As the sun rises over the landscape of cryptocurrency, Bitcoin stands at a mere $68,820, its fate hanging in the balance like a precariously balanced penny on a tightrope. Like an old western showdown, two eminent figures in the digital gold rush, cryptorand and alicharts, are locked in a battle of wits and wisdom, each convinced they hold the key to understanding the miner’s dance and the mysterious strength of hashrate.

Bullish Case: Hashrate and Panic Selling

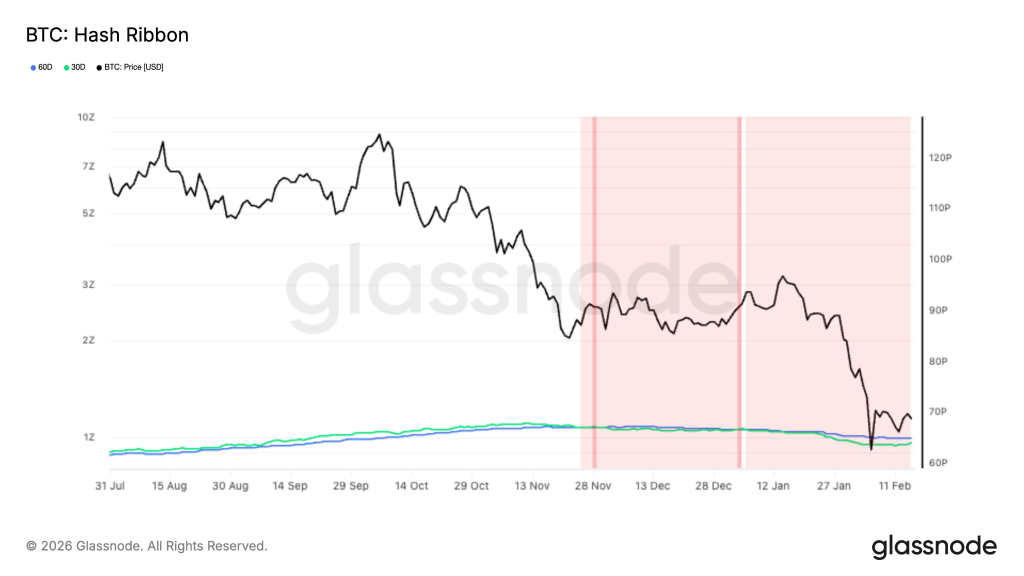

On one side of this philosophical brawl, we have cryptorand, who speaks with the confidence of a seasoned prospector. He claims that every time the market has hit rock bottom, three signs have flashed like neon lights in a dusty saloon: a sturdy hashrate, miners finally throwing in the towel, and retail investors running for the hills in a panic. Today, according to him, all three conditions are either sprouting or blooming like wildflowers after a rain.

His focus is primarily on the rising hashrate, which he argues is as vital as water to a thirsty man. A strong hashrate, he insists, shows that the network is alive and kicking, with miners feeling as if they’ve found gold at the end of the rainbow.

Yet, while miners may be feeling spry, the retail crowd seems as jittery as a cat in a room full of rocking chairs, an essential ingredient for what could be the bottom of this rollercoaster ride.

Every major Bitcoin bottom in history has been accompanied by:

Strong/recovering hashrate

Miner capitulation ending

Retail panic sellingWe have all three right now…this is not the end. This is the setup!

– Rand (@cryptorand) February 16, 2026

Historically, when weaker hands surrendered their treasures, miners dug their heels in, and the network demonstrated resilience reminiscent of a stubborn mule. And cryptorand believes we’re witnessing another version of that story today.

Bitcoin Price Bearish Counterpoint: Capitulation Isn’t Done

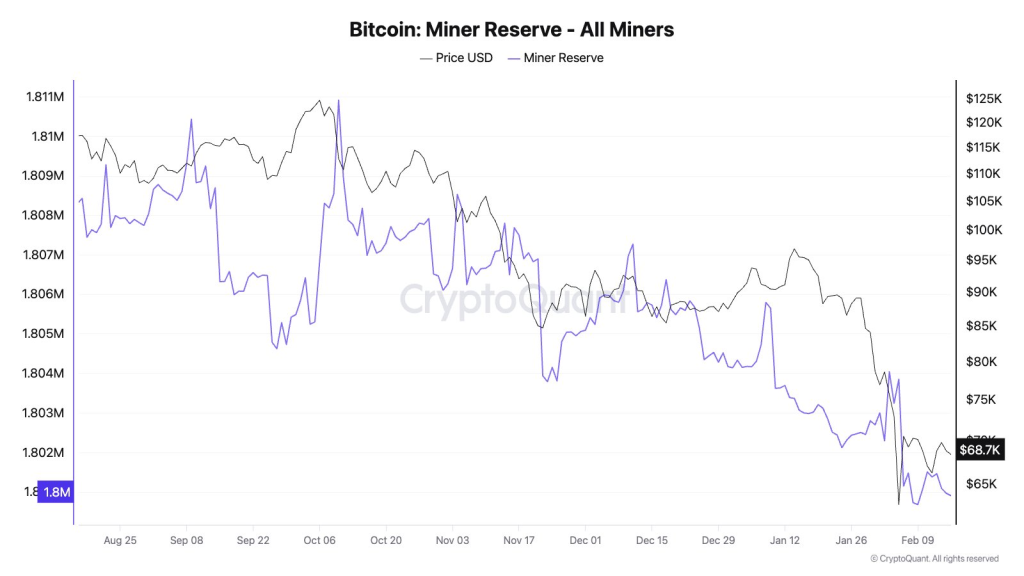

But lo and behold, from the shadows steps alicharts, pointing fingers at ongoing miner distribution and ETF outflows with the flair of a magician revealing his tricks. This analyst insists that capitulation is still knocking at the door, waiting to crash the party.

Miners, he argues, are continuing to sell off their assets like a yard sale gone wrong, putting pressure on the supply chain. If this is true, it means the market is like a soda bottle shaken too hard-it’s bound to explode.

Adding fuel to the fire, Bitcoin ETFs seem to be joining in the selling spree, drawing in institutional dollars that can swing momentum faster than a cowboy on a bucking bronco. It appears that Bitcoin’s price action is influenced not just by retail panic but also by some serious capital gymnastics.

So while the rising hashrate might seem like a beacon of hope, the ongoing miner sell-off is like a rain cloud looming overhead, dampening the spirits of any would-be optimists.

Hashrate vs. Supply Pressure

From a technical standpoint, Bitcoin’s price chart sits at a crossroads, the $68,820 mark being the proverbial fork in the road, where neither bulls nor bears have claimed victory yet.

It’s a classic tug-of-war, folks! On one side, the growing BTC hashrate suggests that miners are committed to their cause, believing in the long-term goodness of Bitcoin’s spirit. On the other hand, the never-ending stream of miner selling and ETF outflows suggests that liquidity needs to take a breather before things can settle down.

The bullish camp is betting on history repeating itself, sure that resilient networks will outlast the short-sighted sellers. Meanwhile, the bears are watching real-time data like hawks, convinced that as long as selling persists, any relief rallies will be as short-lived as a summer romance.

In this clash of titans between cryptorand and alicharts, both sides are armed with measurable data: trends of hashrate, miner reserves, ETF movements, and the unmistakable signs of retail panic. The outcome hangs delicately in the balance, dependent on which force tires first-whether it be the weary capitulators or the anxious onlookers waiting for a sign of life.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- FET PREDICTION. FET cryptocurrency

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Bitcoin’s Bitcoin Boogie: Stablecoins & a Sputtering Dollar Spark Crypto Chaos! 💸🚀

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

2026-02-16 16:23