Ah, the crypto market-a theater of the absurd, where fortunes rise and fall with the whims of invisible hands. After the recent pullback, our dear Chainlink (LINK) finds itself in a state of existential contemplation, hovering near the $8 mark like a hesitant actor awaiting his cue. The initial drop below $9 seemed dramatic, a tragic breakdown, yet the market, ever the contrarian, refused to indulge in further despair. Now, as participation wanes and the crowd grows thin, the true drama unfolds beneath the surface-a silent battle of positioning and liquidity, where the question is no longer why LINK fell, but whether it shall rise again or succumb to the gravity of its own narrative.

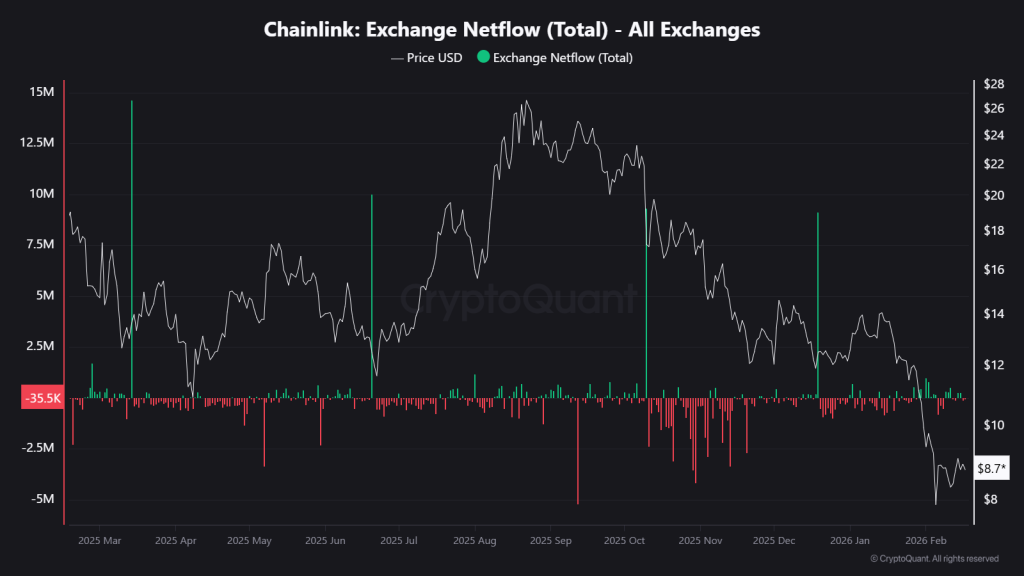

Exchange Netflows: A Tale of Absorption and Apathy

On-chain data, that cold and impartial observer, reveals a shift in the structural winds. Earlier this month, each downward lurch was accompanied by a flood of tokens into exchanges-a classic distribution pattern, where holders, like nervous debutantes, prepared their liquidity for the inevitable sell-off. But now, as LINK revisits the $8.5-$8.8 region, the deposits have flattened, like a tired sigh after a long monologue. The absence of fresh supply, as the price tests its resolve, suggests that the sell-side inventory has been largely exhausted. The market, it seems, has moved from active distribution to passive holding-a distinction as subtle as it is significant. For, as any seasoned trader knows, markets fall swiftly when supply is abundant, but stabilize when the inventory is absorbed. The current flow profile hints that the sellers, once so vocal, have fallen silent, leaving the price to the mercy of demand rather than forced liquidation. If inflows remain muted, the $8.5 zone may yet become an accumulation band, a sanctuary for the hopeful. But should deposits surge anew, it would signal redistribution, reopening the door to lower liquidity pockets near $8.0. For now, the on-chain behavior leans toward absorption, a quiet interlude before the next act.

Ah, the irony of it all! The market, so often a tempest of emotion, now finds itself in a state of stoic indifference. The price, once a frenzied dancer, now moves with the deliberate grace of a chess player, each step calculated, each pause pregnant with possibility. And yet, beneath this veneer of calm, the true battle rages on-a silent war of wills between bulls and bears, each waiting for the other to blink.

Chainlink’s Range: A Post-Trend Balancing Act

For months, LINK has been trapped in a descending channel, a Sisyphean struggle marked by lower highs and lower lows. Rallies, like fleeting moments of hope, were swiftly quashed, leaving the token in a state of perpetual decline. But recently, a curious thing has happened-LINK has stabilized near the demand zone above $8, rotating horizontally between $8 support and $9.3 resistance, forming a short-term range after a failed breakdown. This behavior, so typical of a post-trend balance phase, is the market’s way of deciding whether the prior move was but a dramatic flourish or a genuine shift in the narrative. A reclaim above $9.2 would invalidate the breakdown, pulling the price back into the familiar confines of its prior trading range. In market structure terms, this would convert the move into a mere deviation, often leading to a rotation toward $9.8-$10.2, where the previous consolidation base formed earlier in the month. But failure at $8.0 would confirm acceptance below support, exposing the next demand band near $7.9-$8.1. The structure, for now, shows neither reversal nor continuation, but compression-a quiet prelude to expansion.

Ah, the market’s indecision-a comedy of errors, where each player waits for the other to make the first move. And yet, in this hesitation lies the seed of the next great drama. For compression, as any student of market dynamics knows, is but a temporary state, a pause before the storm. The question remains: which side will strike first?

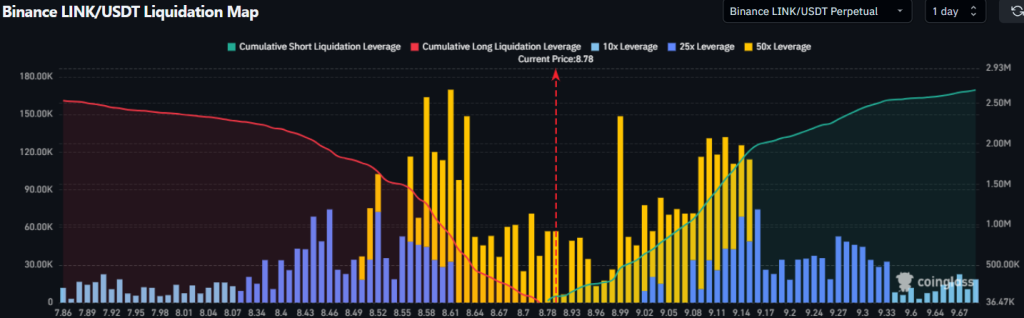

Liquidation Map: A Game of Cat and Mouse

Liquidation data, that grim reaper of leveraged positions, now reveals the next likely trigger zones. The heaviest long liquidation cluster sits just below the price, around $8.40-$8.55, a veritable minefield where a breakdown could trigger forced selling and accelerate a quick flush toward the lower range. Above the current price, dense short liquidations are stacked between $9.05 and $9.40, a zone that acts as a magnet should buyers regain control. For breaking into this zone would force short positions to close, fueling momentum upward. With the price hovering near $8.7-$8.9, LINK finds itself precariously positioned between two liquidity pools, like a tightrope walker balancing between two towering cliffs. The market, ever fickle, is not trending-it is deciding which side shall be liquidated next. The next move, when it comes, is likely to be decisive, for compression phases rarely last. They resolve quickly, once one side regains its conviction.

And so, dear reader, we find ourselves at the precipice of another act in this grand crypto drama. Will the bulls waltz triumphantly into the spotlight, or will the bears maul their hopes into submission? Only time will tell. But one thing is certain-in the theater of the market, the show must go on. And what a show it promises to be!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- FET PREDICTION. FET cryptocurrency

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- Bitcoin Stalls as Big Firms Shift Focus to Altcoins, Says Novogratz

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

2026-02-17 16:38