flutters in the breeze, with a “clear supply air-pocket” between $70,000 and $81,000. Thin ice, indeed, for those who tread there.

At press time, Bitcoin hovers at $88,890, a mere blip in the grand tapestry of speculation. And so the saga continues, with quantum fears as its latest, if somewhat farcical, chapter. Will Bitcoin rise again? Only the markets-and perhaps the qubits-know for sure.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- USD VND PREDICTION

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- ONDO PREDICTION. ONDO cryptocurrency

- IP PREDICTION. IP cryptocurrency

- EUR AUD PREDICTION

2026-01-22 05:10