Coinmarketcap’s latest Proof of Reserves report reveals Binance sitting on a mountain of assets while the rest of the crypto exchange ecosystem ponders its footwear and whether it should have taken up a less strenuous sport like interpretive dancing.

Proof of Reserves Highlights Binance’s Liquidity Advantage

Coinmarketcap (CMC) has published its January 2026 Major Crypto Exchange Reserves Ranking, offering a detailed snapshot of how liquidity is distributed across the industry’s largest trading venues. The data highlights a widening gap between Binance and the rest of the market, both in total reserves and in asset composition.

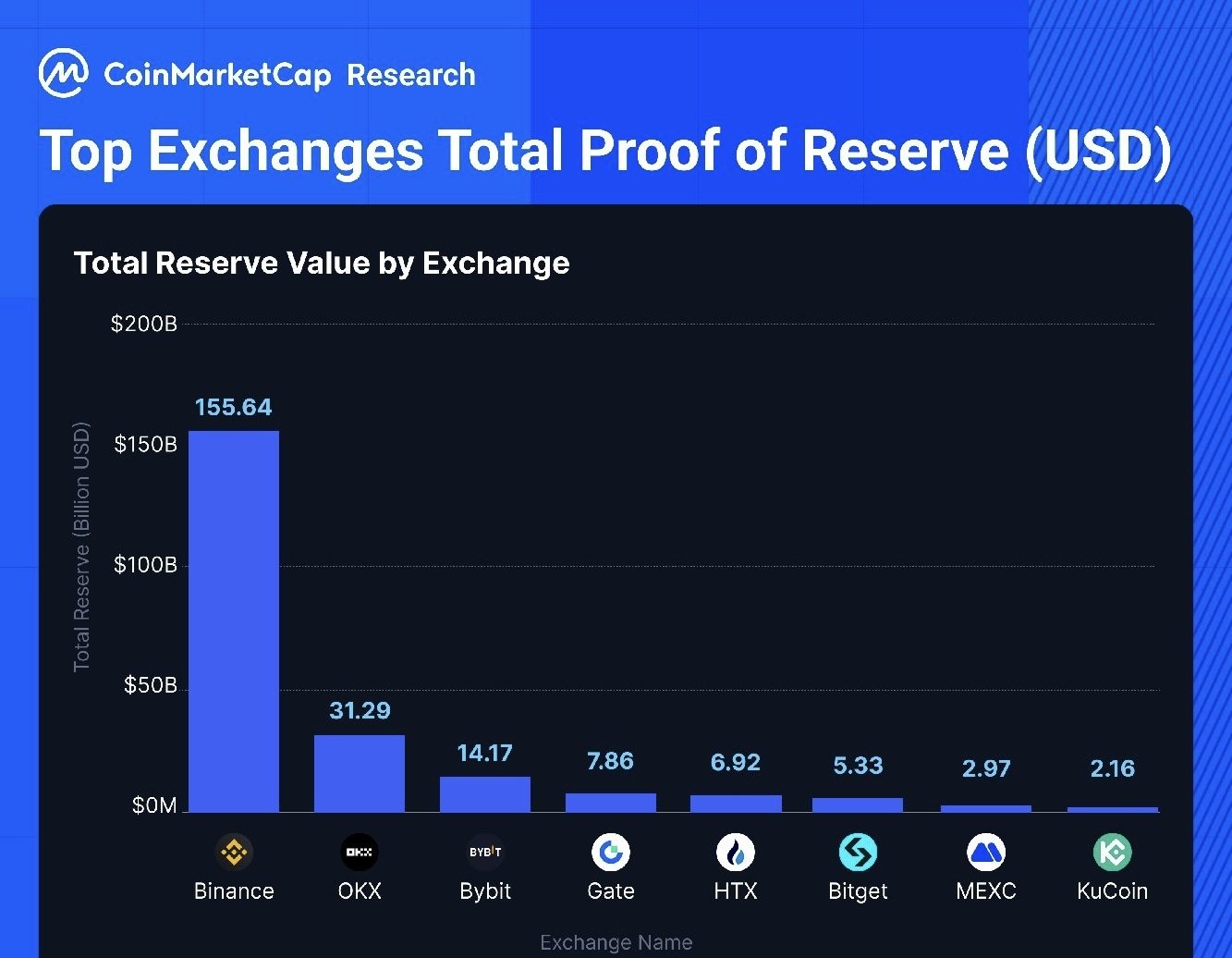

According to the CMC report, Binance ranked first by a wide margin, holding approximately $155.64 billion in total reserves. Stablecoins accounted for $47.47 billion, or 30.5% of its holdings, while bitcoin-related assets made up $49.84 billion, representing just over 32%. Binance’s reserve profile also includes a substantial allocation to its native token, BNB, valued at around $34.2 billion.

OKX placed second with roughly $31.29 billion in reserves, followed by Bybit at $14.17 billion. The next tier of exchanges included Gate ($7.86 billion), HTX ($6.92 billion), Bitget ($5.33 billion), MEXC ($2.97 billion), and Kucoin ($2.16 billion). Together, the figures reveal a clearly tiered market structure, with Binance operating at a scale that eclipses all competitors combined.

Beyond headline totals, the report highlights notable differences in how exchanges allocate assets. Major platforms continue to concentrate reserves in bitcoin, ether, and stablecoins to support liquidity and meet withdrawal demand. Stablecoins, in particular, play a central role, with Binance and OKX holding the largest dollar-denominated balances, reflecting strong capacity for near-instant redemptions.

Exchange-issued tokens also emerged as a key differentiator. Binance’s large BNB holdings significantly boost its overall reserves, underlining the token’s importance within its ecosystem. By contrast, OKX maintains a more conservative exposure to its own token, with a greater emphasis on bitcoin and stablecoins.

Altcoin strategies vary widely. HTX and OKX reported the largest allocations to non-major altcoins, while Gate also showed meaningful exposure relative to its size. Other exchanges, including Bitget, Kucoin, and MEXC, focused disclosures on core assets, reporting limited holdings in smaller tokens. Across platforms, DOGE, XRP, and SOL stood out as the most commonly held altcoins.

The data is based on the latest official Proof of Reserves disclosures, with valuations calculated using prices as of Feb. 3, 2026.

FAQ🏦

- Which crypto exchange holds the most reserves?

Binance leads by a wide margin with about $155.6 billion in total reserves, far ahead of all competitors. - What assets make up Binance’s reserves?

Binance’s holdings are mainly bitcoin, stablecoins, and BNB, giving it deep liquidity and fast withdrawal capacity. - How do other major exchanges compare?

OKX ranks second at roughly $31.3 billion, with Bybit, Gate, and HTX trailing in a clearly tiered market. - Why do Proof of Reserves rankings matter?

They show an exchange’s ability to meet withdrawals, manage risk, and maintain trust during market stress.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- AI, Crypto, and Gen Z: The Future of Holiday Shopping is Here (And It’s Ridiculous!)

2026-02-05 04:07