Bitcoin’s price is $67,925 this morning at 8 a.m. EST, a number pinned like a stubborn demon to a market cap of $1.35 trillion, with $51.15 billion in 24-hour trading and an intraday swing from $65,932 to $68,371. The mighty asset, wearing a grin and a cloak, consolidates beneath a heavy resistance belt as a relief rally claws with a structurally bearish staircase of higher-timeframe trends, while momentum ponders its own existence and whether the market has anything left to prove-spoiler: probably a lot.

Bitcoin Chart Outlook

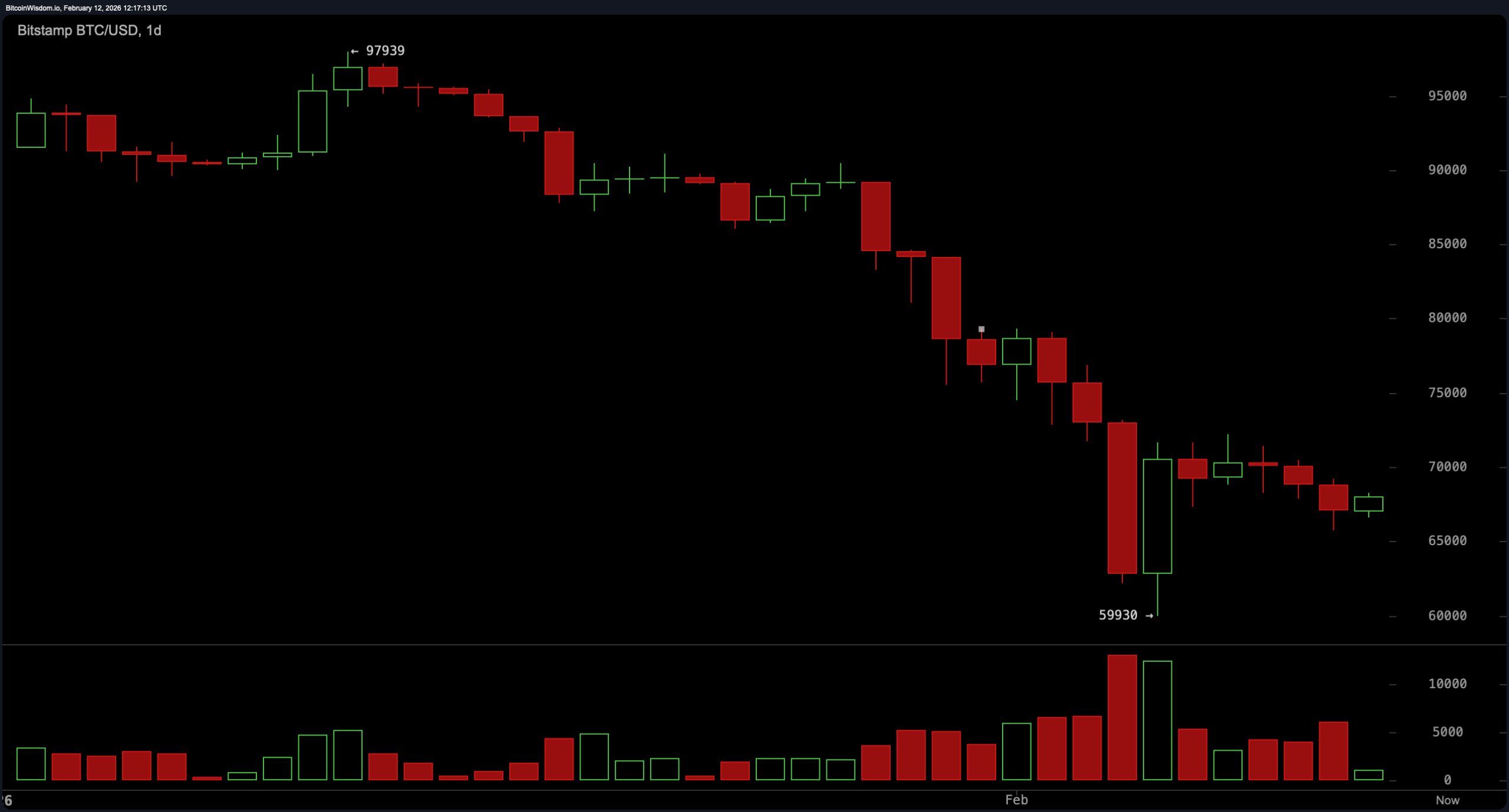

The daily chart continues to reveal a bearish macro structure, a melodrama of lower highs and lower lows following a dramatic rejection near $97,900, a kiss-off that could only be called dramatic if one watched charts instead of soap operas. A capitulation wick toward roughly $59,930 marked an exhaustion event, followed by a rebound into the $68,000 to $70,000 region, where price now sits in a tight, nosy conversation with resistance. The audience knows the script: resistance between $70,000 and $72,000, a broader supply zone from $75,000 to $80,000, and a supporting chorus at $60,000. A breakdown below $59,000 would reveal a stage collapse down to $52,000-$54,000. Until Bitcoin reclaims $72,000 with convincing volume, the daily bias remains a gloomy waltz to the downside.

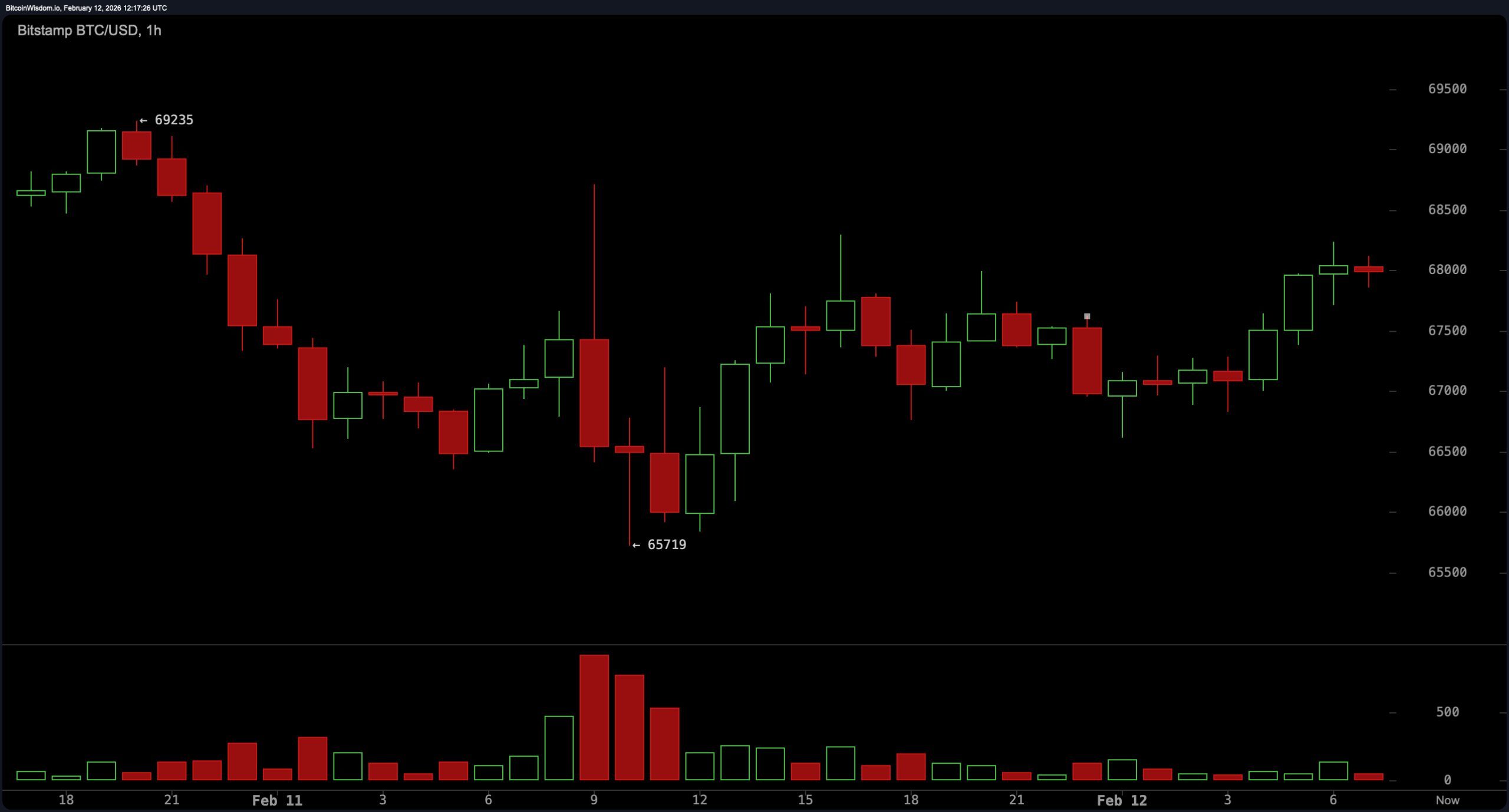

On the four-hour timeframe, price action performs a corrective bounce inside that stern downtrend. A recent low around $66,000 has slimmed into a crawl toward $68,000 and $69,000, yet volume dwindles on the ascent, hinting at a fragile conviction. Resistance clusters between $69,500 and $71,000, with intraday support at $66,000 and a key breakdown at $64,000. In plain terms, this looks like a textbook corrective move rather than a heroic reversal-the kind of bounce that smiles at you from across the room and then proceeds to run away when the lights flicker.

The one-hour chart presents a more constructive short-term picture, with a modest higher-high and higher-low pattern suggesting near-term bullish momentum. Resistance sits at $68,500 to $69,000, and volume is not explosive, meaning any breakout needs confirmation. A sustained move above $69,000 opens the path toward $70,000 to $71,000, while a drop below $67,000 would invalidate that immediate upside scenario. Conversely, failure in the $69,000 to $70,000 region could rotate price back toward $66,000 and potentially $64,000. Short-term optimism exists, but it remains a candle in a larger, bearish storm.

Oscillators tell a story of stabilizing nerves without a dramatic reversal in sight. The relative strength index (RSI) is at 32 with a neutral tone, hovering near oversold territory. The Stochastic oscillator sits at 29, also neutral. The commodity channel index (CCI) prints −85, neutral. The average directional index (ADX) ticks at 54, neutral, signaling a stubborn trend environment. The Awesome oscillator shows −14,576, neutral. Momentum exhales with −10,705 and a sell indication, and the MACD level sits at −5,734 with a sell indication. The bias here is not exactly shouting “buy me a yacht,” more like whispering “maybe later.”

Moving averages remain decisively bearish across the spectrum. The EMA (10) at $70,809 and SMA (10) at $69,539 both point south. The EMA (20) at $75,466 and SMA (20) at $77,022 reinforce the weakness. The EMA (30) at $78,695 and SMA (30) at $82,215 keep the gloom steady, followed by the EMA (50) at $82,727 and SMA (50) at $85,372. Even the longer-term EMA (100) at $89,003 and SMA (100) at $88,709, along with EMA (200) at $94,887 and SMA (200) at $101,303, echo sell signals. In short, the trend remains politely opposed to any grand ascent-reclaiming $72,000 with genuine volume remains the technical line in the sand.

Bull Verdict

If Bitcoin can decisively clear and hold above 69,000 on expanding volume, momentum on the one-hour chart could extend toward the 70,000 to 72,000 band. A confirmed reclaim of 72,000 would begin to neutralize the daily bearish structure and challenge the prevailing lower-high pattern. In that scenario, the relief rally might metamorphose from a mere bounce into something structurally meaningful-a sign that the plot could shift from subplots to a possible trend transition.

Bear Verdict

Failure to sustain strength near 69,000 to 70,000, especially if accompanied by rising downside volume, keeps the broader downtrend firmly intact. With daily structure still printing lower highs and moving averages aligned to the downside, rejection in this resistance band opens the door back toward 66,000, then 64,000, with 60,000 as the next major support. Until 72,000 is reclaimed with conviction, rallies remain technically vulnerable within a dominant bearish framework.

FAQ

- What is bitcoin’s price on Feb. 12, 2026? Bitcoin is trading at $67,925 with a 24-hour range between $65,932 and $68,371.

- Is bitcoin in a bullish or bearish trend right now? The daily and four-hour charts show a bearish trend despite short-term strength on the one-hour timeframe.

- What are the key resistance levels for bitcoin? Major resistance stands at 69,500 to 71,000 short term and 70,000 to 72,000 on the daily chart.

- What are the key support levels for bitcoin? Immediate support sits at 66,000 and 64,000, with major structural support near 60,000.

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

2026-02-12 17:07