My dear financial aficionados, gather ’round and prepare for a tale as tragic as a Coward play, sans the witty repartee, of course. The world of Bitcoin, that digital darling, has left its miners in a most precarious predicament.

The Gory Details, Darling:

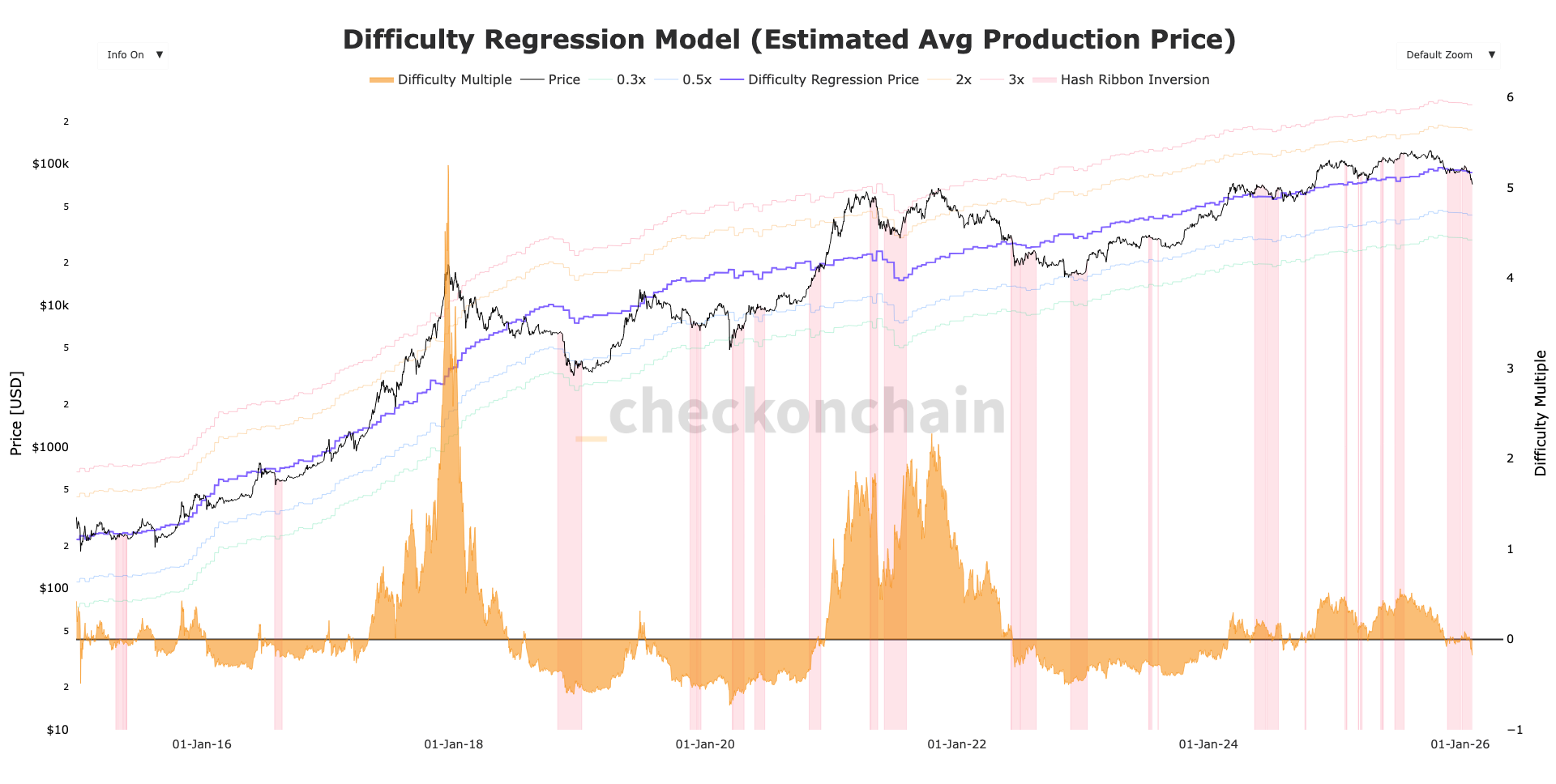

- Imagine, if you will, a Bitcoin priced at a mere $70,000, a full 20% below the exorbitant $87,000 it costs to wrest it from the digital ether. A bear market, my dears, as obvious as a badly timed entrance.

- History, that fickle mistress, reminds us that in the bear markets of yore (2019 and 2022, to be precise), Bitcoin has wallowed below production cost before, eventually clawing its way back to respectability.

- The hashrate, that measure of computational prowess, has rebounded after a dramatic 20% tumble from its October peak. A phoenix rising from the ashes, or merely a desperate flutter before the final curtain?

The poor miners, those digital toilers, find themselves in a most unenviable position. Their revenues, like a deflating soufflé, have shrunk below their operating costs. Selling their precious Bitcoin holdings, like a socialite pawning her jewels, is their only recourse to keep the lights on and the machines humming.

This “miner capitulation,” as the pundits so dramatically call it, is a stark reminder of the sector’s fragility. Will Bitcoin rise again, phoenix-like, from the ashes of this bear market? Only time, that most unforgiving critic, will tell.

Until then, my darlings, let us observe this financial drama with a raised eyebrow and a well-timed quip. After all, even in the world of cryptocurrency, one must maintain a sense of perspective… and a healthy dose of sarcasm.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- The Grand Melancholy of Crypto: A Tale of Greed, Fear, and Foolish Hope

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

2026-02-05 14:33