Ah, Bitcoin, the digital gold that’s currently priced at a mere $87,906, with a market cap of $1.75 trillion. In the last 24 hours, it’s been trading like a nervous pigeon, flapping between $86,126 and $88,800. The market’s as tight as a wizard’s hatband, but the technicals? They’re about as neutral as a troll with a grudge.

Bitcoin Chart Outlook: Or, How to Read the Tea Leaves of the Crypto World

The daily chart for Bitcoin is about as cheerful as a dwarf with a hangover. After being rejected at $97,939 (ouch), it plummeted to $86,000 faster than a wizard falling off a broomstick. Volume surged like a dragon’s sneeze, suggesting panic selling or, as we charitably call it, “automated stop-loss cascades.” Around $757 million in liquidations occurred, leaving 189,853 derivatives traders weeping into their mead.

A modest recovery followed, but the candles are as weak as a gnome’s arm. Lower highs and lower lows persist, proving that the bears are still in charge, probably sipping tea and smirking.

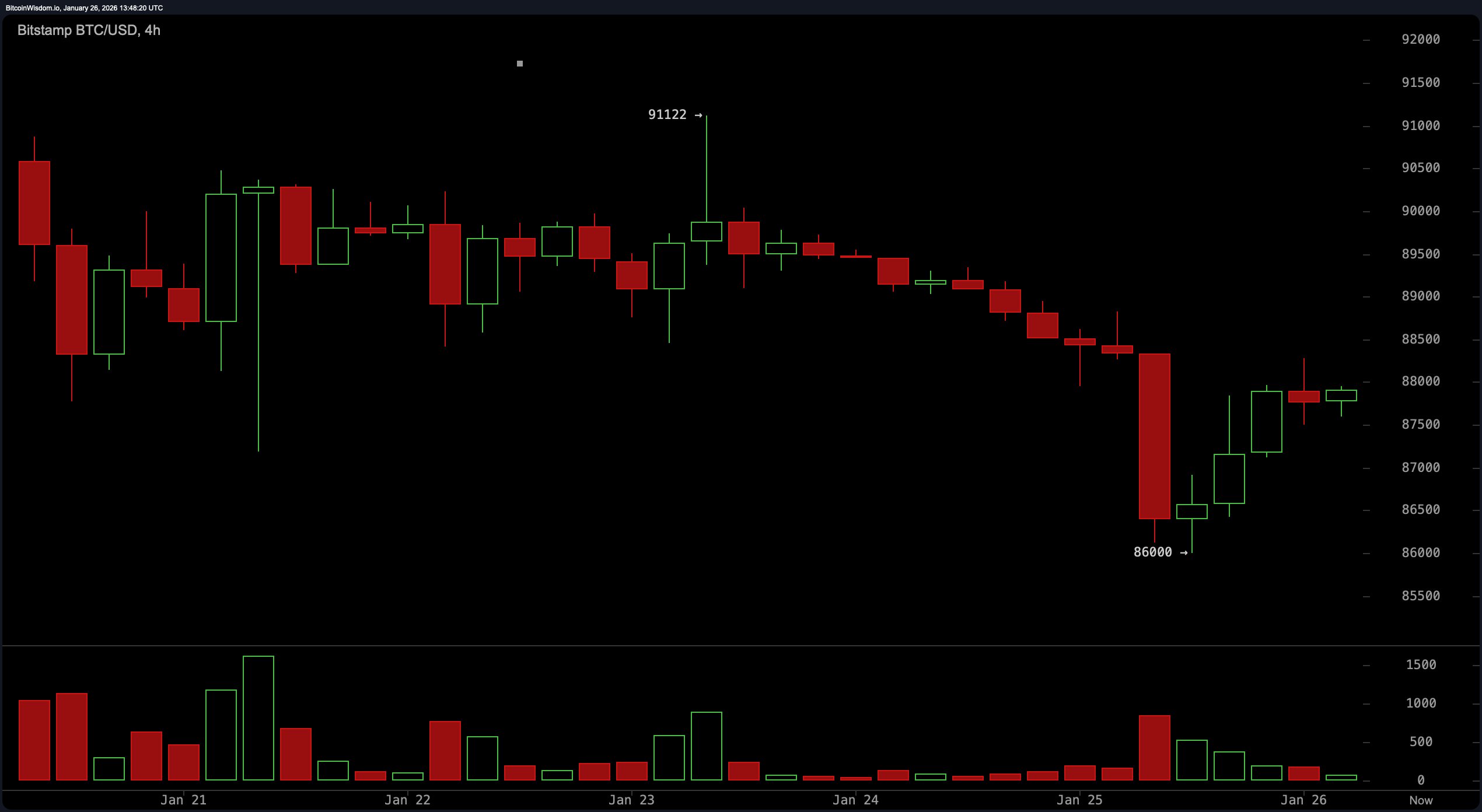

Zooming into the 4-hour chart, we see a breakdown from $89,000 to $86,000-a move as graceful as a troll doing ballet. Some optimists are cheering the slight uptick, but resistance at $88,000 is as stubborn as a crypto maximalist at a fiat party. Volume? Dwindling faster than a goblin’s savings account. This price action smells like a bear flag, and we all know how that story ends.

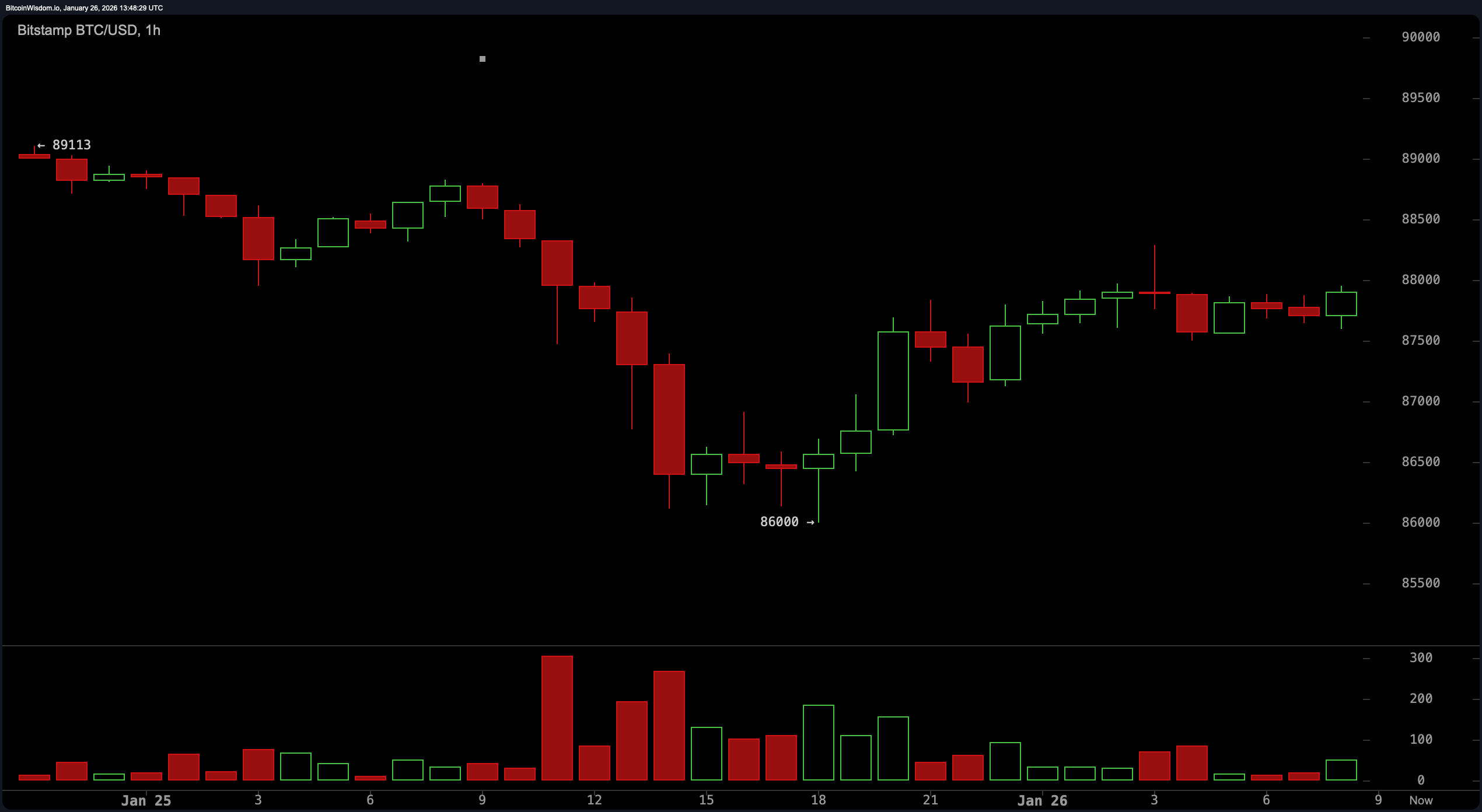

The 1-hour chart? It’s a yo-yo between $86,000 and $88,000, forming what might be an accumulation zone-or just a bear’s playground. Volume is drier than a desert, and without a breakout above $88,500, this feels like a tired retrace. Bulls, you’ll need more than a nudge to break through that resistance.

Oscillator readings are about as decisive as a committee of wizards. The RSI sits at 41-neutral as a Swiss diplomat. The stochastic oscillator? Also neutral. But the MACD at -666? That’s about as ominous as a black cat crossing your path on Friday the 13th.

Moving averages? They’re all singing the same tune: downtrend. From the 10-period to the 200-period, every single one is pointing south. Bitcoin’s got more work to do than a goblin in a gold mine if it wants to turn this around.

Bull Verdict: Hoping for a Miracle

If Bitcoin can break above $88,500 with volume that doesn’t resemble a trickle, we might see a reversal. Reclaiming $91,000 would be like a dragon waking from its slumber-but for now, bulls are on standby, probably sipping coffee and crossing their hooves.

Bear Verdict: Business as Usual

The bears are having a field day. With every moving average pointing down and volume drying up, the momentum is as bearish as a troll with a toothache. Unless Bitcoin reclaims $91,000 with the force of a wizard’s spell, this looks like a pause in a broader downtrend.

FAQ ❓

- What is Bitcoin’s current price?

Bitcoin is priced at $87,906 as of January 26, 2026. Not too shabby, but not exactly mooning either. - Where is Bitcoin finding support?

Support is holding around $86,000-like a stubborn mule refusing to budge. - What resistance is Bitcoin facing now?

Bitcoin is struggling to break above the $88,500 resistance zone. It’s like trying to push a boulder uphill with a toothpick. - Is Bitcoin in an uptrend or downtrend?

Current chart patterns and moving averages say downtrend. But hey, stranger things have happened-like a troll winning a beauty contest.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- Silver Rate Forecast

- USD VND PREDICTION

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- EUR USD PREDICTION

2026-01-26 18:22