In the grand theater of finance, where numbers dance and fortunes sway, JPMorgan, that venerable bastion of prudence, clings to its audacious vision for Bitcoin. With a steadfast gaze fixed upon the horizon, the bank proclaims a target of $266,000 per coin, a figure as lofty as it is ludicrous, even as the present whispers of mining woes and risk-averse murmurs drift into the year 2026.

The bank’s prognostications rest upon twin pillars, as fragile as they are intriguing: a “soft” floor beneath Bitcoin’s production cost, and a valuation model that dares to compare the digital upstart to the ancient luster of gold, adjusted for the whims of volatility. In the immediate future, the current downturn is but a trial by fire for miners, a test of mettle and machinery. JPMorgan estimates the cost of birthing a single Bitcoin at a staggering $77,000, while the market, in its capriciousness, lingers in the mid-$60,000s, leaving the less efficient operators to rue their fate.

JPMorgan’s Unwavering Faith in Bitcoin’s Star

History, they say, is a fickle mistress, yet JPMorgan insists that production cost is but a gentle cushion, not an ironclad barrier. The logic is circular, almost comical: should prices languish below profitability, the weaker miners shall perish, difficulty shall yield, and the cost of production shall shrink, tightening the noose around the very spot it once supported. A grim dance, indeed, but one the bank watches with detached fascination.

For 2026, JPMorgan dons rose-tinted spectacles, betting on institutional capital as the savior, the knight in shining armor who shall revive the flow when the macroeconomic tempest subsides. “We are positive,” they declare with a flourish, “and expect increased inflows into digital assets, driven by institutional investors.” A bold claim, yet one that smacks of wishful thinking, like a farmer praying for rain in a drought.

The $266,000 target, they hasten to add, is not a prophecy for 2026, but a mathematical folly, a “what if” born of comparing Bitcoin to gold’s $8 trillion throne. “Unrealistic now,” they admit with a shrug, yet “possible later,” as if time alone could bridge the chasm between fantasy and reality. The key, they insist, lies in volatility, that fickle mistress of markets. With Bitcoin’s volatility-to-gold ratio at a mere 1.5, unusually tame by historical standards, the bank argues that gold’s recent surge has only burnished Bitcoin’s long-term allure.

“Gold’s outperformance since October, coupled with its rising volatility, has made Bitcoin look even more enticing in the long run,” the analysts muse, their tone tinged with a mix of hope and sarcasm. It is as if they are watching a play, knowing full well the plot twists, yet still feigning surprise at each turn.

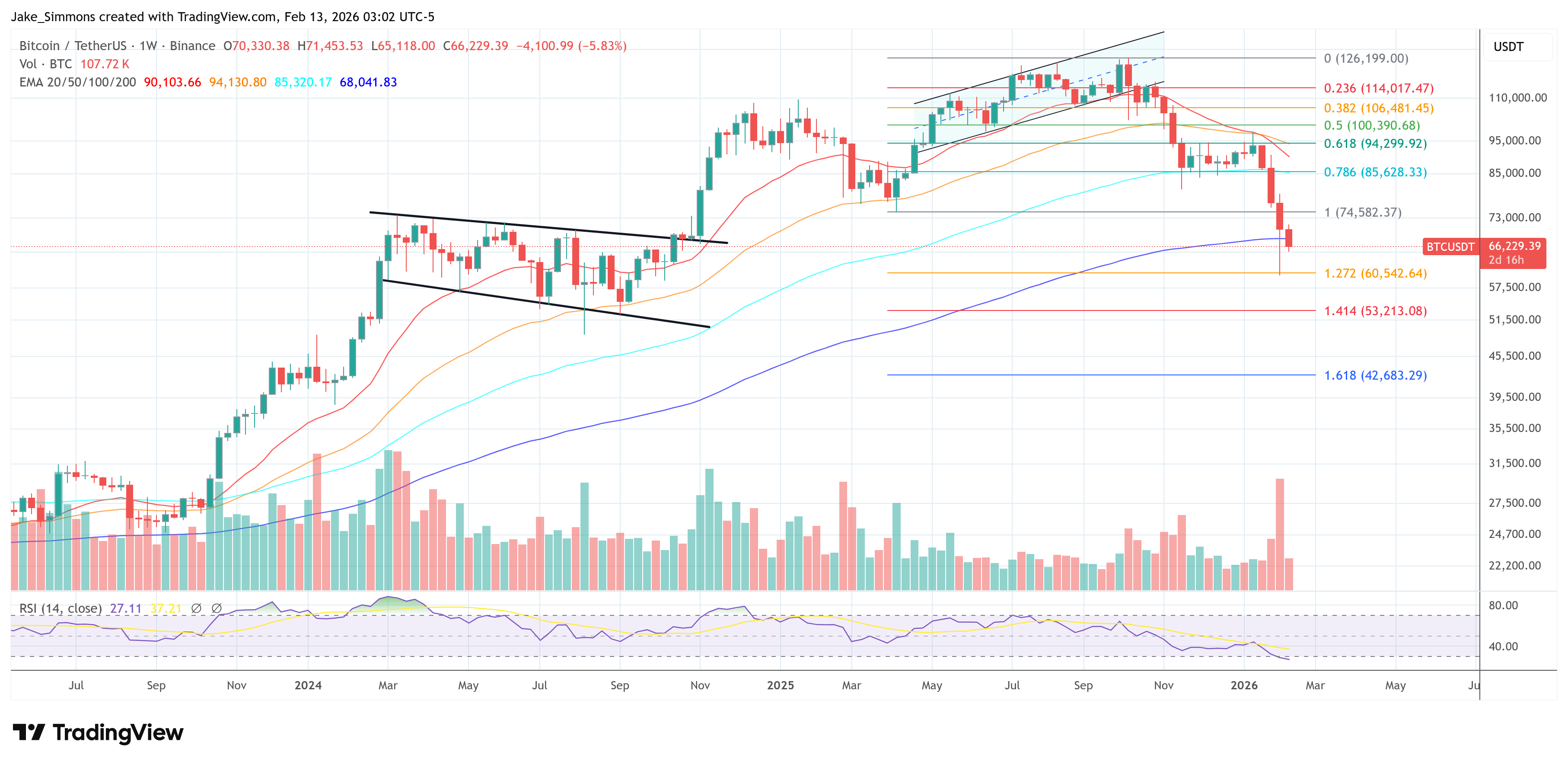

JPMorgan’s stance, in essence, is a tale of two timelines: one mired in the mud of near-term adjustments, the other soaring on the wings of institutional dreams and regulatory whispers. A messy present, a hopeful future-such is the duality of their vision. At the moment of this scribbling, BTC trades at $66,229, a mere footnote in the grand narrative they weave.

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- LINK Soars 20%-Will It Reach $100? 🚀📈

2026-02-13 18:04