ETF outflows remove key liquidity support, increasing Bitcoin’s vulnerability to selling pressure.

Bitcoin started the year facing downward pressure, as demand for investment products significantly decreased. Data suggests that the funds which drove the previous two price increases are now being withdrawn. This, combined with increased global economic and political instability, has created a cautious outlook for the market.

Bitcoin Liquidity Contracts as ETF Momentum Reverses

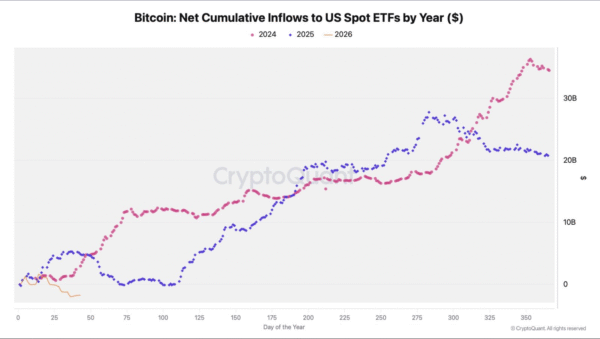

Recent data from Darkfost shows that, for the first time, more money is flowing out of Bitcoin spot ETFs than into them. Unlike previous years, Bitcoin investment funds started 2026 with significant losses.

2024 saw a steady increase in investments throughout the year, with particularly strong growth in the last three months. This pushed the total value of funds linked to Bitcoin over $30 billion. Strong demand for these investment products drove money into the market, which in turn helped to support Bitcoin’s price.

Strong performance continued into the first half of last year, with total investments reaching around $27 to $28 billion. Like the year before, there was plenty of available money, and the products continued to effectively purchase assets directly from the market.

Image Source: X/Darkfost

These products began to show weakness towards the end of last year. Investment inflows, which initially reached $27 billion, fell to around $20 billion by the year’s close. While flows were initially steady, they began to decline in the latter half of the year, and this negative trend now seems to be continuing into 2026.

Recent selling is taking away a significant buyer, and without consistent demand from exchange-traded funds, it’s becoming harder to buy Bitcoin at current prices. This makes the price more likely to drop when people sell, and we can expect more short-term price swings.

Liquidity Tightens as Crypto Funds Struggle to Regain Demand

With growing global uncertainty, investors are becoming more cautious and less willing to take risks. This often shows up first in the cryptocurrency market, and currently, data indicates many traders are holding back from buying or selling.

Things look very different now compared to 2024-2025 and the beginning of 2026. In the past, investments were growing and there was plenty of available money. Now, we’re seeing investment decrease and money being pulled out, which makes the market seem less stable.

Positive and consistent investment into Bitcoin ETFs could boost market confidence. Increasing overall inflows would indicate renewed interest from investors. Consistent buying activity could also help balance out the available supply. Until this happens, limited availability of Bitcoin may continue to push prices down.

According to Darkfost, the recent downturn isn’t a sudden crash, but rather a continuation of a slowdown that began last year. This weaker momentum is now clearly visible in the market. Whether or not investment in cryptocurrencies will recover largely depends on continued interest in related investment funds.

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- FET PREDICTION. FET cryptocurrency

2026-02-15 01:58