In the dusty halls of Washington, where men in suits whisper like the wind through the Salinas Valley, the crypto market bill has risen again, a phoenix from the ashes of bureaucratic indifference. With the specter of a government shutdown looming like a vulture on January 31, the bill has found itself back in the spotlight, though whether it’s a spotlight or a noose remains to be seen.

Over the weekend, the gears of politics churned slower than a broken tractor, yet somehow, progress was made. Democrats, in a rare moment of unity, have agreed to keep their objections to themselves during the markup sessions on January 29. It’s like watching a barn dance where everyone’s too tired to step on each other’s toes.

Crypto Bill Markup on Radar

According to a report from Politico, those grand old men of the Senate, Roger Marshall and Dick Durbin, have decided to play nice. Marshall, who last week threatened to throw a wrench into the works with an amendment on credit card fees, has apparently had a change of heart. Or perhaps someone reminded him that derailing the crypto bill would make him about as popular as a skunk at a church picnic.

Marshall and Durbin, two peas in a pod when it comes to credit card policy, have been tinkering with provisions related to the crypto market bill for months. But in the end, Marshall agreed to shelve his amendment, though not without a dramatic sigh that could be heard all the way to the Capitol steps.

Other amendments, however, remain as unresolved as a Steinbeck novel. Crypto ATM fraud protections and restrictions on bailouts for crypto issuers are still up in the air, like a tumbleweed caught in a crosswind. Politico’s sources claim the White House stepped in, warning that Marshall’s amendment could sink the entire bill faster than a sinking ship in a Steinbeck story.

Making a Move Before U.S. Shutdown

Meanwhile, some Republicans were ready to back Marshall’s credit card proposal, adding another layer of chaos to the mix. The Senate Agriculture Committee is now under more pressure than a grape in a wine press, with a deadline of January 30 to sort out the mess before the government potentially shuts down.

Market participants, ever the pessimists, have already priced in the likelihood that a funding bill won’t be finalized in time. This has sparked a flurry of lobbying efforts, as lawmakers scramble like chickens in a coop. Some insiders whisper that the crypto bill could be delayed until March, though at this rate, it might as well be delayed until the next ice age.

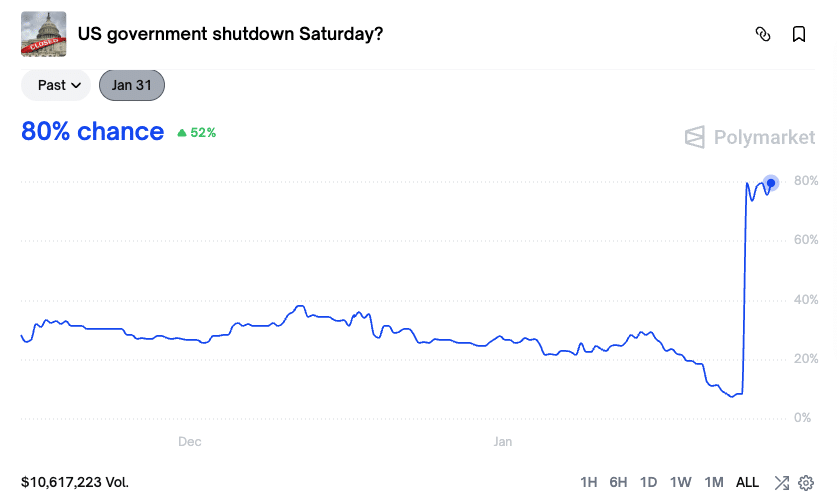

Polymarket data shows the odds of a U.S. government shutdown on January 31 have skyrocketed to 80%, a figure that’s about as comforting as a rattlesnake in your boot.

Chances of a U.S. government shutdown spike to 80%. | Source: Polymarket

Amid this chaos, the crypto market has been on edge, twitchier than a rabbit in a coyote’s den. Analyst Crypto Tice warns that a shutdown would force the U.S. Treasury to rebuild its Treasury General Account (TGA), a process that sucks liquidity out of the markets like a vacuum cleaner on overdrive.

🚨 BIG WARNING

The biggest threat to crypto is back.

🇺🇸 A U.S. government shutdown by Jan 31 is now being priced at ~80% up from ~10% yesterday.

Shutdown means Treasury rebuilds TGATGA rebuild means liquidity pulled from marketsLiquidity drain means crypto gets hit first…

– Crypto Tice (@CryptoTice_) January 26, 2026

Tice notes that liquidity withdrawals tend to hit crypto assets first, like the canary in the coal mine. In past shutdowns, crypto markets experienced brief relief rallies followed by sharp pullbacks as liquidity tightened. Bitcoin and altcoins corrected by 20-25% during those periods, a reminder that in the world of crypto, the only constant is volatility.

This time, liquidity conditions are already thinner than a scarecrow’s legs, increasing the risk that any further withdrawals could have an amplified impact. It’s like trying to bail out a sinking boat with a thimble-not exactly a winning strategy.

So, as the clock ticks down to January 31, the crypto world holds its breath, waiting to see if the bill will pass, if the government will shut down, and if Bitcoin will survive the circus. One thing’s for sure: in Washington, the only thing more unpredictable than the weather is the politicians.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Silver Rate Forecast

- USD VND PREDICTION

- Shiba Inu Shakes, Barks & 🐕💥

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- EUR USD PREDICTION

2026-01-27 17:45