Behold, the beast of Bitcoin, once mighty and roaring, now limps on broken hooves through the mud of a liquidity famine. Ki Young Ju, that scribe of market sorrows, proclaims the beast’s ailments are not of the bones but the blood-its lifeblood, the fresh capital, has turned to dust. The inputs that once fed its hunger have stilled, and now, he whispers, the fate of this creature hinges on a single, trembling thread: whether the enigmatic Strategy shall don the mantle of buyer or seller. A -70% capitulation looms, but only if the Strategy chooses to dance with the devil.

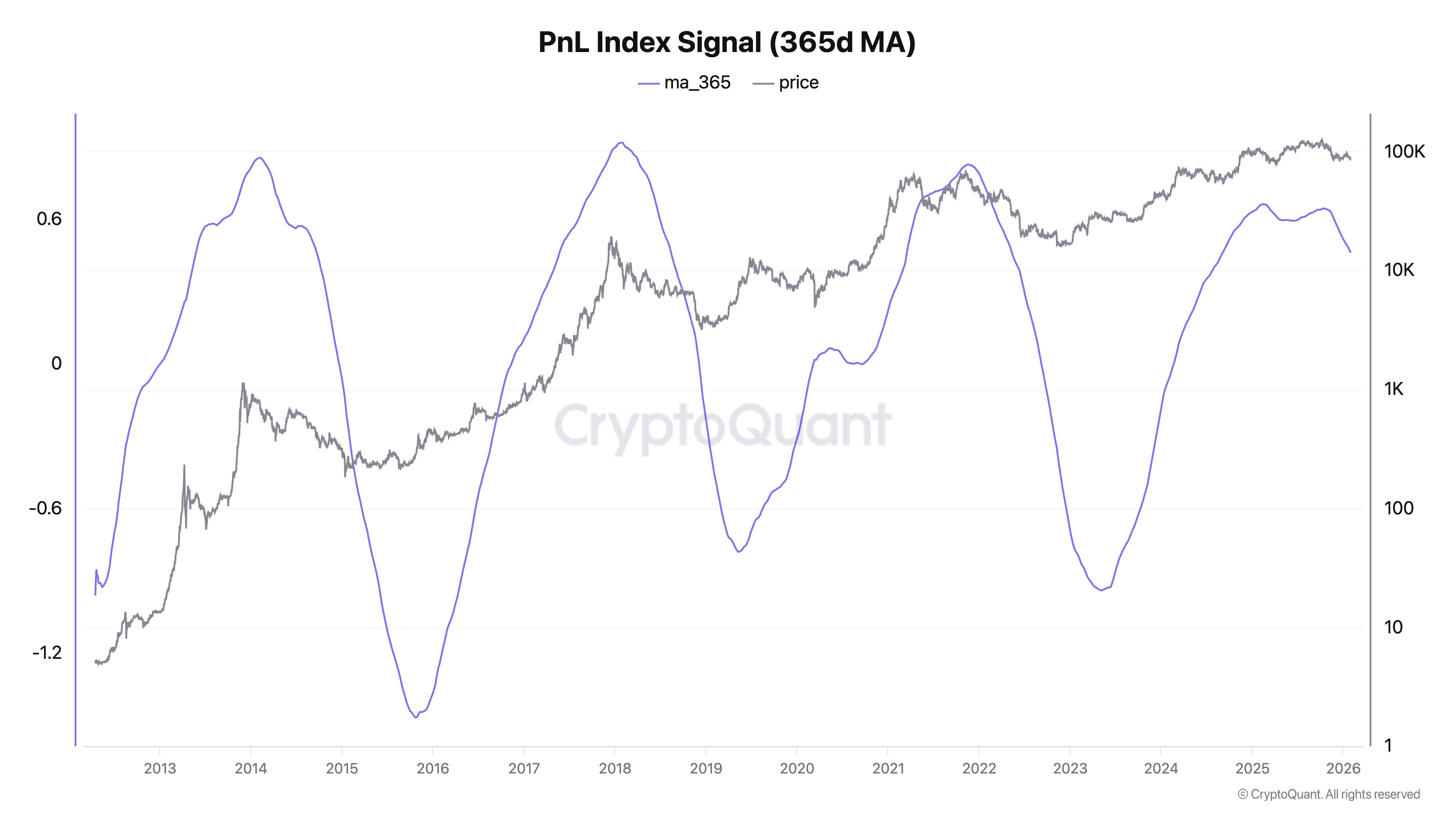

In February’s ink, Ki wrote of Bitcoin’s descent, not as a tragedy of strength but a farce of weakness. The Realized Cap, that barometer of hope, flatlined like a corpse in the snow. “No fresh capital,” he declared, “is the death knell of a bull market.” The market structure, he claimed, is a crumbling palace, its pillars rotten with the rot of stagnation.

Profit-taking, once a quiet murmur, now roars like a tempest, unabsorbed and unrelenting. Early holders, those grifters cloaked in ETFs and MSTR’s shadow, have been milking their gains like serfs in a medieval fairytale. For months, their greed was masked by the illusion of inflows, but now the curtain falls: the bid that mattered has fled. “Now those inflows have dried up,” Ki lamented, as if mourning a lost love.

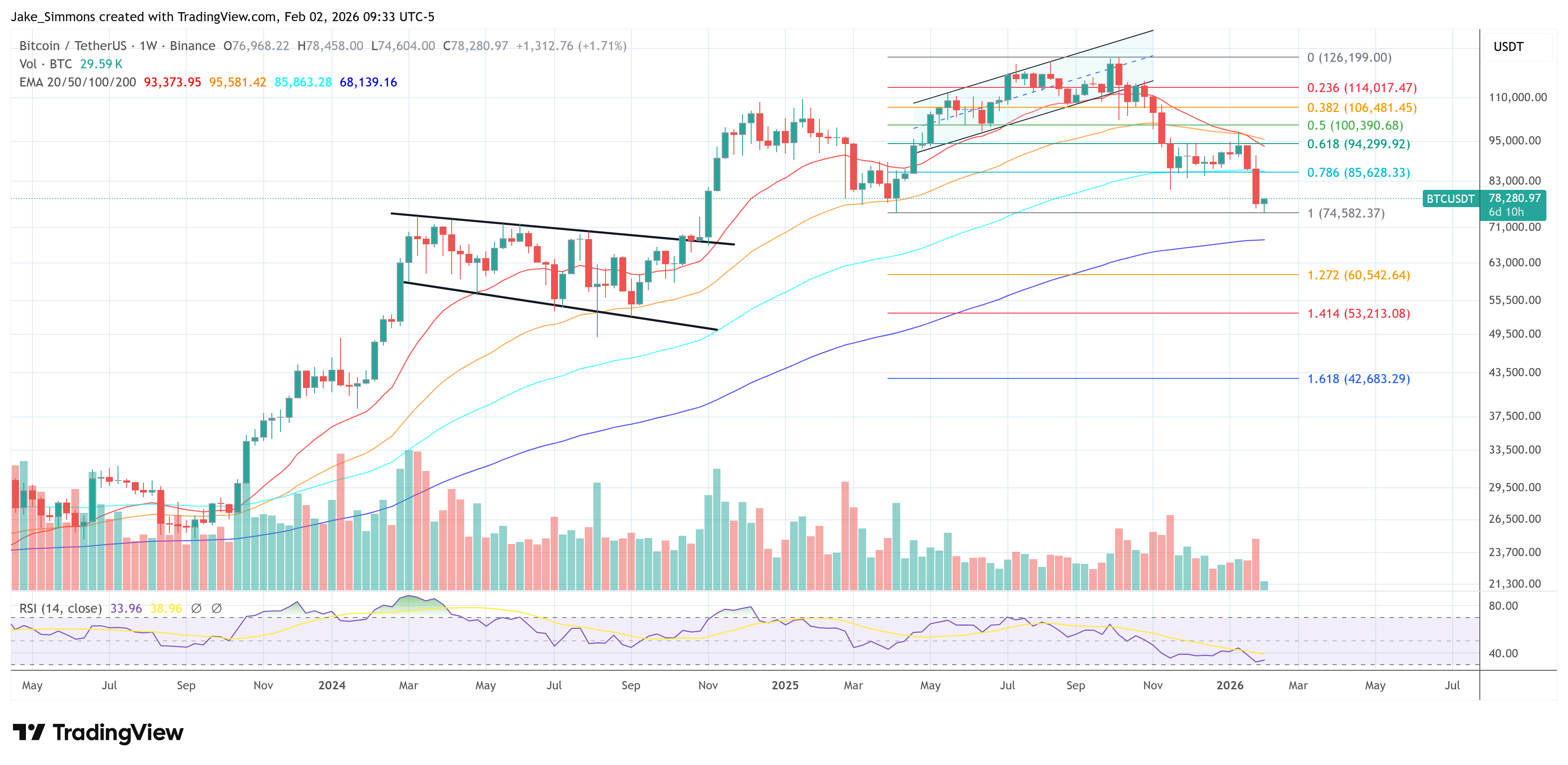

And here, the calculus of crash shifts. Strategy, that savior of rallies past, is now a fickle muse. Ki admits its magic could vanish unless Saylor, that crypto king with a silver tongue, decides to dump his hoard. “A -70% crash?” he scoffs. “Only if Saylor plays the fool.” The crash math, he insists, is not a prophecy but a conditional-a “if you will it, it is done” for the desperate.

Yet even in this bleak tapestry, Ki finds no floor, only a void. “Selling pressure still rages,” he writes, “and the bottom? A myth.” His vision? A “sideways consolidation,” a purgatory of volatility where hope drowns in the soup of indecision. Buyers? They are ghosts in the machine, absent and uninvited.

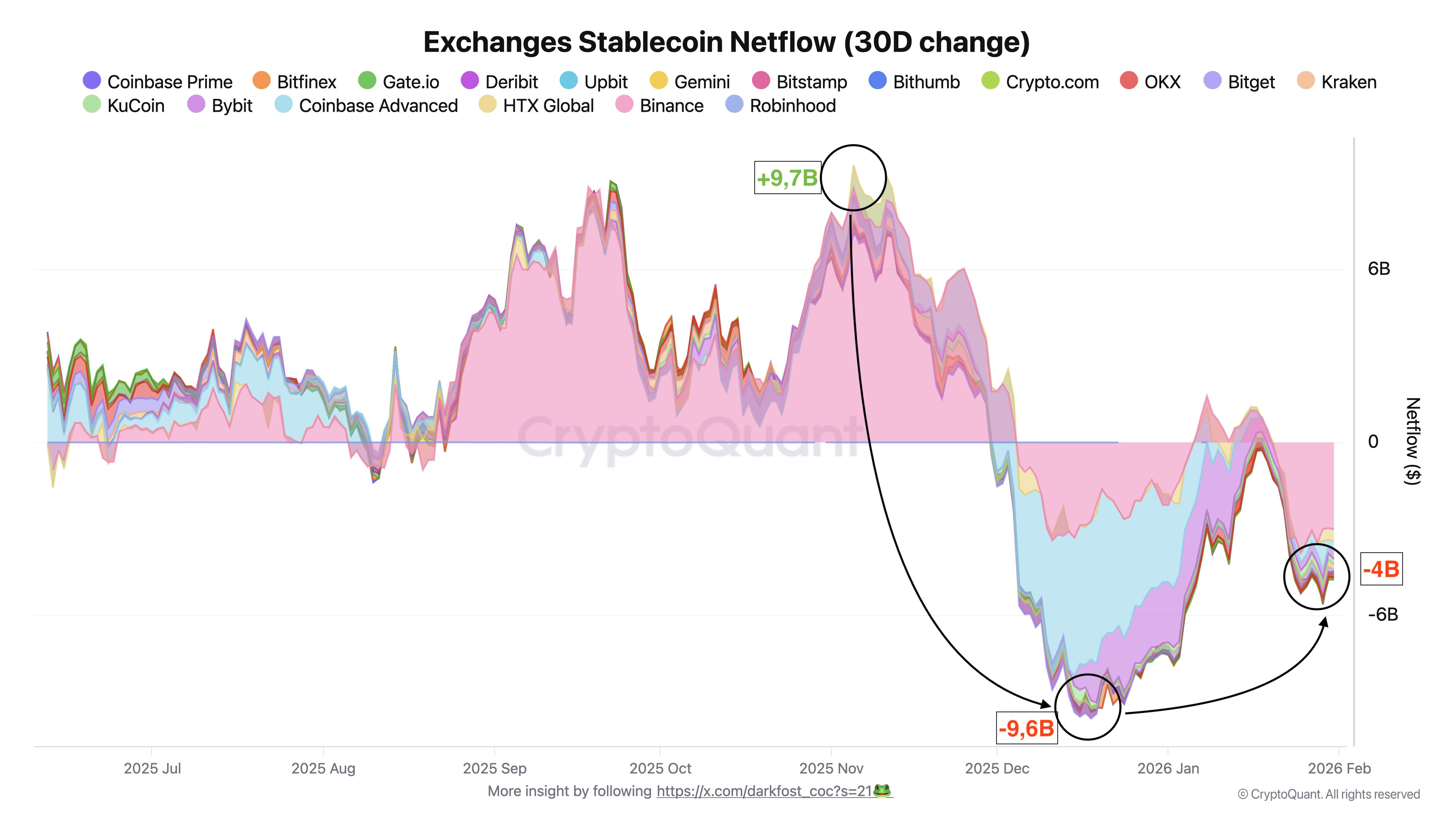

Darkfost, that oracle of stablecoins, adds his dirge. The stablecoin veins, once swollen with liquidity, now bleed. “A structural lack of liquidity,” he calls it, as if describing a plague. In this world of uncertainty, risk-taking is a relic, and stablecoins-those supposed anchors-have become the harbingers of doom. Their market cap, he notes, has shriveled since December, and the inflows? They’ve vanished like smoke in a storm.

October, the last gasp of liquidity, saw Binance’s coffers swell with $8.8B. But now? A $4B outflow, including $3.1B from Binance, paints a picture of panic. The market, Darkfost sighs, is a “delicate phase,” a phrase as hollow as the promises of a conman.

At press time, BTC traded at $78,280-a number, a relic, a joke. The end is not nigh, nor is it clear. Only the Strategy, that savior or destroyer, holds the key. But let us not forget: in the world of crypto, the only thing more volatile than Bitcoin is the sanity of its believers.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- AI, Crypto, and Gen Z: The Future of Holiday Shopping is Here (And It’s Ridiculous!)

- Shiba Inu Shakes, Barks & 🐕💥

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2026-02-03 07:28